New energy needed at Energy Action

Energy Action (EAX) is a perfect example of the reason why you should sell after the first earnings downgrade. With management teams only partially confessing the weakness in an attempt to buy themselves time, more often than not, a second and third downgrade follows. In this case we have had four downgrades with no guarantees the worst is behind them.

Not much has gone right since Scott Woolridge became chief executive in October 2013. The downgrades and questionable excuses have resulted in a significant share price decline. Woolridge is yet to meet one half-year or full-year target. The market has had enough of the broken promises, and it will only be reported earnings growth that will turn the share price around.

Business model

The business model is based around an online reverse auction platform that enables small businesses to achieve the best possible prices for their energy contracts. With a long and successful relationship with the major retailers, they will bid against each other, driving the contract price down. For an initial brokerage fee of up to 2 per cent, small businesses usually achieve a 6-8 per cent discount on what they would otherwise pay.

Energy Action uses this procurement process as a customer acquisition tool, and then achieves the bulk of its revenues from the contract management division.

To provide a complete service they also have a lower margin sustainability division that provides advice on how to save energy costs from energy efficiency recommendations.

Missed expectations

The company has talked up the opportunity associated with a renewal ‘cliff' for contracts in the market, where up to 75 per cent of customers in the market have electricity contracts due for renegotiation within an 18 month window, peaking in December 2015. Customers have increased, but revenues have not met targets.

On May 12, guidance for adjusted net profit after tax (NPAT) was revised down to $2.6-3 million, compared to the $4.5m recorded in FY14. This is adjusted for restructuring costs and deferred payments for acquisitions. It could also arguably be adjusted for the one-of receivables, write-downs and metering over-payment, which would increase the guidance to $3.23-3.63m.

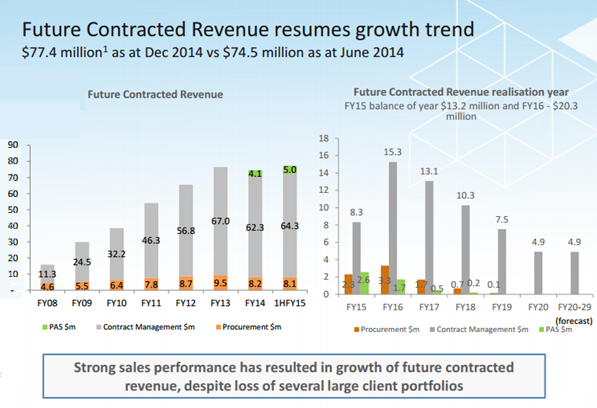

Source: Company presentation

The most recent excuses for missing expectations include

- Customers holding off renewing contracts in Queensland and South Australia due to high wholesale rates, and;

- Continuing low wholesale costs in NSW and Victoria impacting commissions per customer.

Further, the company has had difficulty in integrating its two recent acquisitions Energy Advice and Exergy.

The Energy Advice acquisition has not met expectations. One of the reasons for the acquisition was that some customers need the ability to price more complex energy contracts than the online reverse auction can deliver. It is thought that Energy Advice's procurement solutions can meet these demands. For example, a larger customer with a heavy industrial business may want to take advantage of the variable wholesale price by closing its operations during peak periods.

The acquisition of Exergy provided a boost to the Project and Advisory division (Activ8). However, it looks like management had no idea what they were buying or how to integrate it into the business. There is significant unutilised capacity and we assume this will be a big part of the re-structuring program that is aiming to save $1.5m of costs.

Ward Consulting is the acquisition in the sustainability division and this does look to be fully integrated. But sustainability is a low margin, and add-on part of the business rather than a key focus. It currently comprises about 20 per cent of revenues and is unlikely to ever get higher than 30 per cent.

Management

Woolridge and the remainder of the team are up against it to deliver their promises. With three questionable acquisitions the remuneration packages are also likely to come under attack. A large part of their long term remuneration incentives is based on earnings per share rather than return on capital or total shareholder return. This lack of alignment with shareholder interest is unacceptable given the terrible performance to date.

Michael Fahey is the newly appointed chief financial officer. His experience at AGL Energy may assist in applying some much needed common sense. A first step would be to apply a culture of under-promising and over-delivering to regain a small amount of credibility with the market.

In Fahey's first couple of months he has identified major holes in the company accounts. A $630,000 hit to the profit and loss statement will occur at the full year result due to the write-down of receivables that are unlikely to be collected. Also, we understand about half of this amount is due to the metering providers incorrectly recording and paying revenue as part of the contract management process.

Of concern is the likelihood that the bad receivables have come from the Exergy acquisition. It may also be time for the company to assess the performance of their external consultants.

A summary of Woolridge's earnings guidance announcements

1. December 19, 2013: FY14 operating NPAT downgraded to be approximately in line with FY13 operating NPAT of $5m. The removal of government grants for energy efficiency projects had an impact on the sustainability division. Further, a sales team restructure was said to increase employee costs by 20 per cent. This was apparently going to position the company to benefit from the contract renewal opportunity that was just around the corner.

May 21, 2014: This was an announcement about three senior sales executives. It then followed on to maintain prior earnings guidance for flat FY14 earnings - with a disclaimer that a very strong fourth quarter would be required (technically not a downgrade).

2. August 19, 2014: A terrible full-year result which clearly displayed that the acquisitions were completed in an act of desperation rather than any sound strategic reasons. In a further act of desperation to hide the poor results, the company also announced another acquisition (Energy Advice) at the same time as the results.

November 5, 2014: At the AGM provided guidance for FY15 NPAT of $5.8m.

3. February 10, 2015: FY15 adjusted operating NPAT expected to be between $4.2m and $4.8m compared to $4.5m in the previous corresponding period. FY15 sales revenue expected to be approximately 30 per cent above FY14.

4. May 12, 2015: Revenue growth not meeting expectations and guidance for operating profit declined to $2.6-3m. Stripping out the one-off write-downs gives $3.23-3.63m NPAT.

What is next?

Generally speaking, a higher wholesale electricity price is a positive for Energy Action (EAX) as they get a percentage of the signed contract with the retailers. But the challenge at the moment is the large difference in pricing between the states, causing some customers particularly in Queensland to hold back from renewing contracts.

The combined Activ8 contract management services and Exergy's project and advisory services need to be restructured and combined into one service. The company has lost a couple of larger clients from this contract management part of the business. Clearly competition is an issue and attention is required towards both the pricing and service for critical customers.

Deferred payments

The acquisitions involve no earn-outs and instead involve a fixed cash payment as per below.

Energy Advice:

- August 2015 – $3.1m

- August 2016 – $3.1m

Exergy:

- March 2016 – $1m

Earnings

FY15 revenue growth of 25 per cent is partly due to acquisitions and is lower than the prior forecast of 30 percent. Given the history we will stick with the lower end of the NPAT range for $2.6m FY15 NPAT.

Looking forward to FY16, there will be 12 months of the “Energy Advice” acquisition rather than the 10 months this year. We are forecasting 10 percent revenue growth. There will also be an increased interest bill of approximately $200,000 due to the $3.1m deferred payment to “Energy Advice”.

With a target of $1.5m cost savings there should be some margin growth. But with uncertainty as to how quickly the business can be restructured and how much damage has occurred we will keep our forecasts conservative until proven otherwise. Our FY16 NPAT forecast of $3.9m gives a PE of 9 times (a $1.35 share price).

There is still the potential for the business to achieve significant growth, but with the current state of affairs we are not willing to look too much past FY16.

Summary

A $1.35 share price gives a market cap of $35m. Our decision to maintain the “hold” recommendation is not due to any great confidence of a near term turnaround, but rather that the weakness appears to be priced in. Although there are still significant risks, the company is debt free and we don't anticipate any further negative balance sheet impacts.

A restructured management team may also provide some much needed direction.

We have a $1.80 price target which is based on 12 times our FY16 profit forecast of $3.9m (15 cents per share).