DWS looks promising

IT service business DWS Limited (DWS) announced first half financial results to the market last week. Overall, the numbers were in line with our forecasts, and reflect strong growth in the business when compared to the previous corresponding period (PCP). The business delivered a surge of 51 per cent in earnings before interest, tax, depreciation and amortisation (EBITDA) from $8.012 million to $12.082m. This was carried through to the net profit result, which was higher by 51.22 per cent, lifting from $5.1m to $7.60m.

The lift in profit was converted into a lift in operating cash flow, and the business has declared a stronger dividend, albeit with a lower payout ratio than historically paid. Overall, the result was one that exhibited strength, with the increased dividend being delivered as expected. While no guidance was given for the full year, the second half is expected to deliver similar earnings to that in the first.

Dividend and cash flow

DWS has announced a 4.75 cent fully franked interim dividend. Shares will begin trading on an ex-dividend basis on March 15. This is in line with our forecasts for a full year dividend of around 9.65 cents, and implies some minor growth in the dividend in the second half. I think it is worth noting at this stage that the 4.75 cent interim dividend will be paid on the back of earnings per share (EPS) of 5.76 cents for the half. Thus the half-year dividend payout ratio is 82.5 per cent. Our expectations are for this level of payout to continue, but it may also be worth noting that there is probably downside risk to the payout ratio, which has been historically higher (near 90 per cent in recent years).

Cash flow from operations was again strong with net operating cash flow of $5.942m generated over the six months. From a cash conversion perspective, EBITDA was converted to cash at a rate of 87.5 per cent (gross operating cash flow to EBITDA). This is healthy, but is lower than in previous periods.

Result overview

Here is a quick summary of the P&L (adjusted for underlying):

1H16 | 1H15 | % change | |

Revenue | 68,173 | 46,764 | 45.78 % |

EBITDA | 12,082 | 8,012 | 50.80 % |

NPAT | 7,597 | 5,100 | 48.96 % |

EPS | 5.76 | 3.85 | 49.61 % |

DPS | 4.75 | 3.75 | 26.67 % |

Payout ratio | 82.5 % | 97.4 % | -15.34 % |

This result was one that provided impressive growth on last year. The lion's share of uplift was borne out of the company's acquisition contributions, but perhaps most pleasing was the fact that a lift in utilisation rates also led to organic growth in earnings for the existing business. The Phoenix and Simplicit acquisitions contributed combined revenue of $19.68m for the half, suggesting that the remaining revenue growth of $1.55m came from within the business. The driver of this growth was higher utilisation, and strong demand across most regions, particularly in Victoria.

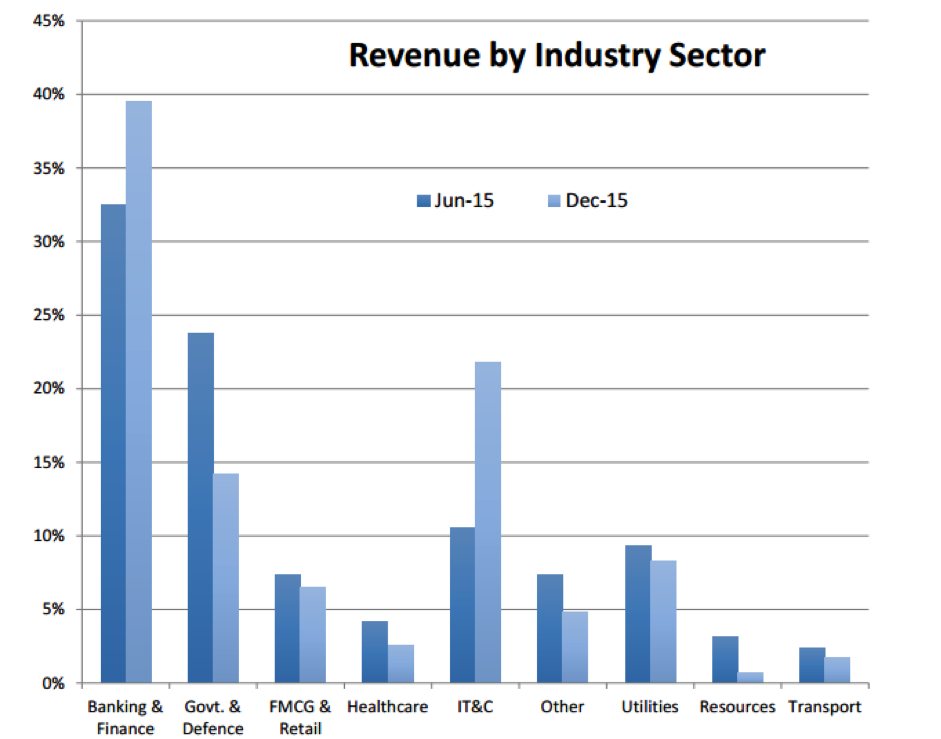

From a sector exposure perspective, DWS has seen its customer exposure to banking and finance, and IT&C increase notably, and this is largely attributable to the exposure of acquisitions (Phoenix and Simplicit) to these industries. While it may appear that diversification is being compromised as a result, we are comfortable with these themes. In particular it appears that the customer exposure to government and defence work has been significantly reduced as a percentage of earnings, which Is a positive in the current market environment. Here is the latest revenue breakdown from DWS report presentation:

Acquisition performance

During the half, the company spent $17.7m on the purchase of 75 per cent of Phoenix, and since December 31 has agreed to purchase the remaining 25 per cent for $6.5m. Additionally, the business acquired Simplicit during 2015, which has boosted earnings. At its half year report DWS has informed the market that Simplicit is tracking ahead of expectations with increased utilisation, and a focus on cross selling beginning to reap rewards. In terms of the performance of Phoenix, the first half only benefitted from a four-month contribution, but much of the focus has been on integration, and client engagement. I definitely get the sense that Phoenix is performing well, but that Simplicit has been a greater success to date.

Phoenix will contribute for the full six months in the second half of this financial year, and for a portion of that under 100 per cent DWS ownership. However, the company has not been keen to emphasise that this will result in immediate earnings growth. As a result we are cautious on the margins and EBITDA contribution that Phoenix will make in the full year.

Outlook, risk and valuation

DWS has again provided no earnings guidance to the market in terms of expected numbers. However, a few things have become clearer that will give us a picture of how the business is likely to perform. The first half represented a return to higher utilisations, strong performance in Victoria and a move to larger contributions from Banking and Finance and IT&C.

This is all very promising, and we are of the view that the company is well placed to replicate the first half performance. However, there will be some challenges. Firstly, there will be less billable days in the second half, purely down to how the calendar falls. This means that DWS starts the half at a disadvantage in terms of repeating 1H EBITDA. Additionally to this, the company's interest burden has risen, meaning that higher finance costs may make it more of a challenge to repeat the 1H net profit result.

From a risk perspective, it is important to remember that DWS is a contracting business. While things are going well at present, there is always the potential for contracts deferrals or losses with little notice. Pleasingly, this is not the trend, nor an expectation at present.

With all of this in mind, we remain of the view that demand for services provided by DWS is strong. The customer mix appears to be in the right areas, and improvements in utilisation are the key indicator that the business turnaround is being executed.

From a valuation perspective, we have made only minor adjustments. Our expectations for revenue have increased, but with some additional costs associated with debt finance for acquisitions, and varying performance from a margin perspective our earnings expectations remain materially unchanged. Thus we are comfortable retaining our valuation of $1.48 with a buy recommendation.