Our growth stories: Tox Free and Empired

What next for Empired (EPD)?

There are multiple reasons to be negative about the IT services company, Empired (EPD). Firstly, a large earnings downgrade in January, confirming management has not been able to execute the integration of acquisitions or benefit from recent contract wins. Secondly, a managing director in Russell Baskerville who sold $836,000 of EPD stock (10.9 per cent of his holdings) at $0.88 in late November - just before announcing an earnings downgrade in January. Further, the aggressive selling from institutional shareholders just prior to the downgrade raises additional question marks.

But at a share price of $0.275 ($36 million market cap), the stock has most likely been oversold. Without doubt the risk profile of the company has increased, however not a lot needs to go right for upside from here. A majority of the weakness has been put down to a sales team re-structure which impacted productivity for about a month, reducing revenue by $4.1m in the first half. At this stage no customers or contracts have been lost, and management is guiding for second half revenue of $80-$90m with an EBITDA margin between 8-10 per cent. If the company hits even the low end of both revenue and margin guidance it will likely see a share price back above 50 cents. The problem is management didn't anticipate the problems they have had in the first half, and therefore the market is unlikely to take much comfort from guidance for a second half recovery until it is confirmed in the reported numbers.

Often in these situations, a large earnings downgrade such as this is followed by a second and a third, and that is what the market is currently pricing in. Management has commented that the third quarter is in line with their budget, and they expect a cash flow recovery in the second half partly due to a $5m working capital unwind. This is the third reporting period in a row that they have stated cash-flow has been impacted by one-off working capital issues. Despite the working capital drag, operating cash flow of -$1.23m was improved on last year's loss of $3.66m.

It is a unique situation to see a share price decimated from $0.95 to $0.275 with minimal declines in revenue expectations. First half revenue was up 56 per cent to $78.5m due to acquisitions and new contract wins. If the middle of second half guidance is met, then full year revenue of $164m would equate to a 26 per cent gain on FY15.

Clearly revenue growth is not the problem, with $65m of contracts secured in the second half of FY15, and $32m in the first half of FY16. The setup costs for new contracts were anticipated and had been adequately flagged, but the sales team re-structure was not. The contract setup costs came in at $1.1m, and further there was $0.7m of costs associated with expense reduction initiatives.

If there are no further issues, and this was simply a one-off impact from a sales re-structure, then the stock is on a FY17 PE of four (assuming an EBITDA margin of nine per cent), and will be proven to be extremely cheap. We unfortunately don't have enough visibility around the likelihood that the worst has past, and therefore need to balance out the upside opportunity with risks of further earnings margin issues, poor cash-flow conversion and a management team that has failed to execute their plans.

First half FY16 result details

The first half revenue and EBITDA was roughly in line with guidance from the downgrade in January. Guidance was for revenue of approximately $79m with a reported EBITDA margin of one to two per cent. Reported revenue was $78.5m and EBITDA was $0.8m. Adjusting for the “one-off” items, this gives an adjusted margin of 8 per cent.

The NPAT loss of $3.7m was also impacted by a $2.3m one-off non-cash write down of fixed assets. Capex of $8.6m included a one-off $4.6m cost for office relocation, with less than $2m expected for the second half. From FY17, sustaining capex is expected to be around $4m per annum.

Net debt was $22.3m, up from $12.7m at June 30. The increase was due to negative operating cash flow and the large $8.6m of capex. With positive operating cash flow expected for the second half ($5m working capital unwind) and less than $2m capex, net debt should be reduced by the June 30 balance date.

As guided there was no interim dividend, and we are forecasting no dividend in FY17 either with management likely to focus on debt reduction.

On October 31 2014, Empired acquired 100 per cent of the shares in Intergen. Based on performance, Empired had an obligation to give the vendors of Intergen payments of $5.2m in May 2016 and $5.2m in May 2017. On February 12 this year, EPD announced a new agreement including the following:

- Issue of 3,140,285 EPD shares immediately

- Pay $0.6m on May 31 2016

- Pay $1.2m on July 1 2016, and

- Pay $2.2m on July 1 2017

- Pay $0.6m on May 31 2017

- Pay $4.6m on July 1 2017

On top of the earnings guidance ($80-90m revenue, EBITDA margin 8-9 per cent), general comments were made that there is a strong pipeline of strategic annuity based contracts to be contested. But hopefully management have learnt their lessons and focus of executing current work, before trying to aggressively expand again.

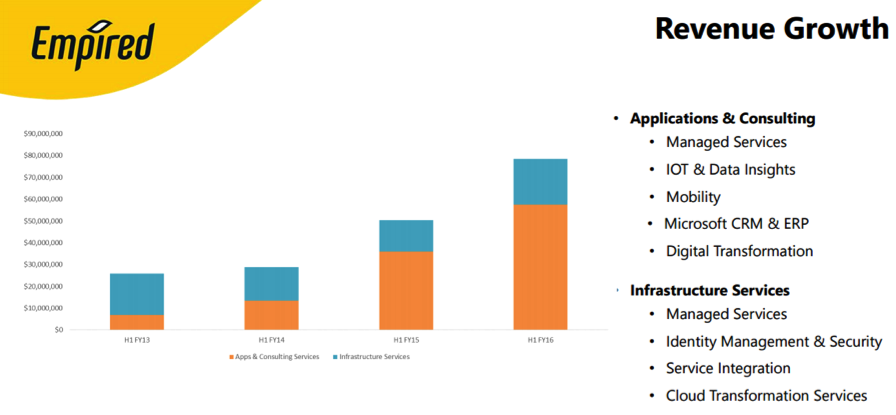

Revenue mix

The revenue mix has transformed since first half FY13 – where Application and consulting services 26 per cent of revenue, and infrastructure services being 74 per cent. Today it is nearly reversed, with Applications and consulting services 73 per cent, and infrastructure services 27 per cent.

Ironically, application services are typically higher margin work, and a key reason why management has increased exposure in this division. This applications services work is primarily aligned to high growth market trends using Microsoft technologies. We believe there is scope to grow the contracted revenue base in Applications services.

Infrastructure services currently represent a higher percentage of long term contracted revenue. There is opportunity to increase infrastructure services margins through cloud and services integration.

Source: EPD company presentation

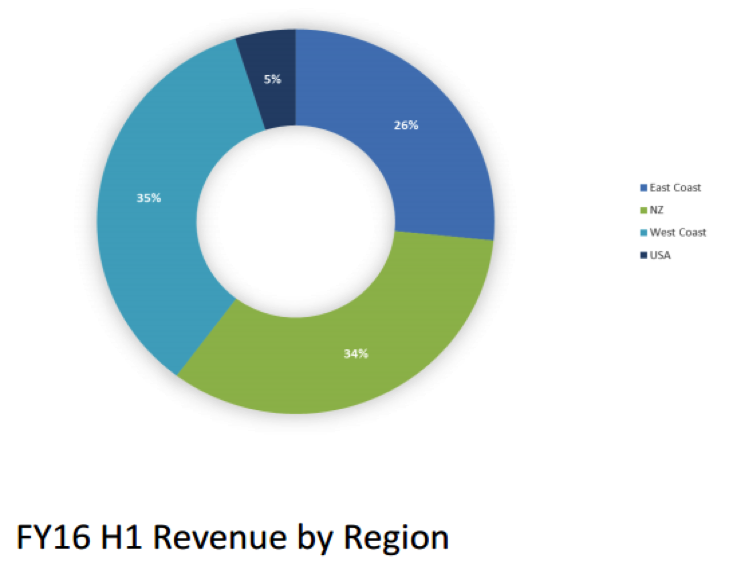

Regional revenue

Empired is diversifying geographically, after previously been predominately focused on WA. After strong growth, New Zealand now comprises 34 per cent of revenue, the West Coast 35 per cent, East Coast 26 per cent, and the US five per cent. After the acquisitions of eSavvy, OBS and Intergen there are strong opportunities to increase the business across the East Coast of Australia. The WA market is performing well despite a weak economy due to a number of large multi-year contracts. Management is of the view that there are low cost, low risk growth opportunities in the US and Asian markets.

Source: EPD Company presentation

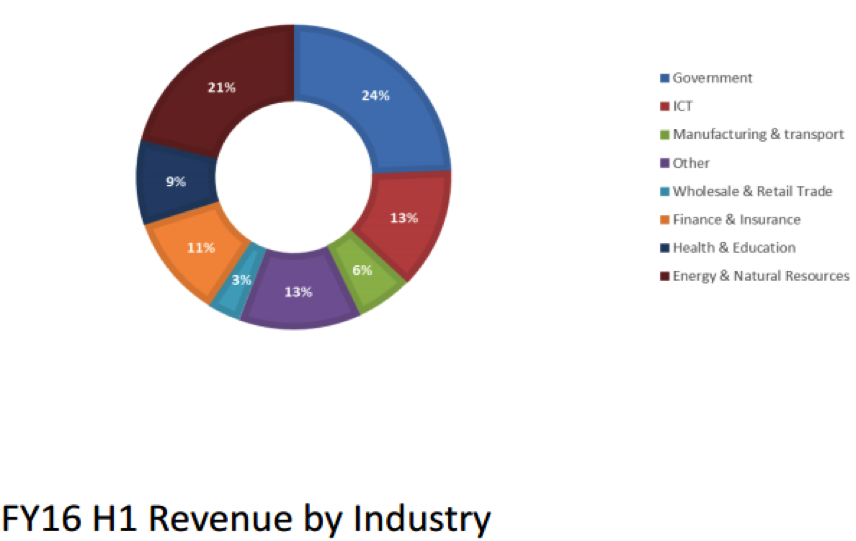

Industry exposure

As can be seen from the chart below, EPD is relatively well diversified in regards to industry exposure. The 24 per cent government exposure is mainly NZ and Australian state governments.

Despite the resources downturn, Energy and Natural resources has remained strong for EPD, with 21 per cent exposure. The key driver is the company's existing relationship with large miners, and their focus on utilising technology to improve efficiency and productivity. Much of the investment to increase exposure to Finance, Insurance and Health & Education is on the East Coast.

Source: EPD Company presentation

Summary

If Russell Baskerville and his team perform as per their guidance, then there will be large share price upside. Using conservative assumptions, our base case valuation is slightly reduced from $0.64 to $0.60.

The key assumption is that this is a one-off margin issue, and the company's service offering and Microsoft aligned strategy remains intact.

The rate of growth from integrating acquisitions and setting up new contracts was clearly too aggressive. Time will tell if management has learnt from this, and focuses on existing work rather than trying to grow too quickly.

The combination of operational issues, Russell Baskerville selling and share price weakness prior to the downgrade have ensured the company's credibility is at an all-time low. The job to recover this credibility will not be easy and any further issues are likely to be treated harshly by the market.

The key re-structure involves one centralised sales team for eSavvy, OBS and Intergen (the recent acquisitions). The plan is to cross-sell all of Empired's capabilities and increase the value of sales to around $500,000, rather than $30-50k.

The positives of an improving Microsoft product offering, recurring revenues and a growing customer base provides significant upside if management has successfully addressed first half issues.

Although highlighting the risk profile has increased, we maintain our BUY recommendation with a $0.60 valuation.

TOX stands strong as miners dwindle

The first half result clearly demonstrated that the Tox Free Solutions (TOX) waste services business model continues to hold up, despite large exposure to the weak resources and manufacturing sectors.

The company managed to report net profit after tax (NPAT) of $12.6 million ( 1 per cent on last year) and EBITDA of $37.9m ( 4 per cent on last year) – an excellent achievement given revenue was down 4.6 per cent to $197.7m. Unallocated overheads fell 12 per cent to $13m, with the new ERP system creating efficiencies.

The tough conditions are likely to remain in place throughout the second half. Gorgon volumes will continue to decline, but LNG volumes will increase as the new WA plants commence production. Despite weak markets, the tender pipeline of $80m remains high.

On February 23, a day before the half-year result, TOX announced a five-year contract with BHP for Olympic Dam, as well as an extension of the Chevron contract until 2021.

The Olympic Dam contract is “Industrial Services and Total Waste Management”, commencing June 2016. The contract scope includes management of all wastes generated from mining operations, industrial cleaning and quarantine services, landfill management and recycling services.

Tox managing director Steve Gostlow said: “Our core strategy is focussed on providing integrated industrial service and waste management solutions for clients like BHP Billiton. We've been able to demonstrate to the client's improvement in productivity and cost savings without compromising our values of safety, reliability and sustainability and we are very optimistic about the opportunity to demonstrate our capability to BHP through the award of the Olympic Dam contract.”

The Chevron extension is recognition of performance, and in particular the impeccable safety track record having just completed six years without lost time injury on Barrow Island.

TOX has been an exceptional growth story, with its share price increasing from $0.04 to in 2004 to a high of $3.76 in 2014. Much of this growth was achieved from bolt-on acquisitions and expanding into new regional resource based hubs. In the regional centres, TOX has benefited from gaining EPA hazardous waste licenses, and creating barriers to entry. With the company now operating in most of the key resources regions, the business model is more mature with growth driven by market conditions and contract extensions from satisfied customers.

Despite growth being more difficult than in prior years, that doesn't mean management have stopped implementing new strategic initiatives. The following are the current focus, prioritising earnings per share growth and return on capital:

- Broadening TOX total Waste Management Capability and “One Stop Shop” services

- Leveraging existing waste treatment capabilities and licensed sites through investment in best practice waste treatment technologies

- Expanding geographic coverage within Australia and overseas

- Reducing costs and increasing productivity by leveraging off the recently implemented Enterprise Resource Planning (ERP) system.

- Business development – award of large, long term contracts with blue chip companies across Australia and overseas.

- Acquisition of complementary businesses

Although margins have declined through the resources downturn, the strength of the business model has been displayed by the relatively high margin performance compared to other resources-related service companies.

Interim result details

Underlying half year profit was $13.1m, up two per cent on last year. The dividend of 4.5 cents per share was up 12.5 per cent with a payout ratio of 47 per cent.

TOX reports within three key divisions as discussed below.

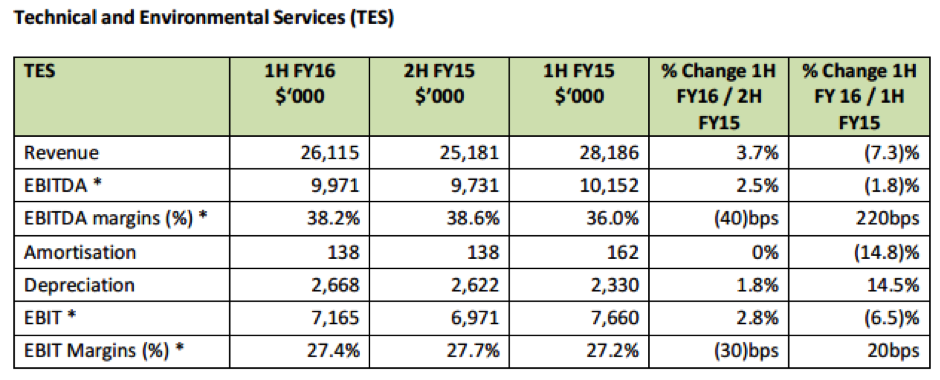

The Technical and Environmental Services had an EBIT decline of 6 per cent to $7.2m. Although Western Australian volumes of waste from resources are reducing, expecting greater volumes of high margin hazardous waste within the next 12-24 months as the various LNG trains in the North West of WA commence production.

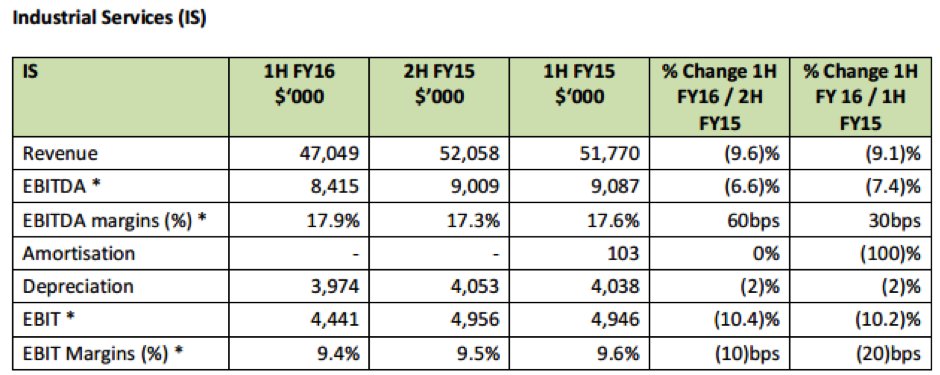

Industrial Services reported a nine per cent decline in revenue, and EBIT down 10 per cent to $4.4m. The division has had pockets of strength in the civil infrastructure and municipal markets, but only partly offsetting the weakness in resources and manufacturing. It is an excellent achievement from management to maintain margins by cost cutting. Olympic Dam is a big win for this division, and the contract with Bechtel for Wheatstone LNG project in Onslow had performed above expectations.

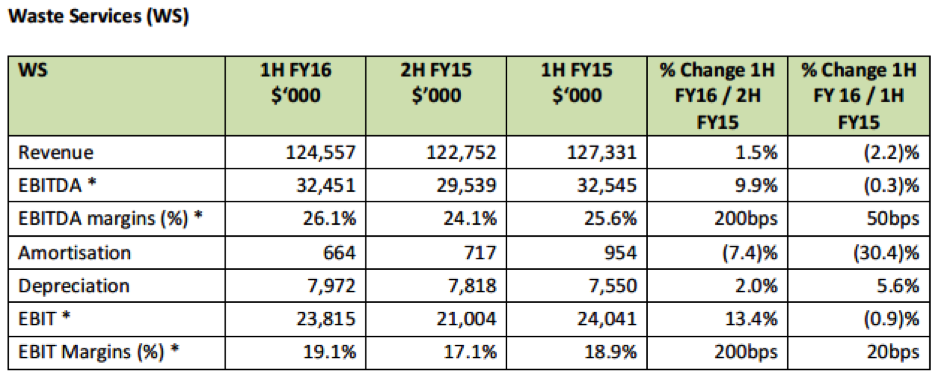

Waste Services reported an approximately flat EBIT of $23.8m with double digit Queensland and infrastructure growth offsetting subdued resources markets. The strategy in this division has been to diversify the client base into commercial and municipal sector to offset resources weakness.

Net debt fell by $0.5m to $70.3m, due to strong cashflow and low capex. Debt should reduce again for the full year result with FY16 capex guidance of $23-25m.

The cost cutting increased the group EBITDA margin from 17.6 per cent to 19.2 per cent.

Two interesting acquisitions included specialist oil and gas chemical company HKD to target LNG growth as WA facilities come into production over the next year or so. TOX has also entered the E-Waste sector with the $2.1m acquisition of PGM. Both purchases are in line with management's strategy of targeting specialist sectors with high growth rates.

Summary

TOX provides earnings security from recurring revenue (85 per cent), with no shortage of additional one-off opportunities. Customer retention is excellent, and the recent flow of contract wins/extensions suggest the company is continuing to satisfy customers. On top of Chevron and BHP (Olympic Dam), TOX has also won work with Inpex upstream, McDermott, Origin, and NSW EPA household Hazardous Waste.

TOX is trading on an approximate FY16 PE of 14, and an EV/EBITDA of 5.6 times. Both of these are at a discount to its recent averages, reflecting the difficult operational environment.

We maintain our HOLD recommendation with $2.80 valuation.