Harley-Davidson rumbles to life

Summary: A heavy-weight in its industry with an extremely loyal customer base, Harley-Davidson has managed to take market share off its competition in the past five years while still raising the prices of its motorcycles. Though the stock hasn't performed well this year due to various issues, its third-quarter results revealed better-than-expected earnings as the company benefited from its new high-end touring line. |

Key take-out: Harley-Davidson should revisit or even surpass its recent highs of $US73 as momentum builds from the improvements seen in the third quarter. I have a target price of $US74 on the stock. |

Key beneficiaries: General investors. Category: International Shares. |

Recommendation: Buy Price at call: $US65.69 Target price: $US74 Risk: Low |

As with Facebook two weeks ago, Harley-Davidson needs no introduction. The company manufactures motorcycles and has done so since 1903. Its forte is large displacement heavy road bikes styled in the classic Harley manner. Recently it has launched a range of smaller, entry level “Street” bikes to entice beginning and younger riders into the Harley “ecosystem”.

For those of you who aren't life-long motorcyclists or a Harley rider like I am, here's a bit of background. Headquartered in Milwaukee, Wisconsin, Harley Davidson manufactures and sells heavyweight, large displacement bikes, as well as a line of parts, accessories, clothing and collectables. It also provides financing to dealers and customers via Harley Davidson Financial Services (HDFS).

Harley produces six “families” of motorcycles: Sportster, Dyna Glide, Softail, Touring, V-Rod, and Street. Harley distributes its products through an independently owned dealer network with over 1,300 locations worldwide. The US remains its biggest market with 66% of total revenues. Europe is also important at almost 20% of sales.

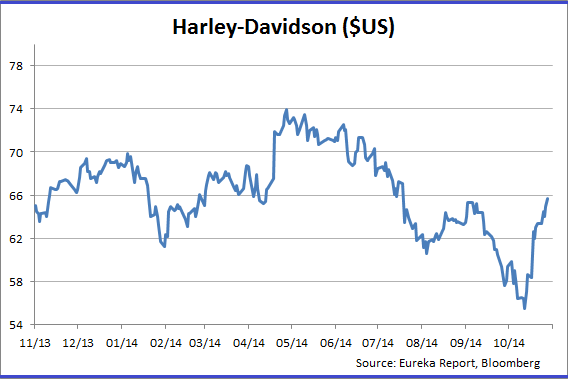

Harley Davidson stock is down 10% this year and some 15% off its recent high, significantly lagging the S&P 500. A soft (weather related) second-quarter earnings report pressured the shares in the mid-year, where the company lowered 2014 shipment guidance (from 279-284,000 units to 270-275,000 units) and flagged lower margins in the second half of 2014 due to its product mix and the launch of the Street product.

While Harley didn't change forward guidance when it reported third-quarter earnings on October 21 (and net income declined 7% on tough 2013 comparisons) it still beat consensus earnings expectations of 59 cents a share, coming in 10 cents higher at 69 cents.

Third-quarter revenues and earnings benefitted from strong sales of its high-end touring line which they recently updated (called project Rushmore) and the introduction of the new “Road Glide” – a classic tourer.

Market expectations were low going into the quarter and a bit of good news drove the stock 7% higher on the day. There is more to come as this looks like a trough quarter.

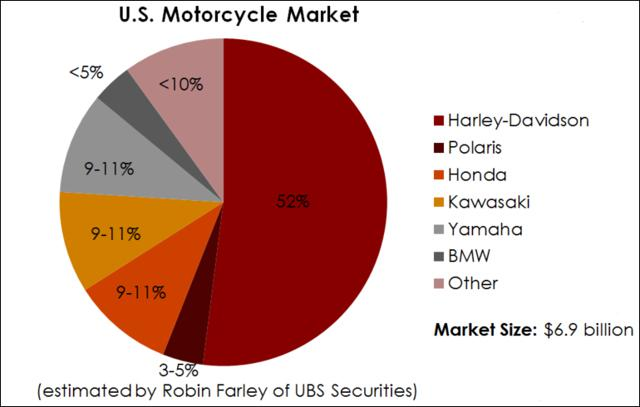

This is a company that dominates the heavy motorcycle industry. It has over 50% share of large bikes sold in the US and 33% worldwide. It has brand recognition and customer loyalty that most companies would kill for. Industry and demographic trends remain positive for large motorcycles over the medium term.

The Japanese manufacturers have been making “look alike” Harleys for years but seem unable to gain more market share in spite of a much cheaper product. In reality, they are a bit “bland” –something a Harley will never be!

As a motorcyclist, I see Polaris with its Victory line up and now the Indian brand as Harley's most serious competitor in the heavy bike category.

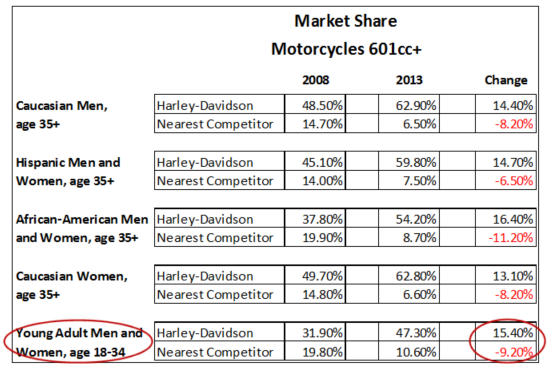

When we look at the US demographic it's clear that Harley has increased market share over the past five years in all five categories at the expense of the competition. See below:

Source: Harley-Davidson

Now Harley is not a high-growth stock (revenue growth has been less than 5% per annum for the last 10 years and will probably grow 6-9% over the next 5 years) and while I love companies that can grow the top line at 20-40%, I also love companies that dominate their industries – the 800 pound gorilla! That's Harley to a “T”.

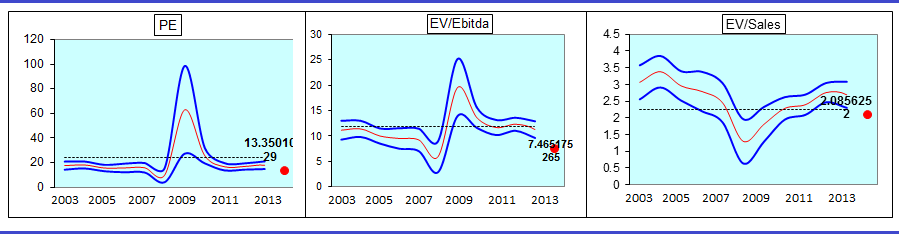

There are other companies that are dominant in their industries – Amazon, Google, Exxon Mobil, Microsoft, and General Electric – but I'm not necessarily buying their stocks. As Kerr Neilson from Platinum Investments said in our September webinar on international investing, “If you pay the wrong price for a stock, you won't make money”. In Harley's case I believe that it's at the right price.

From a valuation perspective, Harley is at a significant discount to its historical averages as measured by most common valuation multiples: price-earnings (P/E), enterprise valuation (EV) to sales and EV to earnings before interest, tax, depreciation and amortisation (EBITDA).

Management

Harley continues to restructure and improve profitability. In 2009, as the company was recovering from the GFC, they appointed a new chief executive, Keith Wandell, who had been the president and chief executive of Johnson Controls, a $US35 billion market cap diversified industrial conglomerate.

For Harley Wandell implemented an extensive restructuring plan which reduced costs, eliminated excess capacity, sold non-core businesses (Buell), renegotiated expensive union contracts, and initiated a new enterprise resource planning (ERP) system – the benefits of which can be seen in Harley being able to generate annual EBIT margins of 22-23% plus and operating margins of 18%.

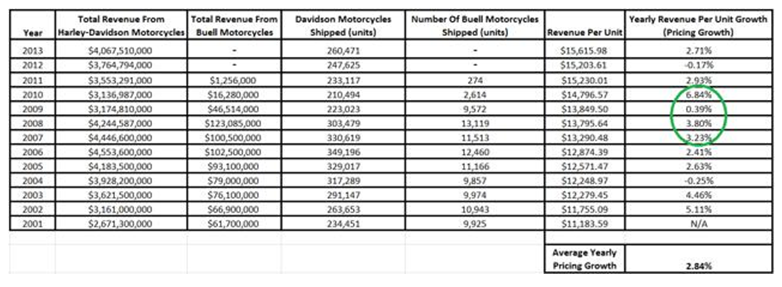

Harley has pricing power. The company has consistently being able to raise prices in most calendar years. This trend should continue.

In other words, Harley is able to achieve 2-3% pricing growth on top of any volume gains.

Conclusion and recommendation

I expect improvements seen in the third quarter report will continue with the high-end “Rushmore” line and the new Road Glide providing some momentum into 2015. News flow (which I believe will be positive) regarding shipments and sales of the new entry level “Street” series and the fact that start up issues are now history should also underpin the stock. I expect Harley to revisit or surpass its recent highs of $US73.

I have a target price of US$74 based on a multiple of 17 times 2015 earnings per share of $US4.35.

Risks

- Harley is the ultimate customer discretionary stock. Consumer sentiment towards high-end products could falter, resulting in lower sales.

- The company must successfully attract new, younger riders and women to the brand. They may not succeed.

- Shipments and sales may incur a mismatch. Inventories would rise.

- Increased competition from Polaris (Victory and Indian), and Japanese manufacturers.

- Currency risk. A strong dollar could affect international sales and growth.

- HDFS (Financial Services arm) is dependent on liquidity and capital markets. Harley finances approximately 50% of retail sales; reduced access to capital markets could affect sales.

To see Harley-Davidson's forecasts and financial summary, click here.