Lam grows as semiconductors shrink

Lam Research Corporation supplies essential wafer fabrication equipment and services to the semiconductor industry. It is one of my favourite semiconductor capital equipment names.

Lam's customers include semiconductor manufacturers that make memory, microprocessors, and other logic integrated circuits for a range of electronics, including cell phones, computers, tablets, storage devices and networking equipment.

Lam is a global operator with facilities in seven geographic regions: the United States, Europe, Japan, Korea, Taiwan, China and Southeast Asia.

Semiconductor manufacturing is a complex process and involves the fabrication of multiple die or integrated circuits (ICs) on a wafer. Lam is primarily involved in what is called ”front-end” wafer processing, which involves the steps that create the active components of a device (transistor, capacitor) and their wiring (the interconnect).

Lam also has products for “back-end” wafer-level packaging (WLP), which is an alternative to traditional wire bonding. In addition, its products are offered for related markets that rely on semiconductor processes and require production-proven manufacturing capability, such as micro-electromechanical systems (MEMS).

The company's thin film deposition systems form sub-microscopic layers of conducting (metal) or insulating (dielectric) materials. Lam is also a provider of plasma etch, a process step that selectively removes materials from the wafer and creates the features and patterns of a device.

Lam Research competes with Applied Materials, Inc, ASM International, Wonik IPS, Tokyo Electron, Screen Holding Co and Semes C. Some of these companies may offer totally different processes for chip manufacturing.

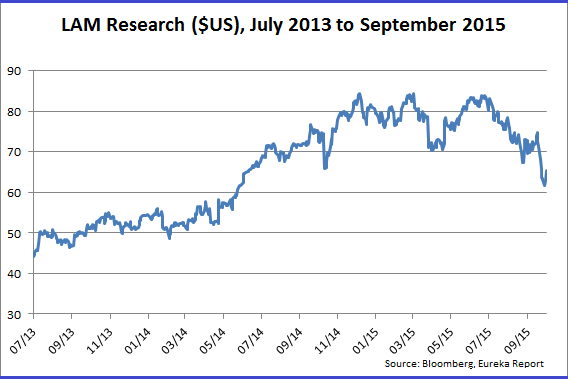

Market falls provide opportunity

The recent market correction and the fact that the Philadelphia Semiconductor Index (SOXX) is down some 20 per cent from its June highs is providing a nice buying opportunity for investors to pick up a best in class name in the semiconductor capital equipment space.

The semiconductor industry has been and will remain a key “enabler” for the progress of technology.

Chips are an essential ingredient in advanced manufacturing

The fact is that “chips” aren't just found in computers anymore; a typical car now uses an estimated $US520 in semiconductors, according to research firm IC Insights. Advanced Driver Assistance Systems (ADAS) and semiautonomous vehicles will increase this amount exponentially.

Semiconductors are also used extensively in wearable tech, in 'Internet-of-Things' (IOT) products, and of course smartphones, which are constantly upgraded and therefore require smaller and more complicated chip designs.

Lam Research - as a major player in “etch fabrication” and “deposition” equipment that is used to manufacture semiconductors - is benefiting from this growth in complexity, rising labour intensity, and the higher costs involved in chip manufacturing.

Lam is also exposed (in a positive way) to the advances in the architecture of NAND flash memory, which is now augmenting and even replacing hard disk drives. These chips have shrunk dramatically over the years, taking up less and less surface area. Once, chips were flat, now these new generations chips are being built in layers to pack in more data. Lam's etching processes, whereby silicon and other materials are added or removed, are well placed for this shift.

Due to its leading edge equipment and processes, Lam has won the vast majority of the etch fabrication business at four of the major NAND flash manufacturers: Samsung Electronics, SK Hynix, Micron Technology, and Toshiba.

Company guidance at Semicon West

At an investor meeting held at the chip industry's annual Semicon West conference on July 14, Lam Research provided better than expected calendar 2015/2016 revenue and EPS target ranges of $US5.8 billion-$US6.3 billion and $US6.00-$US6.75 respectively.

FY16 (ending June 2016) revenue consensus was much lower at $US5.73bn and $US5.78bn for earnings.

Longer term revenue/EPS target ranges are at $US6.5bn-$US7bn and $US7.00-$US7.75 for 2017. For 2018, they're at $US7bn-$US7.5bn and $US8.00-$US8.75. A nice growth trajectory.

As expected, Lam continues to argue its strong exposure to chip manufacturing tech "inflections" will allow it to outgrow the industry. (These advances include 3D NAND, FinFET logic ICs, DRAM multi-patterning and next-gen chip packaging.)

The company forecasts a 32 per cent share of the wafer fab equipment (WFE) spend in 2018, up from 29 per cent in 2015 and just 26.5 per cent in 2013. Lam estimates it had a high-30s share of the deposition equipment market, a low-mid 50s share of the etch equipment market, and a high teens share of the clean equipment market coming into 2015. Deposition and etch share gains were also recorded last year.

Recent earnings

On July 30, 2015 Lam Research delivered excellent June quarter (F4Q15) results with shipments, revenue and EPS coming in well above midpoint guidance. September quarter (F1Q16) shipments, revenue and EPS guidance exceeded consensus expectations as memory spending remained strong.

Lam delivered June quarter revenue of $1.48bn (up 6 per cent quarter on quarter), above the midpoint of guidance, while pro forma EPS of $US1.50 was $US0.03 higher than consensus estimates. Record shipments of $US1.62bn (up 8 per cent quarter on quarter) were again weighted towards memory, at 60 per cent of shipments with DRAM accounting for 37 per cent of shipments.

Foundry investments increased to 26 per cent in the June quarter (from 24 per cent in the March quarter), while Logic, which includes CMOS image sensor, increased to 14 per cent from 10 per cent.

Cash flow from operations was strong, at 20 per cent of revenues - up from 14 per cent.

September quarter guidance also exceeded expectations. Shipment, revenue and EPS guidance of $US1.58bn, $US1.60bn and $US1.70, respectively was well above consensus, as memory is expected to remain strong, with 3D NAND projects starting to ramp.

Operational expenditure is expected to be higher than June quarter levels as Lam continues to invest in customer-facing projects. Looking ahead, the company expects shipments and revenue to decline in the December quarter from a high September quarter base, but the company is on pace to exceed 20 per cent revenue growth in CY15.

Positive longer term guidance and a good earnings report give investors decent visibility.

Given the recent results, guidance, and industry position I would be keen to buy Lam Research even if there hadn't been a market correction.

In my assumptions, I am forecasting a continuation of recent trends and am forecasting solid top-line growth and expect deposition/etch markets to outpace wafer fab equipment (WFE) in CY15/16. In addition, LRCX's P/E multiple will likely expand on an improving non-memory mix.

Wall Street view

Wall Street analysts are favourably disposed to Lam Research with 20 analysts having a “buy” rating and only three analysts with a “hold”. The average target price is $US95.00 which is 50 per cent above the current price.

Lam has received two upgrades recently from brokers CLSA and Evercore.

Valuation

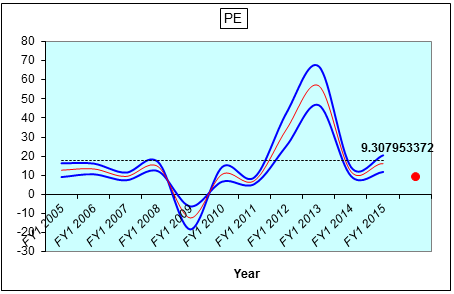

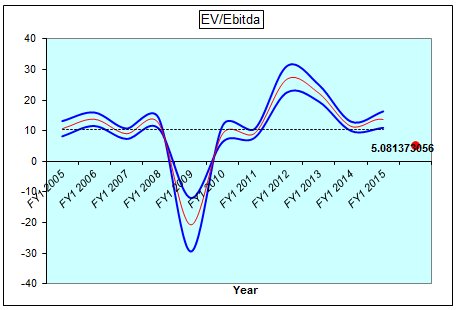

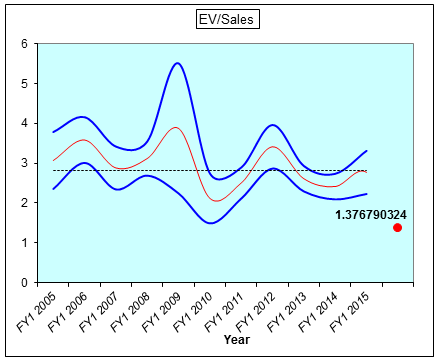

At 15.4 times 2015 EPS, and 13 times 2016 EPS, Lam Is undervalued relative to historical measures of PE, EV/Ebitda, and EV/Sales. See charts below.

Recommendation

I have a buy recommendation and a $US97 price target which is based on 14x 2016 EPS of $US6.25 $US10 in net cash per share. I also expect LRCX's P/E multiple to expand on improved execution, growing share in logic and above average WFE growth.

Key risks include:

- Lam has heavy exposure to the cyclical semiconductor industry, which typically has limited visibility, and a high degree of uncertainty regarding the timing and duration of cycles;

- Semiconductor equipment stocks have traditionally been highly correlated to the expectations of the semiconductor cycle, in terms of pricing, unit levels, and demand patterns;

- Lam competes in the most competitive and price-fierce segment of the semiconductor equipment markets, deposition and etch;

- Failure to develop new products and processes that address rapid technological change could risk its market position. The semiconductor equipment industry is constantly developing and changing;

- Lam Research drives a substantial percentage of its revenues from a limited number of products. This product concentration may be subject to additional risks relating to a weak demand environment, competitive threats, and technological changes; and

- The company relies heavily on international sales (80 per cent of total FY13 sales were non-US).

To see LAM Research's forecasts and financial summary click here. To see the company's video on Lam's capital equipment and services, click here.