Drillsearch stoked with Beach Energy deal

When Kerry Stokes' Seven Group Holdings (SVW) took out 19.9 per cent holdings in both Beach Energy (BPT) and Drillsearch (DLS) earlier this year the idea of a merger between the two was on everyone's lips as the logical next step. This was also a key dynamic regarding our initial recommendation back in March 2015 (see Drillsearch primed for recovery, March 9).

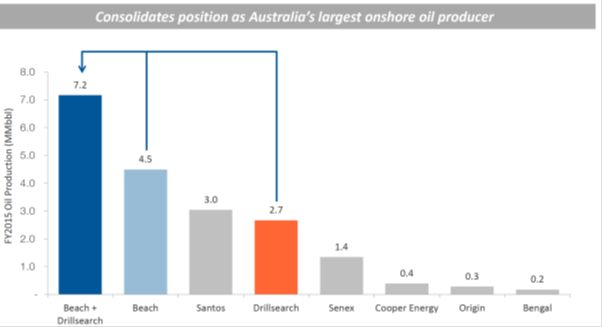

On Friday (October 23) we finally saw the framework set out for a friendly merger between the two to create a $1.2 billion mid-tier producer, which will be the largest Australian onshore oil producer by a significant margin. As we expect this merger to go ahead with little interference, we will be ceasing coverage of DLS from today with our final recommendation outlined below.

Source: Drillsearch presentation

There is little doubt that Stokes had some influence on the proceedings, however, was not formally involved in the negotiations. SVW will now own a combined 19.9 per cent of the merged entity. Under the plan, DLS shareholders will receive 1.25 BPT shares for every 1 DLS share, valuing DLS shares at 83c each. This value is a 27 per cent premium to the previous close and a 10 per cent premium to our recent valuation of 75c per share.

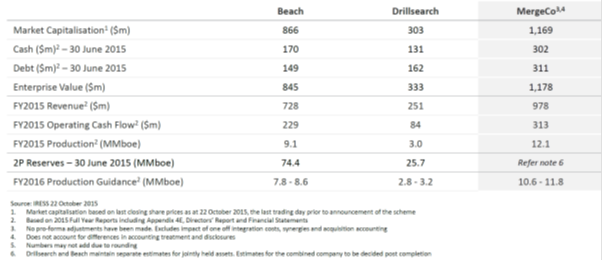

This merger makes a lot of sense as the two companies have a number of combined Cooper Basin projects. Synergies are forecast to be around the $20 million per annum mark for the combined entity. The other key factor is the relatively strong balance sheets held by each. This should net the combined company over $300m of cash on hand.

Further key aspects of the merged entity are outlined in the table below:

Source: Drillsearch presentation

From here the strategy is growth, which inorganically would have been limited and probably beyond the capacity of DLS and BPT as standalone companies. The combined company's large cash balance is primed to take advantage of the potential fire sale from Santos and other struggling oil and gas players to combine with its other core basin assets. It will also try to secure further strategic assets for the growing east coast gas market. BPT has indicated it is prepared to sell some of its infrastructure assets to further fund any of these new purchases. It is expected some of this action may start before the company is officially combined, which is scheduled for February 2016, pending approvals.

While oil prices are expected to be flat for some time, the Beach-Drillsearch combined entity will have the ability to create further shareholder value. Both companies are currently low cost producers, and should continue to be in a position of strength while others are finding the conditions tough. However, we may not see the full share price potential until conditions start to improve. Finally, the option for future dividends, which up until now had eluded DLS shareholders, is now a real possibility.

With existing shareholder associations and strong synergies between the two companies providing a barrier to any potential third party counter offers, we expect little resistance from shareholders towards the merger.

Final recommendation

The full scrip offer for Drillsearch values it at a significant premium prior to the merger announcement and outweighs our recent valuation price target by around 10 per cent at 83c. Our valuation of Drillsearch rises to 83c based on the approximate value of the consideration of this merger. At this early stage we cease coverage of DLS with a final hold recommendation.