Criteo's competitive advantage

Based in Paris, Criteo is a global technology company that enables ecommerce and transactional companies to mine large volumes of data to engage efficiently and effectively with their customers. The company buys ads from publishers on a costs per thousand impressions (CPM) basis and sells ads on a cost-per-click basis.

Nasdaq-listed Criteo's proprietary technology allows advertisers and publishers to target the right ads using predictive algorithms to determine the likelihood an ad will get clicked on.

Criteo is a global business, with more than 9000 clients and direct relationships with over 12,000 publishers such as Yahoo! Japan, Microsoft, ESPN and NYTimes.com as well as exchanges including Facebook, Yahoo, Google, Baidu and Alibaba.

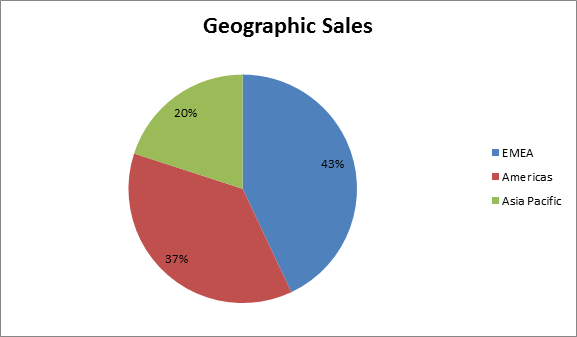

Criteo's geographic spread

Background

Criteo was founded in Paris, France in 2005 by Jean-Baptiste Rudelle, Franck Le Ouay and Romain Niccoli. Criteo spent the first four years focused on research and development, and launched its first product in April 2008. In 2010, Criteo opened an office in Silicon Valley in order to enhance its profile in the US.

In 2012, Criteo opened its new headquarters in Paris, France establishing one of the biggest European R&D centres dedicated to predictive advertising. The centre will continue to provide central support to more than 86 national markets worldwide, on five continents – North America, Europe, Asia, South America and Australia.

In September 2013, the firm filed for an IPO with US regulators.

Criteo is a pure play on the trend in the internet advertising industry towards performance-based display ads or programmatic advertising. Advertisers obviously want to understand the effectiveness of their ads – what works and what doesn't. As traditional display ads move toward programmatic buying and bidding in real-time, Criteo stands to benefit due to its many competitive advantages and innovative technology.

Criteo is becoming the emerging leader in data-driven marketing and so far has the best position in the display advertising market. There are also future opportunities to expand into new verticals (such as auto, telecom, and finance) and geographic regions such as Japan and China.

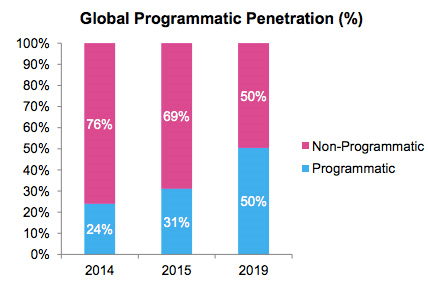

There is clearly an ongoing shift towards programmatic ad buying – whereby ads are placed using certain predictive algorithms. The industry is also continuing to move towards purchasing media at the impressions level. The shift away from broad audience ads towards real-time content targeting is occurring at a rapid pace.

Some commentators believe that the global programmatic buying of display ads is should more than triple over the next four years to over $US36 billion.

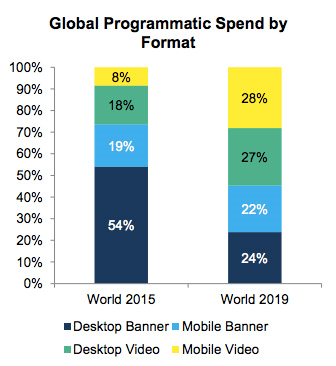

Worldwide programmatic spend is expected to grow this year to 31 per cent of banner display and video share (compared to 24 per cent in 2014), and will increase to 50 per cent by 2019.

The study by the Interpublic Group media investment unit also looked at programmatic spend by device, finding that mobile spend will grow from 28 per cent in 2015 to about 50 per cent by 2019.

Criteo's technology: A clear competitive advantage

Criteo's technology consists of proprietary and sophisticated predictive and bidding algorithms built over the last eight years. This technology is supported by a scalable hardware and software platform, with seven data centres located on three continents.

Criteo personalises its advertising for each user in real time to drive the highest probability of engagement or click-throughs. As a result, Criteo's ad click-through rates are typically 5x higher than the average for traditional display ads, and Criteo's conversion rates for clients are similar to conversion rates in search.

Criteo embeds browser cookies — miniscule text files that let websites recognise users and their preferences when they return to a site — for nearly half of the 100 largest retail and travel websites in the US.

Criteo also has a significant data advantage since it observes transactions happening on its clients' websites. Criteo regularly observes billions of dollars of sales ($US500bn in 2015) on its clients' websites, and data (up to 230 terabytes collected daily) that provide Criteo a significant advantage in determining when and where to place its ads.

Criteo claims that its algorithmic processes improve on a daily basis as it observes more and more data. The result – Criteo claims that it is now able to earn $US17 in sales for every dollar the customer spends (up from $US13 in mid-2013).

Criteo's technology is device “agnostic” (desktop, mobile etc). Management believes that as more and more advertising moves to mobile and is being displayed on larger screens, Criteo will benefit.

Recent earnings

On November 4, Criteo reported solid 3Q results with revenue slightly above consensus. However, full-year guidance was left unchanged as the company flagged a slightly softer 4Q than previously expected due to weaker FX and heavy investments in product and sales.

3Q revenue of €120 million ( 55 per cent Y/Y) came in above the €118m consensus estimate. EBITDA of €31m ( 58 per cent Y/Y with a 26 per cent margin) was 37 per cent ahead of the €23m consensus. Impressive Y/Y rates of growth.

Revenue growth in the 3Q was spread across geographies (Americas gross revenue 69 per cent Y/Y, EMEA 31 per cent Y/Y, APAC 48 per cent Y/Y). All are FX neutral measures.

Criteo benefited from continued client growth (clients reached 9,290, including 726 net adds) and product improvements such as multi-screen adoption, growth of mobile FBDPA, and progress with development of search offering.

CRTO maintained its 2015 guidance, resulting in a slightly lower 4Q, given increased FX headwinds (incremental negative FX impact of €4m and €2m on net revenue and EBITDA in 2H15), continued investment in product (ramping up search efforts for 2016 launch), sales and operations (continued build out of mid-market sales and newer Asian markets), and a bit more conservatism for 4Q.

In terms of product and client progress, “multi-screen” is a winner with 90 per cent of clients now using CRTO's multi-screen solution. Facebook Mobile Dynamic Product Ads have 1.5k advertisers now live on FB mobile. Dynamic Creative Optimization (DCO) has good penetration with some 40 per cent of net revenues coming from clients using DCO. In Search, CRTO has a 50-person dedicated team working exclusively, which is one of the company's major long-term growth projects for 2016 onwards.

All in all a pretty solid report but the stock weakened substantially (-14 per cent) after the report setting up, in my opinion, a good level to begin accumulating the shares of a company that is strongly participating in one of the most transformational trends in advertising.

Criteo is therefore a strong buy here at $US38-$US40.

Financial assumptions (see model summary for detail)

Criteo is clearly a high growth company and I believe this growth is sustainable.

Since 2010, Criteo has grown revenues 84 per cent pa. From 2014-2017, I have estimated the company can still generate a 70 per cent pa revenue compound annual growth rate (CAGR).

Unlike many other high growth companies in the IT space, Criteo has remained profitable since the IPO. EPS should grow at a 40 pa per cent rate from 2014 levels.

Valuation: Criteo is trading at only 17.3 X 2017 EPS of €2.20, significantly less than its earnings CAGR 2014-2017 of 40 per cent.

Target price: 13 X 2017 EBITDA of €241m or $US57.00.

The stock has traded as high as $US56 and is now some 30 per cent lower at around $US38.

Wall Street remains very positive on the company with 12 buys and 2 holds. Goldman Sachs recently added Criteo to its “high quality buy list”.

Risks

Key risks include:

- Competition from large internet companies such as Google and Amazon and other smaller ad-tech players such as RocketFuel, Dotomi (part of ValueClick), Sociomantic, TellApart, AdRoll and Triggit.

- Unanticipated regulatory and technology changes i.e. any changes in the regulations or legislation around web tracking and privacy matters could adversely impact Criteo's model.

To see Criteo's forecasts and financial summary, click here.

To read more about how to buy international shares, click here.