Global Health pauses growth path

We are downgrading our recommendation for Global Health (GLH) to a “sell” due to inconsistent messages from management.

Firstly, the company has stated numerous times that their business model is de-risked due to 80% of revenues being recurring and a diversified base of customers reducing the reliance on any one customer.

That all sounds great, but last week the company announced that if its contract with SA Health is not renewed in March 2015 then it will impact earnings by 1.5 cents per share, or 34% of 2013-14 earnings.

Industry background

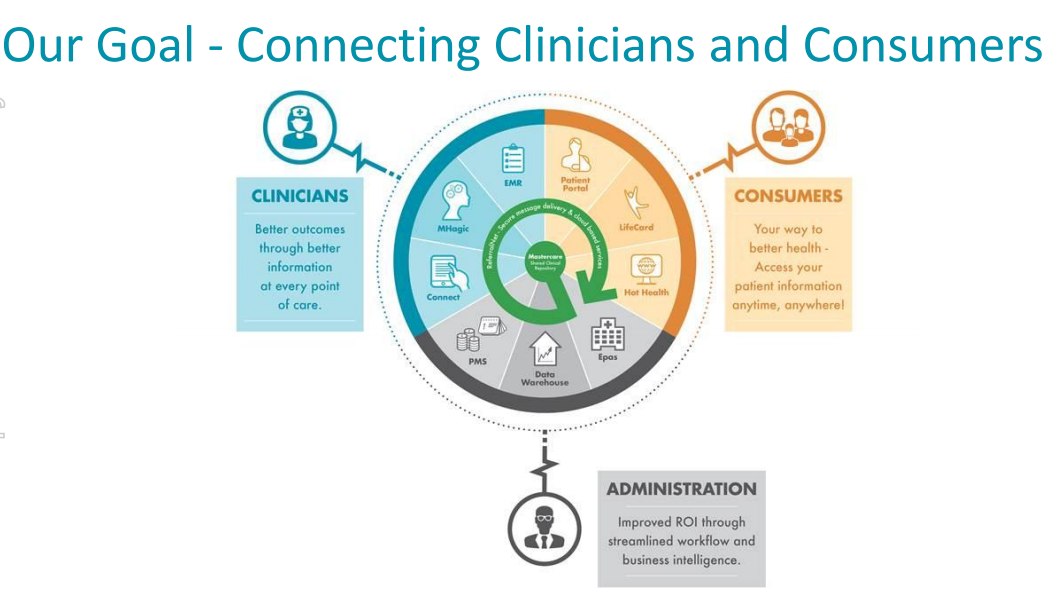

There is a critical need to cut administration costs in the paper based domestic healthcare industry. The way to do this is with the use of digital connectivity between as many of the different healthcare operators as possible, i.e. clinical, patient, governments, health insurance provider, general practitioners, nurses, pharmacies and diagnostic providers.

Telstra has recently announced it is attempting to be a leading provider in E-Health, and there are many other smaller software providers who are trying to build up scale.

Global Health (GLH) is very small with a market cap of $10 million, but it has achieved some success in rolling out its cloud based MasterCare electronic medical record software to the non-acute mental health sector.

It also has software solutions for electronic referrals and patient administration systems (ePAS).

One of the challenges is the need to spend about $1 million per annum on software R&D to keep up with competitors who are also trying to build up scale.

The uncertainty of the government co-payment as well as the failed Personally Controlled Electronic Health Record (PCEHR) system has had an impact on investment, with many healthcare operators waiting for government direction before committing to new systems.

South Australian health contract - CHIRON

The first announcement late on Friday, November 21 stated that Global Health will retire its CHIRON Patient Administration System from the market following advice from the South Australian Minister for Health of its decision to decline an upgrade to MasterCare ePAS.

CHIRON is the company's original healthcare system developed in the 80s and implemented across 64 SA Health Country hospitals from 1991-1993.

The MS-DOS based CHIRON was superseded in 2003 by the company's MasterCare ePAS system. SA Health is the company's last remaining customer still operating CHIRON with the other clients having upgraded to MasterCare ePAS by 2008.

The upgrade didn't proceed because the SA Health Enterprise PAS tender was awarded to Allscripts (US software company) in 2010.

Global Health has continued to provide support with CHIRON while Allsripts was developing its product, but the agreement is due to expire on March 31, 2015.

On Monday, November 24, the company went into a trading halt due to further correspondence with the SA government. Then, on November 26, the company announced that the SA Minister for Health wishes to negotiate terms for the extended use of CHIRON beyond March 2015.

Reading between the lines we believe Allscripts is not ready to roll out its solution and therefore the government needs an interim solution.

We also suspect that the government may have initially asked GLH to upgrade to its MasterCare ePAS. If this occurred there would have been setup costs for GLH and it provides an explanation as to why a non-renewal will have a 1.5 cent per share earnings impact.

The reason for the change of mind is likely to be because of a loophole in the Copyright Act that states Commonwealth and State are allowed to have access to IP which is necessary to perform their administrative functions to serve the public. They still have to agree to a rate of pay with Global Health, but it stops GLH from forcing the government to upgrade to its latest software like other non-government customers would have to do.

So the worst case is a 1.5 cent per share impact with no agreement, a minimal impact if the government extends the CHIRON agreement, and a positive impact if SA Health upgrades to MasterCare ePAS.

Developing nations

Chief executive and major shareholder Mathew Cherian believes the company's largest opportunity is to rollout its software solutions to developing nations.

The rationale is based on the cheaper offering Global Health has, and the fact that many developing nations would not pay the high costs for US based software providers.

In Australia the environment is very competitive, and GLH would likely reach a point where they will need to merge with other smaller opportunities to keep growing.

While the overseas opportunity sounds interesting, there is large uncertainty with the required costs and risks of expanding into new locations.

The company has guided towards the potential for overseas earnings in 2015-16, but we have no evidence to determine the likelihood of this occurring.

Aggressive accounting

There is a large red flag in GLH accounts, and that is all R&D expenditure is capitalised. If the company can justify that the asset base is growing as evidenced by increased earnings then this won't necessarily be a problem. But we have doubts as to how sustainable this situation is. The slow rate of depreciation and amortisation also leaves the company vulnerable to asset write-downs.

By way of comparison, Azure Healthcare (AZV) expenses all software development costs – understating its earnings and potentially also understating its balance sheet.

Further, Global Health also includes a government rebate it gets for this expenditure as operating income. If you leave this rebate as is, then Global Health is trading on a 2013-14 price-earnings (P/E) multiple of six, but if you take it then the P/E increases to nine. The rebate will continue for the next few years at least, but it is still something to be mindful of.

Also, due to the large amount of accumulated losses, the company will not be paying tax any time soon.

Summary and valuation

Conservatively, we have assumed the worst case for the SA Health contract negotiation with our 2014-15 earnings per share (EPS) forecast falling to 3.2 cents per share. Whilst the 2014-15 P/E of 8.6 may appear cheap, the aggressive accounting explained above does need to be considered.

There is upside risk to our view if the SA Health contract is extended past March 2015.

Our valuation is reduced to 36 cents, and normally with the slight discount to valuation we would rate the stock a “hold”.

But given the speculative, high risk nature of the stock we believe it can only be rated a “speculative buy” or a “sell”. As we have some concerns around some inconsistent messages from management we are downgrading the recommendation to a “sell”.

That being said, the stock has plummeted 9.1% to 25 cents today (December 1, 2014). At these levels we recommend investors wait for a retracement back towards 35 cents before selling.

For Global Health's forecasts and financial summary, click here.