Drillsearch downgraded

Tim Treadgold writes:

Too much oil. Too few customers. In a nutshell, that's the state of the world's oil and gas industry as supply floods markets and prices stay low, and might go lower.

The net result for investors is that all oil-linked stocks, from producers to service providers, have become less attractive, including a stock being followed by Eureka Report, Drillsearch, as Chris Booth explains in his updated analysis below.

Much of what's happening is well understood. An oil flood triggered by rising US production and a refusal of Saudi Arabia to cut production as it has done in previous periods of surplus has halved the oil price over the past 12 months from more than $US100 a barrel to around $US50/bbl.

The big question is what next?

Saudi Arabia, and fellow members of the cartel which once dictated terms, the Organization of the Petroleum Exporting Countries, are seen as an immoveable object and US oil producers tapping deposits in shale rock, are seen as an irresistible force.

Stalemate is the outcome of this classic encounter of two powerful opponents which is essentially a battle between government-controlled oil production in the OPEC nations and another big player, Russia, and private-sector producers in the US relying on the efficiencies of new technologies.

For an academic observer of how markets work the situation is fascinating.

For investors, and people working in the western world's oil and gas industry, it's a nightmare.

The problem is knowing which side in the OPEC v US oil war will blink first, allowing prices to rise back to what is regarded as a sustainable level of around $US80/bbl.

Both sides want a price which is well above current levels but no-one knows how to achieve it, leading to depressed trading conditions for producers, oilfield closures, project deferrals and poor returns for investors.

Putting pressure on oil demand

Adding to this cocktail of supply factors there is uncertainty about oil demand thanks to another set of pressures, this time on the demand side of the equation, including:

- Global growth seemingly stuck in a low-growth phase.

- China, once the fastest-growing oil user, suffering an economic slowdown.

- Competing energy sources, such as solar and wind, eating into the overall energy market, and

- Coal, the least loved energy source, available at highly competitive prices.

The oil-price war is spilling over into what was supposed to be Australia's next resource sector leader, liquefied natural gas (LNG).

While once immune from what happened on a day-to-day basis in the oil market thanks to long-term sales contracts, LNG production, which underpins stocks such as Woodside, Oil Search and Santos, is coming under increased pressure.

The immediate problem for LNG is that all sales contracts are linked, albeit with time delays, to the oil price, which means that if the prices stays low it will eventually be felt in LNG.

The longer-term problem is that the US, which has already revolutionised oil thanks to its technology breakthroughs in tapping once uneconomic pools of oil, is within months of joining the LNG exporters club.

Cheniere Energy is putting the finishing touches to its Sabine Pass project in Louisiana and will be shipping LNG to Europe early next year.

A new entrant is one thing, but Cheniere's chief executive, Charif Souki, says he will not join the LNG club by using a long-term pricing formula, preferring to sell LNG on a spot (short-term) basis to help make LNG trading more like oil.

In other words, the oil flood might soon be joined by an LNG flood with the result being the addition of another layer of energy supply which could keep pressure on the price of all forms of energy.

Update on Drillsearch

Chris Booth writes:

When we last looked at Drillsearch it was in the box seat in regard to taking advantage of oil and wet gas opportunities in the Cooper Basin. Since then the worldwide demand for oil has all but gone and maybe gas will next. Nevertheless, most of the underlying factors that made Drillsearch a standout before are still there and at current low prices consolidation opportunities may be too good to refuse.

Looking at the full-year results

The Drillsearch share price surged after the company announced a full-year net loss of $8.1 million which was a better result than expected. The loss was attributed to a significant impairment of $51.9m due to weaker oil prices impacting carrying valuations, however underlying profit only deviated -1 per cent to $57.8m compared to the 2014 results which is a more accurate measure of ongoing operations.

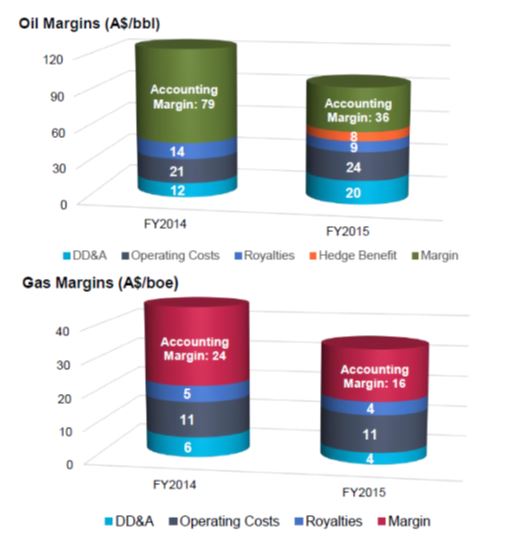

Revenue was down 35 per cent in 2015 to $250.6m over the period also due to the falling oil price although $20.6m was clawed back thanks to a well executed hedging strategy. This drove the realised oil price in Australian dollars to $89.50 a barrel ($97.2 including hedge gains) which was higher than expected. Drillsearch will continue to assess its hedging strategy, however in 2015-16 it will have 1.43m barrels locked in at a $60 floor.

Production was down overall to 3m barrels of oil equivalent, down 11 per cent on 2014. Forecasts are for 2.8-3.2mmboe for FY16. Operating margins continue to be strong despite low energy prices and should carry on into 2016. The balance sheet has growth in strength, now with $171m of cash and undrawn debt. This liquidity gives Drillsearch the capability of riding out any periods of low prices and is a major strength in these conditions.

Oil and wet gas margins 2014-15 (source: Drillsearch FY15 results presentation)

Significant investment in exploration was carried out in the previous 12 months. Total 2P reserves were down 9 per cent overall mainly due to wet gas production and a revised down estimation on the Western Wet Gas Joint Venture. However after the production of 2.7m oil barrels in 2015, 3 per cent was gained in 2P oil reserves due to exploration success on the Western Flank which is a strong indication of continued success.

Capital investment will continue with the replacement of reserves to again be a key focus, however this will be at a reduced capacity in a response to lighter oil prices. This downgrade is also reflected in the five year outlook where production growth is now targeted at 50 per cent compared to 100 per cent this time last year.

The results show that Drillsearch's management team has forward thinking, underpinned by a solid hedging and capital management strategies. The extra value combined with a mature response to the current market conditions should reduce risk in the short-medium term and conserve resources. Drillsearch is now primed to take advantage for when oil prices return to a more respectable position.

Getting ready for growth

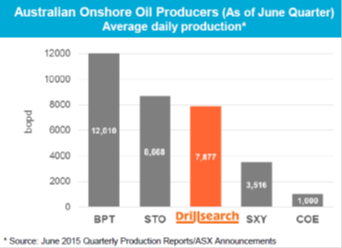

Drillsearch is one of the three biggest onshore oil producers in Australia behind Santos (STO) and Beach Energy (BPT). It is the only producer however to focus entirely on the Cooper Basin.

Drillsearch is number three on the list (source: Drillsearch FY15 results presentation)

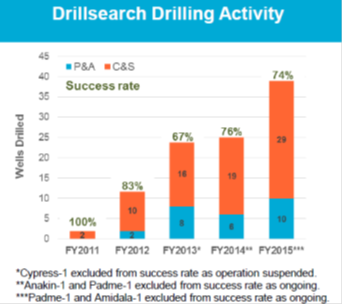

In 2015, Drillsearch had a 74 per cent success rate when drilling new wells which defines its strong track record of achievement and the ability to grow or replace its oil and wet gas reserves year on year.

Drilling success seems to comes naturally to Drillsearch (source: Drillsearch FY15 results presentation)

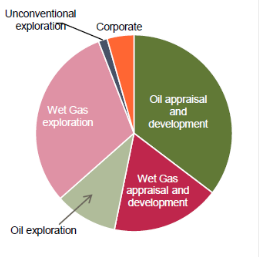

As mentioned above, capital investment will be at a reduced capacity in 2016. It will range from $80-$110m compared with $142m in 2015. Over 50 per cent of this will be invested in appraisals and development within the company's owner portfolio combined with its STO and BPT joint ventures. Nonetheless, this lower target should continue to drive value for Drillsearch, which still plans to drill 22 new wells, up to 15 of them being exploratory.

Capital expenditure structure 2016 (source: Drillsearch FY15 results presentation)

The new disciplined approach and previous history of success should give investors confidence that in a difficult market, Drillsearch can invest its capital in its high priority, lower risk assets and yet provide the possibility for shareholder growth in 2016 and beyond.

Working out the valuation

The forecast downgrade in production over the next five years will have a notable effect on the revised valuation. Production is expected to peak at around 4.5mmboe compared to the previous forecast of 6mmboe with most of the production gains still expected to be in wet gas. This may expand further depending on market conditions and exploration success.

The Brent Crude spot price consensus has also been downgraded since the previous recommendation and may be down for an extended period due to reductions in demand. As mentioned above by Tim Treadgold, the supply pressure may come onto the LNG market as well which could be harmful to Drillseach's expanding wet gas revenues.

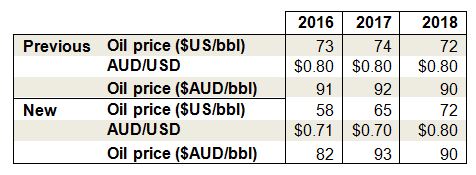

Updated Brent Crude and dollar consensus forecasts.

Previous reports have highlighted the potential consolidation within the Cooper and with market valuations of basin players at a significant discount to previous months this may become reality sooner rather than later.

We continue to exclude unconventional assets from the valuation due the forecast low prices and inherent risks making it assumedly unprofitable.

With the share price currently trading at around 55c, we have adjusted our buy recommendation down to a hold with the discount cash flow valuation of 75c according to new forecasts. We feel risks associated with gas demand, development forecasts and exploration could impact price creating short-term volatility, however with a strong cash balance, growth opportunities and solid hedging practices, Drillsearch is still a standout in today's market.

To see Drillsearch's forecasts and financial summary, click here.