Getting to know Wellcom

Wellcom Group – stable and growing yield, but liquidity risks exist

This week we are adding to our Income First model portfolio and initiate coverage on Wellcom Group Limited (WLL) with a buy call and an initial 5 per cent holding.

For investors unfamiliar with WLL's operations (probably most of us given the company's size), WLL is a Melbourne-based company that has grown to be an increasingly international provider of marketing content, production services and technology in the marketing and advertising space. Having a long, rich history in the production and print of catalogues, WLL has managed to stay at the front of its industry in terms of technology and retain many of Australia's largest retail facing brands among its client suite.

The company has a squeaky clean balance sheet, a strong history of profits and dividends, and is well placed to grow via cash acquisitions. Overall, WLL is a very appropriate stock for our Income First model portfolio. That said, the key drawbacks are the company's size, at about $160 million in market capitalisation, and relatively low liquidity.

With a share price near $4, WLL is expected to provide a cash dividend yield of about 5 per cent (over 7 per cent when grossed for franking credits). Based on a strong dividend stream and despite factoring in some risk given the company's size and relative illiquidity, we are happy to initiate on WLL as an income generating business with a $4.30 valuation.

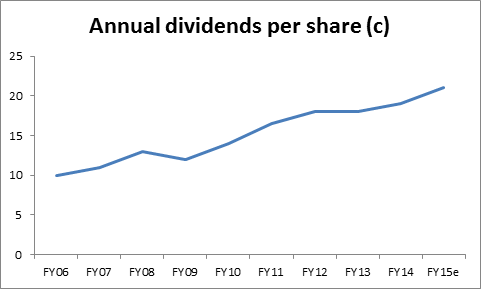

Cash flow and dividends

WLL's cash flow and dividends have been impressive and consistent over an extended period. The annual dividend has only fallen once – in FY09 during the throes of the GFC when it fell a total of 1 cent. If WLL hits our expectations for FY15, dividends will have grown at a compound annual growth rate (CAGR) of 8.59 per cent p.a. Unsurprisingly, this growth in dividends has been matched by an 8.71 per cent CAGR in the company's net operating cash flow between FY06 and FY14. I think this is a key point. WLL is a business that has delivered strong, stable results over an extended period, and has been happy to let the growth in cash flow and income lead dividends higher. For those of us who love the benefits of franking credits, WLL had a strong franking balance at the end of FY14, so I expect a continuation of full franking into the future for WLL.

Resilient operations

It may seem counterintuitive, but WLL has built itself into a position that could be described as one with strong, defensive earnings. The company has been the incumbent provider of marketing services to some of Australia's largest retail brands (including Coles, Target, Woolworths, Ford, NAB, ANZ, David Jones, Foxtel and many more). The company's client list is a who's who of Australian retail and has been growing slowly over time.

In Australia, WLL's CFO estimates that 70 per cent of the company's earnings are quite sticky in the sense that they are embedded into their clients' operations. This is achieved through the use of ‘hubs' whereby WLL staff and/or software are inserted into the clients' operations. For example, WLL has five staff operating within ANZ. With this in mind I believe there is a strong level of base earning for the Australasian operations.

Technology has been a key driver of WLL's success over recent years in the face of a structurally changing industry. This success has not come without challenges after a period of technological investment and price pressure put pressure on the business a few years ago. However, WLL management responded and has worked collaboratively with clients in order to ensure continued relevance. This has brought strong recurring earnings to the group, and provides us with the confidence to forecasts continuing dividends into the future.

What exactly does WLL do? Its business operations are split into three major divisions, although these are not reported separately.

WLL operations

First, the Content division creates marketing collateral for its clients. This division recently won contracts with both Kmart and Target in Australia. This content creation can range anywhere from photography services, to website design and app development. WLL is capable of creating content for many mediums including video, TV, print and more.

Second, the company's bread and butter is the Production segment, which focuses on strategy, messaging and the production of advertising and marketing collateral. This is a segment with a broad range of capability and is core to the company's function.

Third is WLL's Technology stream. This focuses on the use, development and ownership of technology that equips clients and WLL itself with the tools to create and produce collateral with efficiency. The company's focus on investing in technology is epitomised by its ability to move with structural changes in the industry that have required more and more digital content.

Ownership structure and lack of market liquidity

WLL listed in 2005 at a price of $1, having been founded in 2000 by Wayne Sidwell. The company has come a long way since then, but Sidwell remains a key part of the business with the original well.com business a 47.51 per cent owner as at the last annual report. In fact, the top 20 owners of WLL owned over 81 per cent of the business. While this is quite positive in terms of the alignment of business operations with shareholder interests, it means that there is a lack of trade in the stock. Hence low liquidity is a risk that investors should consider. By our estimates, the average daily volume in WLL over recent months is around 2,000 shares, or $8,000.

Growth avenues, international expansion and a clean balance sheet

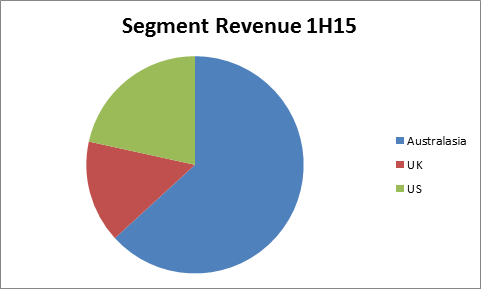

WLL has had mixed success in its international expansion plans. At present the exposure on a revenue basis is significantly skewed towards Australasia-based earnings, and margins in Australasia are quite stable. In the UK, successes have been variable, though operations are profitable and the intention is to continue to invest. WLL also purchased theLAB in the US during FY14 and produced a profitable contribution to group earnings. In addition, WLL expanded its US operations with the $US2.2m acquisition of a business in the content creation and advertising marketing space. This acquisition was funded from a combination of cash reserves and debt finance.

Pleasingly, WLL has a very clean balance sheet with minimal levels of gearing. As at December 31, 2014 WLL's balance sheet carried a net cash position of around $5.6m. In my view, this places the company in a strong position to continue to fund growth aspirations. Yes, growth investment will bring with it some risk, and to date performances have been mixed in some of the company's international businesses. But given the strong balance sheet WLL has the firepower to both invest for growth and continue to reward shareholders with a strong income stream.

Reporting on Wednesday August 19

Investors should take heed that WLL is reporting full-year results to the market this week. We have decided to take this reporting risk into the portfolio, in light of a strong first half, and guidance to the market for 10 per cent earnings per share (eps) growth. Additionally, it is our position that the company has the cash generation and balance sheet to pay a dividend at least as strong as that paid last financial year.

However, bringing a stock into the portfolio so close to a result does add some near-term risk. Specifically it is worth noting that the payout ratio last year was stretched towards 95 per cent, and that the company may not wish to replicate this high level. While this is not representative of our view, we acknowledge that with guidance suggesting only 10 per cent growth in eps, there is a chance that the dividend will disappoint. In light of our buy call being so proximate to the result, investors may wish to consider whether they want to take on the same reporting risk that I am bringing into the portfolio with this call.

Portfolio role and weight

We view WLL as a stock that will introduce a different type of risk to the Income First model portfolio. The company operates in an interesting niche but has exposure to general business confidence as customer volumes are largely determined by the marketing and advertising budgets of Australia's major retail companies. Not only is this a different angle, but WLL's share price behaviour has been quite stable over time. The low liquidity, predictability and skewed ownership structure mean that WLL is likely to actually reduce portfolio volatility. We are happy to add the company to the portfolio with an initial weight of 5 per cent.

To see Wellcom Group's full forecasts and financial summary, click here.