MGM Wireless gets an A

MGM Wireless (MWR.AX) is a South Australian technology company that specialises in school SMS service. In fact, many of you who have recently had, or currently have children in school may have unknowingly been a recipient of their service. If you have received a message from a school, there is a good chance that it was sent via MGM's technology.

History

MGM Wireless was founded by Mark Fortunatow and Mark Hurd in the early 2000s with the aim to capitalise on the rapidly evolving mobile SMS market. It may not seem it now, but it wasn't that long ago mobile phone messaging was an emerging technology.

While the company initially focused on broad range of ideas it quickly evolved into a business, which focused on messaging requirements of Australian schools.

The founders will tell you that the idea to focus on schools originated when a well know school in South Australia had ~200 students fail to attend school on a day at the end of the year. This presented a problem where clearly the school has an obligation to account for the whereabouts of the students but didn't have the capacity or resources to contact parents or locate the children.

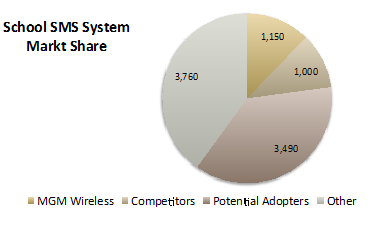

This identified problem led the founders to focus on school SMS solutions. In 2003 the company floated on the ASX and today the company today is the leading SMS solution provider to Australian schools now servicing in excess of 1,150 schools. Nevertheless, there is still plenty of growth potential as discussed below.

MGM Wireless business model

At its core MGM Wireless provides technology that allows schools to easily communicate with the families they are serving. This could be for a range of reasons but include attendance management services (related to both truancy and safety) and general messaging services (typically used for emergencies, school event reminders, sport events etc).

Much of MWR's business model is clean and simple to understand. We like this.

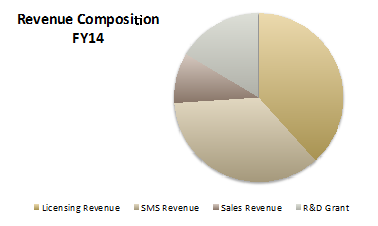

Specifically, the company generates revenue from four key sources.

- The company generates a one-off consulting and training fee of $500-$3,500 for each school as it signs up.

- An annual license fee is payable which equates to $3-$8 per student.

- SMS revenue equates to $1.40-$2.60 per student per annum

- The company benefits from a Government R&D grant which has accounted for ~$500k of revenue in recent years.

In FY14 we estimate that the MGM Wireless' revenue composition was as follows:

The cost structure of the business is more complex however and we make the following observations:

- Employee expenses account for approximately 75 per cent of operating costs. We view this as a semi-fixed cost, which provides significant operating leverage as revenues continue to increase.

- Wholesale SMS costs are volatile. While ultimately these costs are passed on to customers the associated lag negatively impacted FY14 earnings. In turn FY15 earnings appear set to relatively benefit. This is not an overly significant cost to the business and should diminish in a relative sense as messaging trends from SMS to data.

- Data messaging. A trend to sending higher quality and more complex attachments via data messaging as opposed to SMS messaging has the potential to improve MGM's margins.

School messaging market

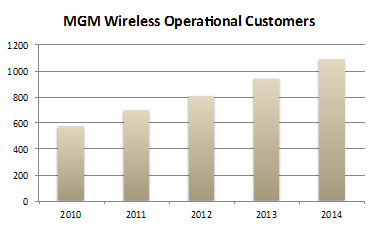

MGM Wireless has done a terrific job in recent years increasing the number of schools, which it has signed up to its services. As you can see below, the number of schools signed up has doubled in the last five years.

What is interesting to us is that this that despite this positive track record, the potential for future growth remains meaningful.

MGM Wireless has now contracted in excess of 1,150 schools. However, this relatively modest number considering that there are in excess of 9,300 schools in Australia. This leaves the company ample room to continue to grow the business.

We estimate that there are in excess of 3,000, which MWR can potentially sell its services to that are currently not being serviced by the company or its competitors. While selling into the school network is a complex and often lengthy process, we believe that the market structure presents MGM Wireless with a solid footing for growth in the coming years.

Additional growth options

The company is actively seeking to develop its product suite into wearable devices and the internet of things. While the company has a strong track record developing profitable technology services, it is early days and we do not account for this in our earnings forecasts or valuation. We view this as a free growth option.

Accounting issues

While we are attracted to MGM Wireless's business model, its returns profile, balance sheet and cash generative ability, there are a couple of accounting issues which will impact reported earnings that investors should be aware of.

- Historically, reported earnings and cash flow have benefited from carried forward tax losses, which were generated when the company was in its start up phase. Unfortunately, theses losses have been largely exhausted and the associated benefit is coming and end. For context, in FY13 MGM Wireless incurred an effective tax rate of 6 per cent. In years prior to this the company paid no tax at all. We expect the company tax rate to increase towards 30 per cent in FY15 and beyond.

- FY14 saw a change in amortisation accounting policy. In the past MGM has expensed its R&D expenditure. However, in FY14 the company changed its accounting policy and capitalised $567k of R&D expenditure, which will subsequently be amoritised over three years. This resulted in a $498k reduction in FY14 amortisation charge. This change in accounting policy is a one-off benefit which will see a normalisation of amortisation charge (i.e. an increase) over FY15 and FY16.

- Notional cost of options issued to directors. The notional cost of options issued to directors is expensed. In FY14 this amounted to $107k. This notional expense is a non-cash item which is entirely normal for a company if this nature. Nevertheless, it is an expense to be aware of.

Balance sheet and earnings outlook

MGM Wireless is in a sound financial position. At the end of the March quarter the company was in a net cash position with $1.1 million. This positions the company well to continue to develop its product suite and capitalise on opportunities as they present.

We estimate that MWR will deliver double digit EPS growth in the coming three years despite the challenges mentioned above relating to normalising amortisation charge and tax rate. This is predicated on the company continuing to contract new schools while maintaining strong focus on costs and an added margin benefit of the trend from SMS to data messaging.

We note that the company delivered a very strong, record 1H result in 2015, with revenue up 36 per cent and NPAT increasing by over three times the previous corresponding period. While the result was positive there appears to have been a strong seasonal bias to the first half which is in contrast to most years. We do not expect this growth rate to be reflected in the 2H result to be released in August. We do however, anticipate that FY15 will see record revenue and NPAT from MGM Wireless.

Valuation

Despite a clearly articulated growth strategy, a successful track record and a favourable market structure MGM Wireless is a small illiquid company with a market cap of $13.7m. We are attracted to MGM Wireless's business model, its returns profile, balance sheet and cash generative ability.

Although the accounting changes need to be considered, we take comfort from the increasing free cash flow. For FY17 we have forecast net cash of $5.6m which is about 40 per cent of the current market cap.

We have a BUY recommendation and our $1.90 target price is based on a price-earnings ratio of 16 times FY16, or 12.5 times FY16 after adjusting for net cash of $3.7m (FY16). This PE is in-line with the small industrials, and is justified by our above market growth forecasts for the next three years.

To see MGM Wireless' forecasts and financial summary, click here.