Our income stocks stay strong

AGM Updates – AHG, FXL and ARF

In the last couple of weeks, there have been three further updates from businesses in the income portfolio with Annual General Meetings (AGMs) taking place for Automotive Holdings Group Limited (AHG), Flexigroup Limited (FXL) and Arena REIT (ARF). Overall, all three updates were positive, with a strong trading update at AHG, business as usual at ARF and a new chief executive announced at FXL. While AGM updates may seem run of the mill in some cases, they are important opportunities for management and boards to take stock of recent performance, and provide a timely update to shareholders.

Automotive Holdings Group (AHG)

AHG has provided fairly benign performance since its inclusion in the portfolio. However, it remains a highly attractive business for investors seeking both growth and income investment attributes. At its AGM, the company provided a trading update for its three divisions and painted a picture that showed strong overall profit growth thus far in FY16. All of the divisional trading updates below are for the period from July through to the end of October this year.

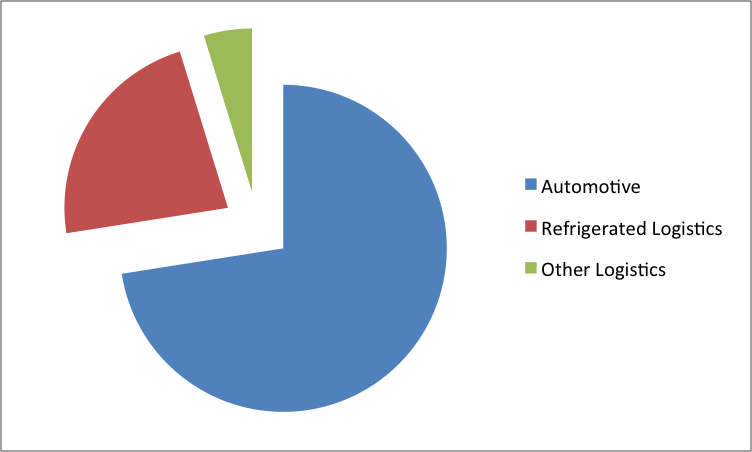

The Automotive division of AHG has delivered an operating earnings before interest, tax, depreciation and amortisation (EBITDA) of $48.8 million, up 13.5 per cent on the $43m delivered over the same period last year. In Refrigerated Logistics, the company has made slower steps forward as a phase of investment continues. The company's operating EBITDA was 2.3 per cent better than the same period last year at $15.3m versus $15.0m a year ago. Finally, the Other Logistics division produced a decline in operating earnings by 14.1 per cent to $3.2m from a previous year's result of $3.7m. A divisional chart is below, but what is evident is that Automotive is still by far the company's most material division, and pleasingly, over the past 4 months it has been the fastest growing.

Overall, these divisional results have resulted in a 14.3 per cent uplift in operating net profit as compared to the same period last year, at $27.9m compared with last year's $24.4m. This is an encouraging update from AHG showing that despite softness in the WA market for new vehicle sales the company is growing at a national level, and converting that growth to bottom line improvement. AHG remains a key idea for income investors, with the added benefit of growth that should support higher dividends in the future.

Arena REIT (ARF)

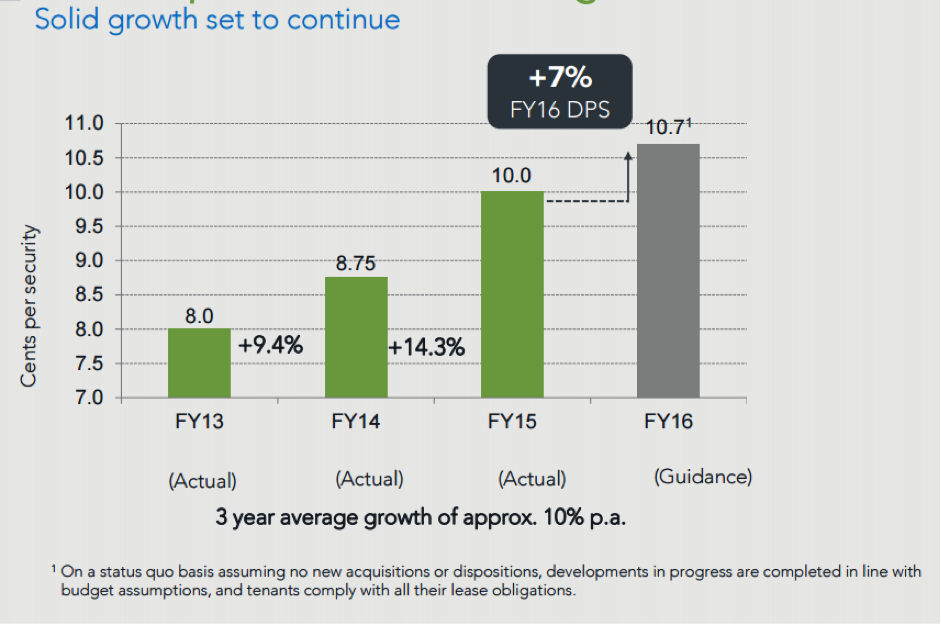

Arena REIT (ARF) has provided the portfolio with solid performance, lifting by a touch under 10 per cent since its inclusion in the income first model portfolio. Essentially, ARF has reiterated its distribution guidance to the market, citing a full year payout of 10.7 cents. This reflects a highly foreseeable rental income stream, and strong recurring base earnings. My view is that this is a base level for distributions, and as the company invests and completes new developments or acquisitions, there is potential upside to this guided distribution. For now, it is business as usual at ARF.

Here is the distribution guidance chart from ARF's presentation at the AGM:

Flexigroup Limited (FXL)

FXL recently acquired Fisher and Paykel Finance (my previous analysis on this can be read here), and completed a rights issue to raise the capital for the purchase (my analysis is here). However, the company has executed all of this without a chief executive until the AGM.

It was announced with the AGM that Symon Brewis-Weston was appointed as FXL's new chief executive. In my view this was always a low-risk hire. The company's strategy had been in place for some time, with execution the key to regaining market trust for the business as a growth company. The acquisition of Fisher & Paykel has been well received by the market, and FXL continues to offer an interesting non-bank exposure to the consumer finance sector.

With this in mind, the income first model portfolio has exercised its rights, and FXL remains a key position providing both growth potential and an attractive dividend yield.

A word on AGM season generally

Each of the companies in the income first model portfolio with a June year end that were due to hold AGMs during the October – November period have now completed these meetings. On the most part the results have been good, with strong trading updates providing catalysts for improved outlooks at WLL, DWS and AHG (notwithstanding the disappointing update from DSH). The portfolio has performed well through this period and a continuing difficult period for the market. It is expected that quarterly dividends for ARF and G8 Education (GEM) will be announced in coming weeks, which should bolster the overall income payout of the portfolio for investors.