Earnings call for conviction stocks

Four of our highest conviction stocks have reported quarterly results, with three exceeding market expectations.

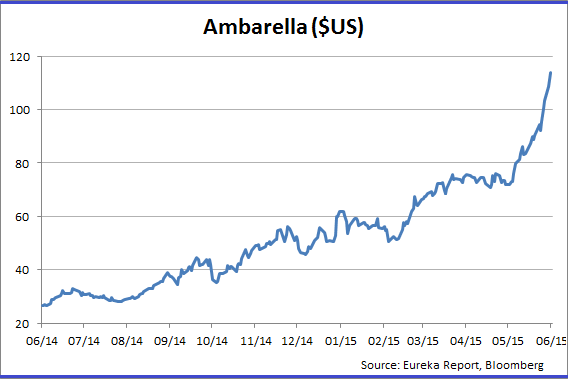

Image processing products manufacturer Ambarella, which is a supplier to GoPro, has handily beaten forecasts and has now more than doubled since I initially recommended the stock.

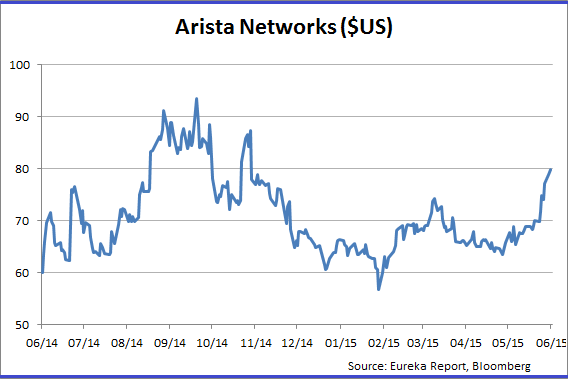

Computer networking company Arista Networks crushed estimates and guidance. While it offered conservative guidance for the upcoming quarter – as usual – it is seeing an accelerating in cloud spending and believes the industry is ready for a major refresh cycle.

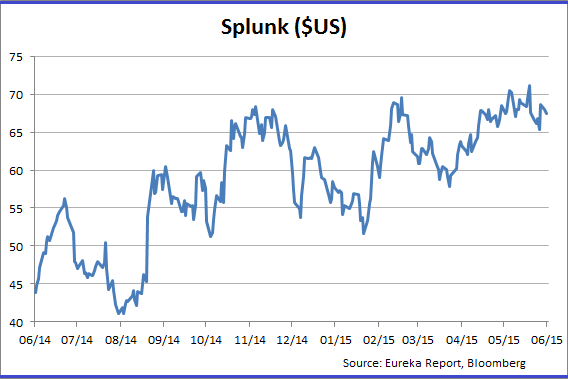

Splunk, which provides software products that allow users to monitor and analyse big data, reported strong revenue licence growth as well as license billings. The stock has risen more than 50 per cent over the past year.

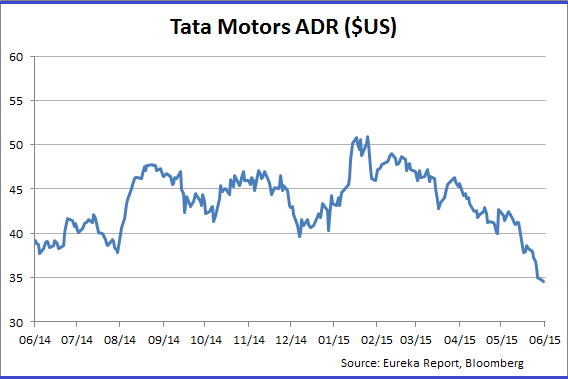

However, Indian car manufacturer Tata Motors disappointed the market with its earnings. The miss was due to the adverse mark-to-market losses on unrealised hedges and higher depreciation and amortisation expenses.

Ambarella

Ambarella reported an excellent set of first-quarter numbers, beating on earnings ($US0.71 versus estimates of $US0.58), revenues ($US 71m up 73 per cent) and gross margin (64.8 per cent versus estimates of 63.3 per cent).

Year‐over‐year earnings growth was 187 per cent in the quarter with strong revenue growth, expanding gross margins, yet only 20 per cent year‐over‐year operating expenditure growth.

Chief executive commentary in the press release was positive:

“We enjoyed a strong first quarter with revenue up 73.5 percent from the same period last year," said Fermi Wang.

“In addition to continued growth from our existing wearable, IP security and automotive video recorder camera markets, we see increased activity across a wide range of home monitoring cameras including models by US service providers, as well as from quadcopters or flying cameras. We look forward to continued success, as we enable the next generation of intelligent HD and Ultra HD cameras.”

On the call (webcast) the company also guided well above street forecasts for the second quarter, seeing revenues of $US79-83m with consensus at only $US68.6m.

The company also flagged new product introductions from GoPro and Xaiomi which will drive the wearable camera segment, while the S2Lm SoC will be involved in new product launches in the professional and consumer (home) security markets. More impressively, drones (UAVs) are anticipated to be greater than 10 per cent of total revenue (1 per cent in the current quarter), because of two new product releases from the most successful Chinese quadcopter maker DJI.

Second-quarter EPS guidance is in a range of $US0.77‐0.83, correlating to year-on-year EPS growth of at least 105 per cent. I expect most analysts will raise earnings estimates for 2016, 2017 and beyond.

Our take: Great results but Ambarella is up 82 per cent this calendar year and has gained 120 per cent since I recommended it.

Normally I would suggest taking some profits here but given the current consolidation going on in the semiconductor space I'm reluctant to cut and run just yet.

AMBA has great technology in a number of different product areas other than action cams, is debt free, and cash flow positive. It even has earnings and while the price-earnings multiple of 35 times is high it is underwritten by a stellar growth rate. Rumours have it that Qualcomm (market cap $US113bn) might be interested.

Potential M&A is never a reason to buy a stock but it does make sense to stay invested here as long as Ambarella continues to execute well. Any take out would be at 20-40 per cent premium to the current price.

I am raising my target price to $US110 based on 31 times 2017 EPS of $3.55.

Wall Street view: 7 buys, 6 holds.

Average broker target price: US$103.30.

Arista Networks

Arista crushed estimates and guidance. Revenues came in at $US179m compared to street estimates of $US169 million. Further, revenues increased a solid 55 per cent year-on-year and also increased quarter-on-quarter in the seasonally weak first quarter of the calendar year.

The earnings per share (EPS) beat was also impressive. Arista delivered $US0.50 EPS in the quarter as compared to the street estimates of $US0.35-$0.37.

Gross margins were ahead of forecast at 66 per cent. Operating expenditure was up 23 per cent, but 55 per cent revenue growth permits the company to aggressively spend on R&D and sales expansion and still improve on the operating line. Operating margins were up over six percentage points to 28.5 per cent in the quarter.

As usual, the company offered conservative guidance for the upcoming quarter with revenues forecast in a $US183-191m range and an implied EPS of $US0.41. Both are roughly in line with consensus.

On the call, Arista said it is seeing acceleration in cloud spending even as the 25G/50G cycle sets up for 2016.

The company believes the industry is set for a major “refresh” cycle based on recent product initiatives from Broadcom (Tomahawk chip set) and Intel (Broadwell 25G Server chips) That's a clear positive for Arista.

Arista thinks demand is accelerating due to the fact that the cloud players (Amazon, Google, MSFT)and Web 2.0 players are spending just to meet ongoing demand and do not have the luxury of slowing down to anticipate a technology change over.

Arista continues to see robust expansion of its customer base with strong and consistent additions of new customers. However, even as this base builds, it is not outpacing the exceptional growth within Arista's core customer base.

Arista says they are not seeing any real pricing pressures from Cisco; some analysts have flagged this as a concern going forward. Instances of lower realized prices are coming from volume price breaks to existing customers.

Arista and Hewlett Packard just announced that they have entered into a partnership to provide a joint reference architecture for deployments combining Arista's switches, HP's servers and storage, as well as HP's OneView data centre management software. According to HP this is partly aimed at common rival Cisco, which offers solutions pairing in its UCS servers and Nexus data centre switches. A definite positive for Arista.

Our take: Excellent set of results. No change in our investment thesis or target price of $US90.

Wall Street view: 16 analysts have a buy, 9 analysts have a hold, and 2 a sell.

Average broker target price: $US84.

Splunk

Splunk reported strong license revenue growth as well as license billings. Total revenue of $US126m for the quarter (up 46 per cent compared to the previous corresponding period) was well ahead of the Street ($US118.5m), with maintenance and services driving more of the upside.

The quarter also showed diversity of revenue as IT operations drove large deals in the quarter (226 were greater than $US100,000), in contrast with security being the driver in the fourth quarter.

Sales and marketing spend increased 8 per cent as quota-carrying rep hiring continues to grow in the same 35-40 per cent range seen the last six quarters.

On the call management raised second-quarter guidance to $US138-140m, well ahead of consensus of $US136m, and for the full year (FY16 ends Jan16) guided to revenues of $US610-614m, which is well up on previous guidance of $US600m and consensus.

Capital expenditure remains elevated at $50m this year on the headquarters built-out but should be more like $20m in FY17.

Our take: A decent set of numbers; the company is executing well. Splunk remains the only pure play in this space and the total addressable market including security is $US20bn-plus in size.

The company is moving well beyond its core-SIEM market into other verticals such as business analytics and the Internet of Things (IOT). It has plenty of room to grow as it only has some 3 per cent of the market so far and the competition is benign. The company is also expanding internationally.

Our take: Splunk remains a high conviction buy.

Wall Street view: 30 analysts have a buy, 5 analysts have a hold, and 1 analyst has a sell.

Average broker target price: $US83.

Tata Motors

Tata Motors earnings numbers were not what the market was looking for. Tata Motors reported fourth quarter net profit at Rs17.5bn (56 per cent below the same time last year), which was well below the Street estimate. The miss was due to the adverse mark-to-market losses on unrealised hedges and due to higher depreciation and amortisation expenses.

Jaguar Land Rover (JLR) revenues were £5,826m, an 8.9 per cent increase year-on-year, accompanied by a 6.8 per cent increase in overall volumes. Earnings before interest, tax, depreciation and amortisation (EBITDA) were £1,016m, an increase of 10.4 per cent. All the figures were more or less in line with expectations. The EBITDA margin came in at 17.4 per cent (vs. 18.6 per cent q/q) on increased other expenses relating to new product launches and also due to production shifts in China.

Consolidated revenues grew 3.5 per cent year-on-year, but fell 3.4 per cent quarter-on-quarter to Rs676bn, impacted by a foreign exchange loss of Rs15bn. However, the India EBITDA margin turned positive at 2.8 per cent (versus losses over the past five quarters) signalling the nascent recovery in the domestic business, in line with our investment thesis.

On the conference call, JLR management appeared reasonably optimistic on the outlook for luxury SUVs in China, somewhat alleviating concerns over volume growth and noted that a recovery is also expected across the European markets and that demand in the US is strong.

New models being launched in CY16 (FY17) are the Evoque convertible and also the F Pace (Jaguar crossover). The all new XF will be launched in 2HFY16. The new Discovery continues to track well in all markets.

Management provided more colour on the China joint venture (JV). Evoque/Freelander volumes are expected to be 52,000 annually in China and management is still optimistic this target will be attained in FY16.

ASP/unit declined to £46,500 in the fourth quarter versus the third quarter's £48,100 on account of volumes shifting to the China JV. Management is gradually raising production at their new plant as the earlier inventories run out and manufacturing stabilises.

The original equipment manufacturer (OEM) will also produce the new Discovery Sport at the new facility over the year. Fourth-quarter production in the China JV was 4,000 units- all were Range Rover Evoque which are selling well.

On the domestic side, management stated that MHCV sales are being driven by replacement demand. Revenues were also boosted by better product mix (M&HCV growth, Zest/Bolt) Fourth-quarter standalone revenue stood at Rs10,784 with a 26.2 per cent increase on the same period last year. Volumes increased by 5.1 per cent and realisations improved by 20.4 per cent. That's a huge positive for the Indian business.

Previous to this earnings release, JLR had also reported strong April US retail sales growth of 14.8 per cent despite the lower volumes due to the model change for the Discovery Sport. Although inventory increased on a month-to-month basis, incentives declined to the lowest level in five years (that's a positive) and underscored JLR's prior track record of limiting incentives to avoid brand dilution.

With the average selling price flat and volume rising to result in robust sales growth, JLR is able to maintain its pricing power while competitors are offering higher incentives to attract customers.

From this release it appears that in the US market JLR faces a supply issue rather than a demand issue with the Range Rover and the Range Rover Sports all sold out and an average wait time of four to six months. Customers are continuing to queue up it seems.

Our take: The earnings shortfall appears to be a one off. Operationally (revenues and EBITDA) are tracking pretty well in line. JLR continues to deliver in all geographies (save the China glitch) and the next 12-18 months is very much a new product story. Indian domestic (standalone business) is recovering nicely.

Our take: We would be an aggressive buyer under $US40. Our original thesis is intact and our target price remains at $US57.50.

Indian Brokers: 48 analysts have a buy, 4 analysts a hold and 2 analysts have a sell.

Average broker target price: Rs620.