Gauging Gilead's superior growth

Gilead is a biopharmaceutical company that focuses on the discovery, development and commercialisation of drugs primarily in the areas of HIV/AIDS, hepatitis, and oncology.

Revenues in 2013 were $US11 billion and analysts expect the company to generate total revenues in excess of $US25 billion in 2014, driven primarily by its Hepatitis C drug Sovaldi and its premier HIV franchise. Gilead will earn over $US8 a share in 2014, putting it on a forward price-earnings multiple of 12.9 times. This makes it one of the cheapest biotechnology stocks globally.

There are three growth drivers for Gilead over the next three years: the company's best-in-class HIV treatments, global development of its HCV (Hepatitis C) drug and variants, and the recent approval of its latest cancer formulation, idelasib, for treatment of various forms of lymphoma.

Gilead was founded in 1987 and began life as a public company in 1992. Early success with its revolutionary and lifesaving treatments for HIV/AIDS – when the disease was essentially a death sentence – provided the basis for a market leading position in the treatment of HIV globally using antiretroviral therapies, some of which are in a single pill dosage.

Two of Gilead's more recent commercial indications, Complera and Stribild, continue to gain market share. Gilead is on track to replace its legacy products that will go off patent in 2017-2021 (Viread, Truvada, and Atripla) with the TAF Quad tablet in 2016. GILD's HIV franchise will generate an estimated $US10 billion in 2014 and is expected to grow at 20% plus to 2017.

The blockbuster drug

The main growth driver over the past 12 months has been Gilead's blockbuster hepatitis C treatment Sovaldi (sofosbuvir). Sovaldi doesn't just treat HCV – it cures it (in 90% of cases), has few side effects, and a once-daily dosing. Hepatitis C (HCV) is a life threatening, chronic infectious disease of the liver. Spread primarily by blood to blood contact (intravenous drug use, poorly sterilized medical equipment, and transfusions) untreated patients usually develop cirrhosis of the liver or liver cancer and will eventually require a transplant or die.

There are an estimated 150-200 million sufferers worldwide. Due to the efficacy of this indication, Gilead is the market leader with a 65% market share. Sales growth is phenomenal with $US139 million in 2013 (the year it was launched), $US13.3 billion estimated in 2014, $US17 billion in 2015, $US20 billion in 2016 and $US22 billion in 2017.

A $US22 billion sales number in 2017 would rank Sovaldi as the world's best-selling drug. Lipitor (from Pfizer to treat high cholesterol) peaked at $US12 billion.

Gilead has drawn much criticism from health insurers and government officials for its pricing of Sovaldi and its variants. A 12-week regimen costs $US84,000 or roughly $US1,000 per day.

The latest variant to be approved, Harvoni (Sovaldi ledipasvir) treats Genotype 1 HCV. This type, which is the most difficult to treat and the most common, will go for $US1,050 per day or $US94,500 for a 12-week regimen (although in trials the disease was cured in only 8 weeks, making it truly cost effective).

Gilead and other drug companies with lifesaving but expensive indications argue that the long-term costs of treating, supplying transplants and generally supporting a patient with a chronic disease are far greater than a cure. Most doctors agree. A recent study (2011) by the Henry Ford Health System stated that the direct costs of supporting a chronic hepatitis C patient was over $US25,000 per annum.

Oncology is the newest area of focus for Gilead. Their pipeline includes targeted therapies that inhibit certain signalling proteins involved in the development and proliferation of cancer cells. In July, Gilead received FDA approval for Zydelig (idelasib) which has shown much promise (in conjunction with Roche's Rituxan) in treating three separate forms of blood cancers. Analysts believe that this is a $US1.5-1.7 billion revenue opportunity and can possibly capture 10-20% of the market.

Gilead is serious about the oncology market and has another seven potential therapies currently in Stage 2 for pancreatic cancer, colorectal malignancies, solid tumors and myelofibrosis.

Management

Senior management have been with the company in executive positions since 1990 and have essentially built the company into what it is today.

Chairman and chief executive John Martin, president and chief operating officer John Milligan and chief scientific officer Norbert Bischofberger are all PhDs in organic chemistry and previously worked in senior research roles with industry leaders such as Bristol Myers, Genentech, Syntex, and Hoffman –La Roche.

Conclusion and recommendation

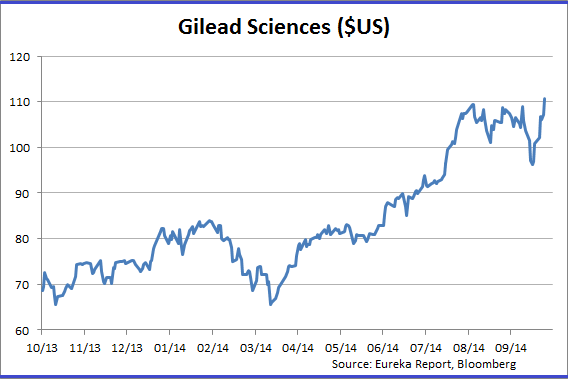

Gilead is a buy at current levels. In spite of a strong performance this year ( 40%), the stock is trading at a significant discount to its large cap biotech peers and the S&P500 Index.

Earnings are expected to grow at least 20% from 2014-2016. In addition to the pure growth GILD is expected to deliver it will generate over $US10 billion in free cash flow over the next decade, allowing aggressive share buybacks and acquisition of strategic pipeline assets.

Gilead should be in any serious global investor's portfolio due to its quality, scale, and growth characteristics. I have a target price of $US136 or 12 times earnings per share of 11.37 in 2014-15.

Risks

Gilead's HIV business depends on its current indications (Stribild, Complera and Truvada) to continue to gain share and that its TAF indication currently in Phase 3 gains approval.

Given the high cost of Sovaldi and its variants it is expected there will be pricing/reimbursement pressure from US private payers as well as Medicaid and the US Department of Veterans Affairs. European governments may also insist on greater rebates.

Due to the attractiveness of the HCV market there are a number of major pharmaceutical companies such as Merck, Bristol Myers, AbbVie, and Johnson and Johnson that have indications in development. At present, however, none have the efficacy of Sovaldi and some may have to be employed with Sovaldi (as a “combo”) making pricing difficult for new entrants.

To see Gilead Science's forecasts and financial summary, click here.