Dick Smith: The retailer the market has missed

One of our key observations from reporting season was an improvement in operating conditions for retailers in Australia (see Retailers rise again). Most retailers reported improved sales in the first half of FY15 and strong trading conditions for January.

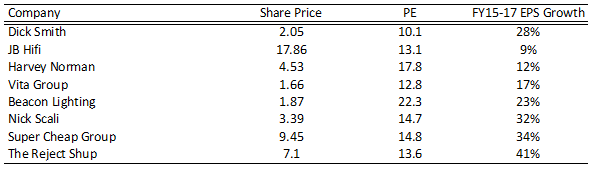

Unfortunately, a number of the retail stocks that we have looked at are expensive, and arguably trading on inflated earnings. For a number of these stocks the risk-reward dynamics do not appear attractive.

One exception is the recently floated consumer electronics business Dick Smith which is trading on a price-earnings (PE) multiple of less than 10 times FY16 earnings and a dividend yield of 7.1 per cent.

Dick Smith has had an interesting history. In its recent past, many people would have been less than impressed with how the stores were presented when it was floundering as a distraction to Woolworths management in the years up to 2012. In the years before 2012 the store experience wasn't great.

However, under new management and direction a number of things have improved. Investing isn't all about reading the news and flicking through the odd annual report. It's about trying to work out and value what is happening in the real world.

If you want to see how things have changed since 2012, drop into a Move store, the Sydney airport duty free store or even the traditional Dick Smith stores (most of which have been refurbished in recent years). Now, one store might only be one data point on any given day but things have clearly improved from where they were.

History

Dick smith was founded in 1968 by Richard ‘Dick' Smith to initially service car radios and subsequently the electronic hobbyist market. The business evolved until eventually Woolworths acquired a 60 per cent stake in the business in 1980. Shortly thereafter, in 1982, Dick sold his residual stake to Woolworths, giving the company full ownership.

Woolworths expanded the business over the following 30 years and in 2009 had in excess of 430 stores generating over $1.5 billion of revenue. In FY07, under Woolworth's stewardship, Dick Smith generated earnings before interest, tax, depreciation and amortisation (EBITDA) of $95.5 million at margins of 7.4 per cent.

After that, however, operating conditions began to deteriorate. In 2012, Woolworths restructured the business, taking $420m of impairments and related charges and subsequently sold the business to private equity firm Anchorage Capital for $20m. At the time Dick Smith was perceived to be a peripheral distraction to Woolworths management.

Under new ownership and management, DSH undertook a rapid transformation program. This primarily focused on a review and the restructuring of corporate costs, its supply chain, procurement initiatives and aggressive rebranding. These changes are becoming visible in reported earnings today.

The Anchorage deal gave Woolworths 25 per cent participation of any profit on sale of Dick Smith. Anchorage subsequently paid $74m to Woolworths to remove this option as the turnaround was getting traction. In 2013, Anchorage floated Dick Smith at an issue price of $2.20 per share, or $520m – an incredible profit in anyone's language.

The company today

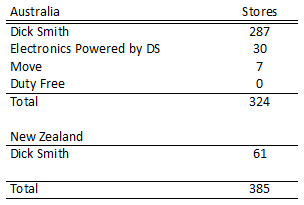

Today, Dick Smith is one of the largest consumer electronic businesses in Australia and New Zealand. At the end of 2014 DSH had 385 stores.

The company is led by Nick Aboud, who was appointed managing director and chief executive from November 2012 when the group was under Anchorage ownership. Nick has spent his career in retailing with 19 years at Myers prior to joining Dick Smith.

The company has been expanding its store format. The traditional Dick Smith store is a well known service offering and provides a broad range of consumer electronics primarily focusing on the office and mobility segments. The majority of these stores have been refurbished in recent years.

In October 2013, Dick Smith started operating David Jones's consumer electronics business. This business aims to target a more affluent demographic and importantly required limited capital outlay.

The company has also recently launched a store format, Move, which is targeted at a younger and more affluent demographic. These stores typically have a smaller store size and lower cost base.

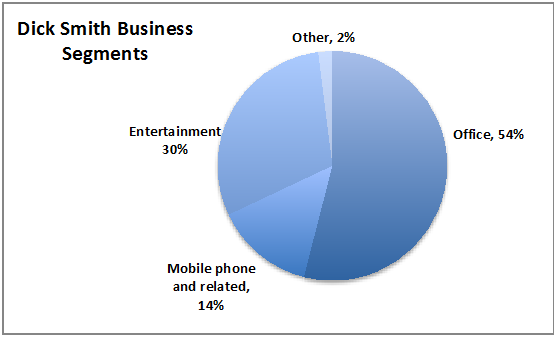

The company sells a broad range of consumer electronics primarily focusing on the following segments:

- Office: desktop computers, laptops, monitors, printers, related accessories.

- Mobility: Mobile phone handsets, pre-paid and post-paid contracts, sim cards and accessories. Dick Smith provides pre- and post-paid plans for Telstra, Optus and Vodaphone. Move stores will largely focus on this category.

- Entertainment: televisions, audio products, digital cameras, headphones and docks, gaming and related accessories.

Four drivers for stellar earnings growth

Dick Smith clearly wasn't getting the attention it needed under Woolworths ownership.

While the current management team significantly improved Dick Smith's business under Anchorage's ownership there is still some way to go in this turnaround story yet.

In fact, we expect Dick Smith to deliver 28 per cent earnings per share (EPS) growth between FY15 and FY17. Four of the key drivers of this growth are outlined below:

- Store roll out: We expect Dick Smith to expand its store network from the 385 currently operating to 450 by the end of 2017. The store roll out will be the primary driver of sales growth, which we expect to reach $1.55bn in FY17. In addition, with Dick Smith now having more than one store format, this store roll out should allow the company to better target specific customer demographics.

- Improving cost productivity: In FY11/12 Dick Smith's cost of doing business (CODB) as a percentage of sales over 22 per cent. This is materially higher than a number of their retailing competitors such as JB Hi-Fi, which delivered CODB/sales of 15.2 per cent in FY14. Dick Smith materially improved its cost structure in FY14m reducing CODB/sales to 19 per cent. While JB Hi-Fi does have some scale advantages, Dick Smith should be able generate further cost improvements as its sales footprint improves.

- Private label products: In FY14, private label products accounted for 11.5 per cent of sales. Management has a stated objective to increase this to over 15 per cent by FY17 and appear to be on track delivering over 12 per cent in the first half of FY15. Increasing private label penetration will both improve margins and also allow more cost-effective options for customers.

- Online sales: Online sales were 4.1 per cent in FY14, 5 per cent in the second half of FY14 and over 7 per cent in the first half of FY14. We expect the company to achieve 10 per cent online penetration by FY17.

What could go wrong?

It isn't unreasonable have some skepticism when a private equity firm acquires a retailing business from one of the most successful retailing groups in the country and can so dramatically turn things around in such short order.

As outlined above, we think the turnaround story is far from complete but there are still some challenges investors need to be conscious of.

Is management too aggressive pulling costs out?

Dick Smith's rent and labour productivity are already at impressive levels when compared to their competitors, namely JB Hi-Fi. In FY14, Dick Smith managed to generate procurement sales, supply chain and corporate efficiencies, delivering a 2.9 per cent reduction in CODB/sales.

One key question that needs to be asked is whether Dick Smith is being too aggressive pulling costs out of the business and will this hurt in any way the long-term earnings capacity of the business? Recent reported earnings don't suggest that this is has been a problem.

Nevertheless, the question has to be asked – why didn't Woolworths do what current management are doing now? Perhaps they didn't focus on the business given it is small in comparison to their supermarket chain. Perhaps consumer staple retailing isn't entirely transferrable to consumer electronics retailing. Perhaps the new management's growth initiatives are too aggressive and not sustainable.

At the current share price, a healthy amount of skepticism appears to be priced in with an effective free option on new management getting things right.

Weak consumer environment

The earnings outlook for Dick Smith will be impacted by the Australia and New Zealand economic conditions.

As it stands at the moment we know that declining interest rates and lower petrol prices add cash to household budgets (see Currency, oil and the reporting season).

Further, rising asset prices would historically suggest wealth effect led expenditure. However, what we don't know is to what extent subdued consumer confidence prevents this cash from being spent on consumption. Indeed, if consumer confidence does improve, consumer related businesses are going to be very well placed.

Increased competition

A key risk to the outlook for Dick Smith is deterioration in its competitive positioning. The clear challenger here is the prevalence of online retailing.

While online competition is going to continue to change the competitive landscape of all retailing, management are aware of the threat and developing strategies to compete. Online sales have been materially increasing and are expected to reach 10 per cent of total sales by FY17.

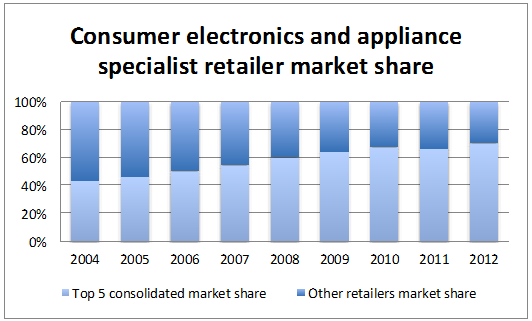

Online is here and real but it isn't new. It is interesting to note that in the nine years to 2012 (as online retailing started to become relevant) the competitive landscape of consumer electronics has actually materially improved with the top five largest companies nearly doubling their collective market share. Clearly, companies in this segment with less scale have been most impacted by online competition.

Balance sheet

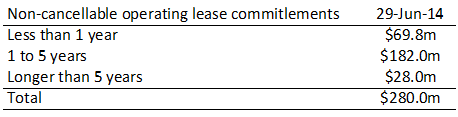

In FY14 Dick Smith moved to a net cash position. However, it is important to be aware that the company has material operating lease commitments. Dick Smith doesn't own the stores that it operates in so these largely relate to lease arrangements for retail stores.

Operating lease commitments are effectively off-balance sheet debt as they are long-term commitments.

Assumptions

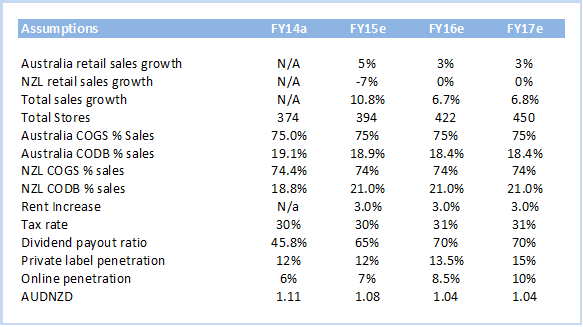

We expect Dick Smith to deliver 45 per cent EPS growth between FY14 and FY17. We outline below the assumptions that underlie these earnings forecasts.

Valuation

On the basis of some relatively conservative assumptions, we estimate that Dick Smith can generate in excess of $0.24 EPS in FY17.

The company has now delivered three results since its IPO, which have indicated that management is executing on its key objectives. Clearly, the market remains skeptical of execution risks but if these trends continue we expect the share price to re-rate to a more appropriate multiple when compared to its peer group.

We have ascribed an 11.8 times multiple to FY16 EPS to arrive at a valuation of $2.60. This is a 10 per cent discount to its closest comparable company, JB Hi-Fi. The discount reflects lower liquidity and execution risks associated with its growth strategy.

Dick Smith is certainly not without its challenges. Consumer electronics is a competitive sector. However, at less than a 10 times FY16 PE these challenges appear to be more than discounted into the current share price.

The stock offers a free option that management can deliver on their strategy and provide above market EPS growth. And with a dividend yield in excess of 6 per cent, investors get paid to give management the opportunity to so.

To see Dick Smith's forecasts and financial summary, click here.