Empired should emerge stronger

Last week, technology services and solutions firm Empired Limited (EPD) announced that earnings margins in the first half were going to be significantly behind market expectations. The announcement advised that management views the lower margin as being caused by a number of “one off” issues, indicating that the longer term investment thesis remains intact. Of course, this is a downgrade to near term earnings, and we must consider that this is unexpected and does create some uncertainty in the business' ability to execute its growth strategy. However, teething issues are always possible when a business grows its revenue base so significantly and attempts to acquire businesses integrate them and successfully scale its operations to deliver significant new contracts won in the last 12 months.

Our view is that the problems stem from issues with internal systems. While this is a concern, the company's core products remain strong, with exposure to Microsoft a particular positive at present.

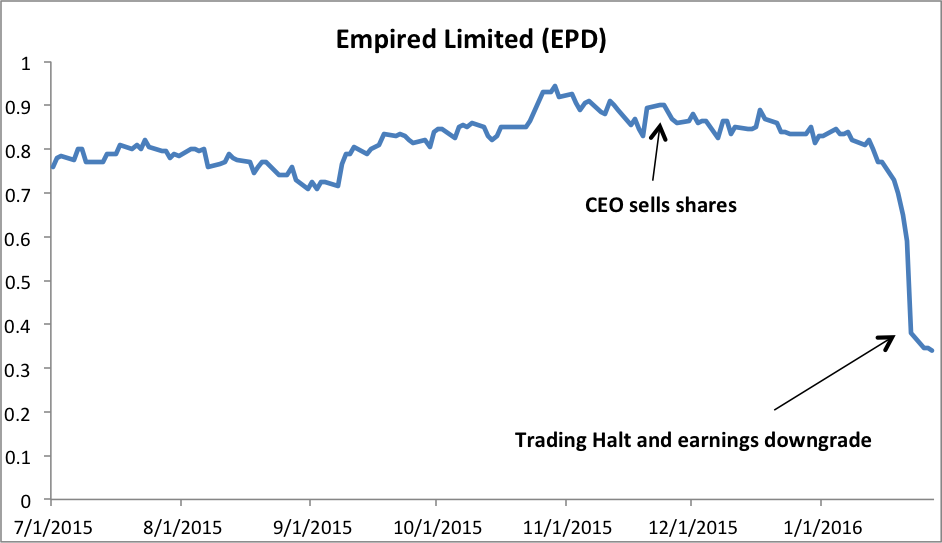

Unfortunately, the company's chief executive, Russell Baskerville sold a large part of his holdings in EPD in November at a significantly higher share price. This has caused frustration amongst investors, and perhaps is a circumstance that has explained why the most recent downgrade has been received with additional disappointment. At this point the share price is trading well below value as a result, thus we retain a buy call despite a lower valuation of $0.64.

Downgrades and one off items

For background, EPD has three main operating divisions. Infrastructure Services is around 25 per cent of revenue and the company manages applications and IT infrastructure on behalf of the client. The Applications and consulting services division is a non-Microsoft exposure and accounts for around 20 per cent of revenue. Finally, the Microsoft Business Solutions division is largely focusing on Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP), which are areas in which Microsoft has a strong market presence. This division accounts for around 55 per cent of EPD's revenue. Overall, we view the ongoing exposure through Microsoft CRM and ERP as a positive, and despite these one off restructure costs, believe that the demand for EPD services remains strong. The problem at present is undoubtedly internal to EPD itself.

The key to the future for EPD will come in whether this downgrade is indeed “one-off” in nature, or indicative of issues that will continue to manifest in lower profit margins in the future. Management has indicated that the downgrade was attributable to three main issues.

• Firstly, the sales organisation has been restructured to afford the integration of recent acquisitions. This has resulted in an estimated $4.1 million impact through delays in work and lower utilisation. I spoke with EPD management and this write down was attributed to centralising the sales team, some turnover in sales staff and the associated temporary dip in utilisation of billable Applications staff over that period. Management has commented that they are confident in the team heading into the new year, but that the severity of the changes needed to the sales structure were not anticipated, hence the one off expense.

• Secondly, there has been a $1.1m impact in the first half that is attributed to contract initiation costs. This is attributable to the costs associated in ramping up and some commencement delays relating to new contract wins. Effectively this is a temporary need for more staff and set up costs in executing work. It could be argued that management should have foreseen this, but nonetheless it is a one-off expense involved in setting up new contracts.

• Finally, a non - cash write down of $2.3m will be incurred at the half-year accounts after a review of the value of EPD's plant and equipment, and relates to assets no longer in use. This write down relates to a multitude of small assets acquired with acquisitions an in my view is a non-material, non-cash write down.

We have no reason to believe that there are ongoing issues at EPD. Management was keen to point out on a call that the major challenge was associated with the restructure of the sales organisation. This restructure was made with the intention of centralising the sales effort for eSavvy, OBS and Intergen. Effectively, the strategic rationale is that this will equip sales staff with the ability to cross-sell all of EPD's capabilities and to make higher value sales, targeting $500k sales as against many $30k to $50k sales.

The ramp up of contracts won in 2015 has coincided with the need to restructure, and teething issues at this stage are considered an acceptable negative. Undoubtedly, the fact that these issues have had unforeseen financial impacts is worrying, and as such there is a need to acknowledge that risks are high for investors in EPD at this stage. This is certainly always the case when a company announces an earnings downgrade, and is also always the case when management is relying on a turnaround in results in the second half of a financial year. I think it is important to acknowledge that further downgrades are possible in the second half.

Perhaps the pleasing aspect of this announcement is that the company has reiterated strong expectations for revenue growth. In the first half, revenue is expected to be delivered at around $79m, with guidance for $159m to $169m at the full year result. At this stage, if we assume that the one-off items mentioned above are in fact unique, the growth in revenue on long term contracts bodes well for the company's ability to deliver strong growth in earnings in FY17 and beyond.

Trading in the lead up to the downgrade

Perhaps one of the most unsettling aspects of this downgrade was that the share price fell sharply before the information was released to the market. On Wednesday, EPD responded to a request from the ASX to explain this, and confirmed that it was and is in compliance with ASX listing rules. When asked to comment on this, chief executive Russell Baskerville said that the trading activity and circumstances were disappointing, but that he had no further explanation for the share price action. While there is neither proof, nor allegation that the information was not properly managed, the fact the market moved so heavily before bad news is also likely to impact investor sentiment.

In that same vein, investor sentiment will also likely be impacted by the fact that chief executive Russell Baskerville sold around $800k (950,059 shares) of his EPD share in last November last year. While this is all circumstantial, and I certainly have no issues with directors selling some of their holdings in order to diversify or service their own lifestyle, the timing has left a sour taste in some investor's mouths. For the record, these shares were sold in order to facilitate a property purchase. In my view, it is important that they have “skin in the game”, and with Mr. Baskerville continuing to hold 7.8 million shares, I am comfortable his interests are aligned with shareholders in that respect.

These two issues above are not likely to directly impact ongoing operations. Sure, the circumstances of the trade around this downgrade are frustrating, but investors should be careful reading too much into non-operating issues, and stick with the company's fundamental strengths.

Long-term contracts with recurring earnings

As mentioned, the reason we continue to recommend EPD as a buy is that the company has shown impressive revenue growth off the back of newly won contracts in FY15 0 – in FY15, around 50 per cent of revenue was sourced from multi-year contracts, and I expect this to continue into FY16. These contracts in FY15 are largely annuity based or multi-year and underpin the ability to maintain revenue above current rates. With this revenue being highly recurring, the task before the business is to implement integration and strategy within its control. The recurring nature of the company's revenue and the speed at which this growth has been acquired is probably the key reason we are comfortable retaining EPD in the Growth First model. Time will tell as to whether the company can deliver the margins expected from this revenue base, but there is definitely a pleasing base from which the company can deliver future profits. Here is the FY15 revenue breakdown I mentioned:

Source: EPD FY15 results presentation

Cash flow and reducing capex in coming years

Perhaps the most immediate aspect of this downgrade is the near term impact on cash flow. EPD has flirted with paying dividends in FY15, and failed to deliver. Now the company's low EBITDA margin in 1H16 is likely to lead to weak cash from operations, albeit temporary. As a result, and given the need for the business to invest in new contract delivery, I expect free cash flow to be weak.

During FY16, and into FY17, EPD will also be executing some office moves. This will constitute capex, lifting investing cash flows temporarily. In subsequent years, it should be noted that one of the attractions of EPD is that it is a very “capital light” business. With management expectations that long run maintenance capex is around $3m per annum, and given the recurring nature of the contracts, and assuming margin recovery, EPD is well placed to lift its free cash flow significantly. Therein lies the value.

It is worth noting that EPD's working capital management has not delivered of late, as receivables expanded to a touch under $27m at the end of FY15. While we expect this to remain similar in the upcoming report, the potential to tighten this following the sales restructure may produce additional cash inflow in the second half of FY16.

Margins and the risks of ‘hockey stick' earnings

While we are retaining a buy call on EPD and viewing the recent issues announced by the company as one off, there are significant risks – EPD should be viewed as high risk for that reason. Effectively, the question for EPD is whether the company can get control of its cost base, lift utilisation and deliver higher margins in terms of its earnings before interest, tax, depreciation and amortisation (EBITDA). The company is in our view capable of lifting margins towards 10 per cent to 11 per cent in the longer term future.

At present, these margins have been guided for a range of 8 per cent to 9 per cent in FY16, and a second half margin of between 8 per cent and 10 per cent. This is of course assuming and adjusting for the recent costs incurred as one-off – and here lies the risk. Why give EPD the benefit of the doubt that these are one-off items, when the company should have or could have foreseen that costs to initiate contracts would be coming? It is the key question, and we need to see some evidence that margins are returning to normal levels before risks are deemed to have abated.

Summary

Overall, we are disappointed that EPD has announced a downgrade to first half expectations. There is no doubt that this announcement increases risk, and lowers value as a result. Accordingly, we downgrade our valuation of EPD from $1.00 to $0.64.

Despite this, the downgrade has been issued in response to temporary issues that are largely what could be best described as growing pains, and the price has been heavily oversold. Certainly, sentiment is also weak due to the circumstances of trading halt.

That said, EPD appears to have the revenue stream to support longer term profitability, and may provide an opportunity for investors willing to take on additional risk. We will keenly watch the company's financial results this February, and note that any recovery in margins in the second half would be a catalyst for our view to that risks will decline. We reiterate a buy call on EPD.

Click here to view Empired Limited's forecasts and financial summary.