Cerner's global edge

Cerner develops and sells financial and clinical information technology (IT) solutions to hospitals, health systems, physicians, and other healthcare providers. Cerner's products are utilised in over 10,000 facilities, and by 45,000 physicians, 2,700 hospitals and 4,150 physician practices globally.

Cerner has over 12,000 employees worldwide including about 6,000 in Professional/Managed Services/ITWorks. Cerner develops its solutions on the “Cerner Millennium” architecture, a unified IT platform combining clinical and financial systems. Through this framework, Cerner allows its users to securely access, organise and distribute critical patient information to physicians, consumers and others within the healthcare delivery system.

In the US, Cerner has a substantial share of the large hospital market and a stronghold on large health systems, with contracts for seven out of the 10 largest health systems in the country– that's one of the reasons I like the company.

Bookings continue to grow, and its move to a cloud offering via a SaaS model is proceeding at a good pace, with service revenue mix up four percentage points year-on-year. This will provide a more consistent long-term revenue stream.

In February 2015 Cerner acquired Siemens Health Services which was a strategic way to increase its client base and addressable market and should allow the company to grow its international customer base in Europe, the UK and the Middle East. The acquisition should add over $US1.1bn to revenues in 2015 and is already earnings accretive. By 2017 it could add as much as $US0.40 per share to Cerner's bottom line.

Recent earnings

Uncharacteristically, Cerner reported first-quarter results for FY15 that missed revenue projections. Revenue of $US996m was 8 per cent below the Street's $US1.09bn and its own $US1.05-1.1bn guidance. Even so, the company managed to meet expectations of $US0.45 adjusted earnings per share on better margins, and most importantly, achieved $US1.20bn in new bookings vs. $US1.10bn expectations and $US1.05-1.15bn guidance.

Also contributing to the slightly negative tone was a bit of “noise” from the Siemens Health Services unit both as to how it's accounted for in generally accepted accounting principles and also for its slightly soft quarter. However, Cerner still reiterated 2015 EPS guidance and raised the low end of the range by US2 cents.

Underlying Cerner's business prospects is a large industry (hospitals, physicians, and other health providers) that is essentially underpenetrated by “modern” IT and has yet to realise the full benefits. Upgrades from increasingly inefficient ageing legacy systems are a necessity if the industry is to reduce costs and raise the standard of care.

Broker Citibank released the results of a recent survey conducted among 389 not for profit hospitals and the results favour Cerner and the broader industry. There will be approximately $US60bn spent on capital expenditure in 2015 and this is poised to increase for the second year in a row. IT, imaging, and outpatient are favoured areas.

Further, Healthcare IT (HCIT) spending is flagged to increase double digits with 70 per cent of hospitals increasing IT spend in order to upgrade legacy systems and acquire latest platforms. Cerner is a direct beneficiary here.

The stock price and valuation

This year Cerner is up 4 per cent, while the S&P500 is up 1.24 per cent. Over the last year the stock has gained 26 per cent. Currently Cerner is trading at $US67.00, some 10 per cent off its year high reached in April 2015.

Cerner is a growth stock and valued as such. It trades at 27 times 2016 EPS – slightly less than its growth rate.

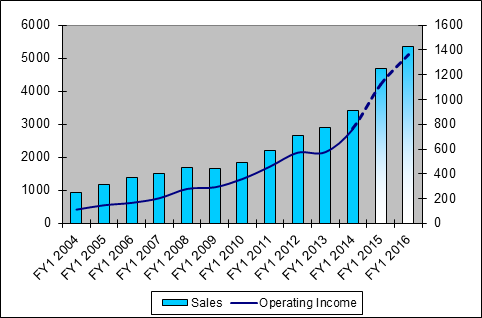

Historically growth has been spectacular (see below).

In my forecast, Cerner will grow revenues 20 per cent per annum and earnings 30 per cent plus per annum to 2017.

Recommendation

Cerner is a “buy” at current prices. My target is $US83 or 31 times 2016 EPS of $US2.70 – a 23 per cent upside from here. The Department of Defence “opportunity” mentioned below would obviously be beneficial for Cerner and could provide further upside but there is no guarantee they will win it.

Never make an investment decision based on a potential tender win.

The DoD Opportunity

In August of 2014, the U.S Department of Defence (DoD) put the modernisation of its Healthcare Management Systems out to tender with an estimated value of some $US11bn. Cerner (along with partners Leidos and Accenture) is one of the leading candidates along with IBM/Epic and a CSC (Computer Science)/Allscripts/HP consortium. A year later (these things take time) analysts believe that Cerner/Leidos and Epic/IBM are the favorites. The award decision may come in mid-August.

I have not included any of the potential revenues in my financial models. However some analysts have flagged a minimum of a 3-5 per cent uplift in Cerner's earnings to 2022 if it wins the contract along with its partners. The DoD award would cover some 56 hospitals and 300-plus clinics.

Risks

- Cerner could realise lower than expected synergies from its recent acquisition of Siemens. The merging of cultures, products and people could be more difficult than management expects which could result in client attrition

- Cerner operates in an extremely competitive market, and market share gains or losses to competitors could pose a risk to operating performance.

- Cerner is and will be dependent on its customers for continued investment in technology solutions. If the company's customers decelerate their spending, it could negatively impact Cerner's results.

- Changes to the reimbursement levels of Cerner's customers could trickle down to their spending level and impact results.

- Healthcare Is a highly regulated business, and the government could seek to increase its oversight of HCIT companies, which could raise Cerner's cost of doing business.

To see Cerner's forecasts and financial summary, click here.