Income portfolio: Moving Steadfast to a hold

Insurance broking business Steadfast group (SDF) has produced a stellar share price run since joining the Income First model portfolio back in November. This was catalysed by a strong financial report for the first half of FY16, and seen the company rerate for expectations of an improving insurance premium price environment. SDF has announced that chief executive officer Robert Kelly will remain with the business until at least 2020, and has also reiterated its full year guidance within a presentation at a conference for analysts and fund managers. Despite retaining a positive view on SDF, we are changing the recommendation from buy to hold. This is purely a price versus valuation assessment. The crux of our view is that the market may be pricing in upside to the company's future through an improving cycle that we have yet to include in our forecasts. Should conditions improve further, as the market appears to be predicting, our valuation will be adjusted higher. For now, we note that the share price exceeds our valuation and thus the call is changed to a hold. Additionally, the strong share price has led to a steep decline in the dividend yield, which sits at around 3.2 per cent (based on a share price of $1.90). This is pushing the lower limited of an acceptable yield for the portfolio, and for inclusion as an income first recommendation. This lower yield reinforces our change to a hold call.

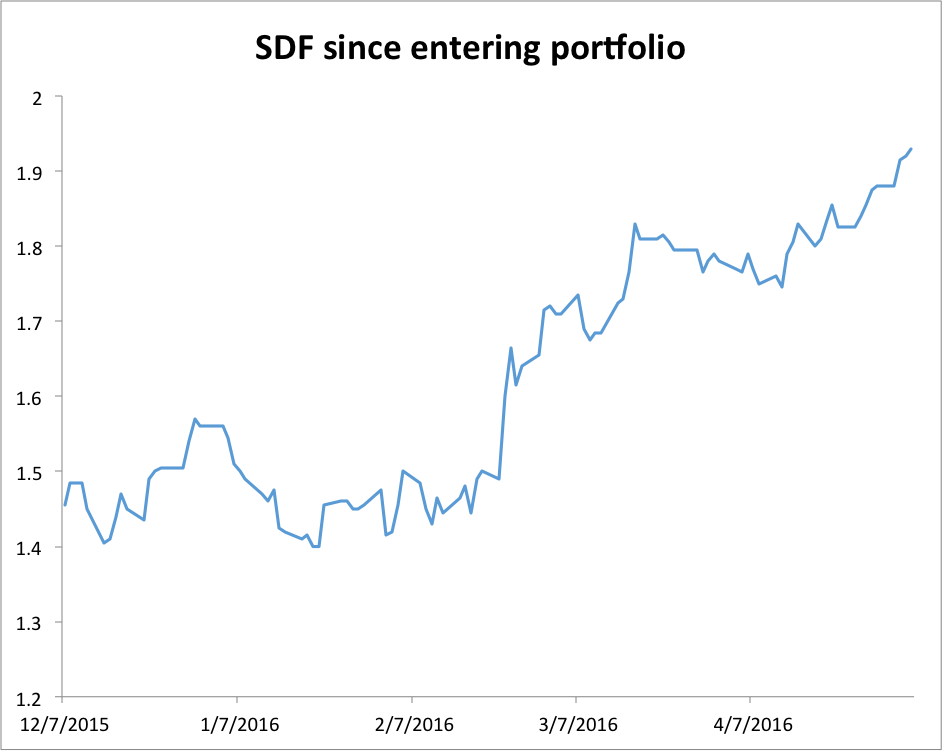

Share price performance

SDF has had a very strong run since it first entered the income first model portfolio on December 7, 2015:

Our valuation was initially $1.68, upgraded to $1.74 after the interim result and remains unchanged. Given that the share price has been so healthy, and is now materially above our valuation, we move SDF to a hold recommendation.

That said, the changing dynamics in the insurance sector may give rise to general insurance premium increases at a rate above that included in our forecasts. We see this as the key potential catalyst for valuation upgrades, along with the potential for acquisition outperformance to create further shareholder value.

CEO retention

Last week, SDF announced that its chief executive Robert Kelly has agreed not to terminate his employment before the end of 2020, extending his expected services tenure by three years from the terms of the current arrangement. This is a formality in our view, but nonetheless a positive in terms of the stability it will provide the business going forward. Mr Kelly has thus far delivered for shareholders, and the recent acquisitions of Calliden and QBE owned assets have reflected well on his record to date.

Income First model to wait and see

Despite the change in recommendation from buy to hold, the Income First model portfolio will be making no changes to its exposure. SDF is currently the portfolio's largest holding at a weight just under eight per cent. While the upside to the share price may be limited in the short term, we still consider that the business is in a strong position, both competitively and in terms of the insurance cycle. The key concern that may lead to weighting adjustments in the future is the running dividend yield. As mentioned, the increasing share price has diminished the yield, and should this continue further there may be a case to rebalance the capital elsewhere in order to generate a higher yield. For now we will wait and see.