Celldex: Pioneering a cure to cancer?

Summary: Immuno-oncology is a promising approach to treating a variety of cancers, where drugs are used to awaken the body's immune system to fight the deadly disease. One of the pioneers in this field, US-based biotech Celldex Therapeutics, is developing a number of these drugs. Its most advanced drug is currently in phase 3 trials and is showing impressive longer-term survival rates. |

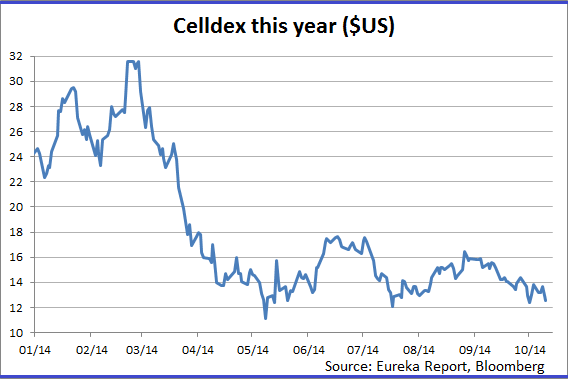

Key take-out: Celldex is a high-risk investment proposition. It could become a profitable mid-cap biotech by as soon as 2018 if just one of its drug treatments is approved by the FDA. Its shares could rise to $US36 each – around three times what they are now – when factoring in the industry average price-earnings multiple of 30 times. I am a buyer of the stock at current levels, but in a small amount. |

Key beneficiaries: General investors. Category: International Shares. |

Recommendation: Buy Price at call: $US12.55 Target price: $US36 Risk: High |

Recently I came across an article in the Daily Telegraph where researchers at the Melanoma Institute Australia are successfully using drugs to awaken the body's immune system to combat advanced cases of the skin cancer.

Immuno-oncology is one of the more recent and revolutionary approaches to treating cancer and may be the most promising in eradicating the pernicious disease that has plagued humankind since day one.

There are a number of publically traded biotechnology companies in the US that are utilising this approach and trying to achieve breakthroughs in the treatment of the most common and deadly cancers: melanoma, and those of the lung, brain, breast and colon.

Earlier this month pharmaceutical giant Merck gained Food and Drug Administration (FDA) approval for Keytruda (pembrolizumab) used to treat advanced melanoma and Bristol-Myers Squibb isn't far behind awaiting approval for its PD-1 inhibitor nivolumab. The great appeal of these types of treatments is that they are open-ended and may be able to treat multiple types of cancers.

One the “pioneers” of immuno-oncology is Celldex Therapeutics (NASDAQ: CLDX), a US-based biotechnology company. Spun out of Medarex in 2005, when the company was purchased by Bristol-Myers Squibb , the Celldex research team had already been working in this area for a number of years and was allowed to retain the commercial rights to the Medarex UntiMab technology platform and the proprietary monoclonal antibodies.

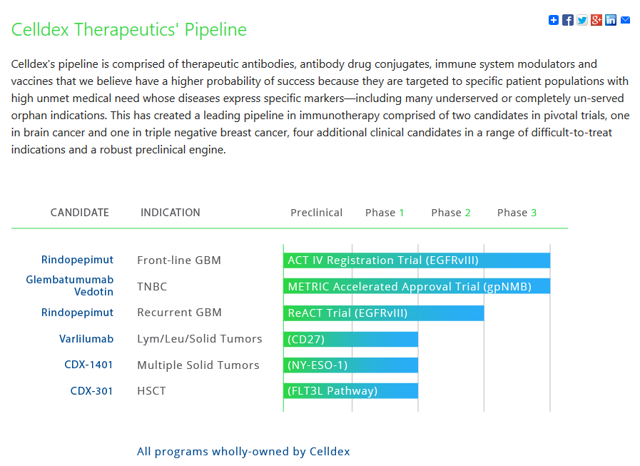

Since then the company has developed an impressive pipeline which is comprised of antibody and protein-based therapies that “modulate” the immune system and target tumors.

Rindopepimut is company's most advanced drug and is currently in Phase 3 trials with 700 patients enrolled for the most common form of brain cancer, glioblastoma multiforme. In phase 2 trials, Rindo (as we'll call it) achieved impressive longer term survival rates for a disease whose survival rate is literally 0%. If Phase 3 results are successful then FDA approval can be sought via a regulatory submission. Of course, not all Phase 3 trials pass the scrutiny of the FDA.

If it passes, estimates vary widely as to the revenue potential of Rindo. It could be $US500 million, $US1 billion, or any other figure. At any rate, if it's approved Celldex stock is going higher since Celldex had revenues of only $US4.1 million in 2012-13. Given there are no other treatments that are effective, a modest efficacy rate could well gain approval. I believe there is a good chance.

(Source: company website)

Celldex has other promising indications in the pipeline. CDX-011 Glembatumab Vedotin or “Glemba” is currently in a Phase 3 study for triple negative breast cancer. That's the 15-20% of cancers that don't have targeted receptors such as oestrogen, HER-2, or progesterone on which treatment is based.

Glemba is an antibody-based drug which targets a protein (glycoprotein NMB) present in most cases. It's early days in Phase 3 but the drug has shrunk tumours in 33% of cases. Given that this same protein is present in most Melanoma cases, this indication could be promising indeed. If approved, Glemba could also be a billion dollar drug.

There are also a number of promising indications currently in Phase 1 such as CDX-1401 for solid tumors, CDX-301 for metastatic melanoma and CDX-1127 (Varlilumab), which could be the biggest Celldex blockbuster of all with an antibody that stimulates T-cells to counter invaders at the cellular level and could be effective in combatting not only lymphoid malignancies, but also solid tumours from metastatic melanoma and renal cell carcinomas.

Financials

As of June 30, 2014 Celldex had $US252.4 million in cash and cash equivalents.

The company believes that this will fund present activities to the end of 2016. Cash burn in the last quarter was $US 21.8 million, partly offset by a partnering payment from Bristol-Myers Squibb of $US5 million. More partnering agreements are likely.

At some point CLDX will raise additional equity. Most analysts see the share count rising 5% per annum.

Management

Management is experienced and committed. The two co-founders of Celldex, Anthony Marucci and Tibor Keler, remain in senior roles as chief executive and chief scientific officer respectively.

Avery Catlin has been with Celldex as chief financial officer since 2000 and Thomas Davis MD, the chief medical officer, has been with the team since it was part of Medarex.

Investment case

Why invest in Celldex, which at this point has no approved or commercialised indications, when you could buy Merck or Bristol-Myers Squibb – large successful companies that have numerous and diverse revenue streams?

The answer is that even if an indication at Merck or Bristol-Myers Squibb is successful, it hardly moves the needle. Merck (market cap $US170 billion) had revenues of $US47 billion last year. Another billion dollar drug is nice but somewhat meaningless.

If Celldex gets approval for the two indications currently in Phase 3, that's probably a 1.5 to 2 billion dollar opportunity and greater than its current market capitalisation – now that moves the needle!

If only one of them is approved the stock will definitely move higher. If neither makes it beyond Phase 3 the stock will probably trade in the mid to low single digits, preserving some of its market cap due to the other promising indications currently in early stages of development.

That being said, I am a buyer at current levels but in a small amount and the purchases will probably in tandem with buying another stock I'll be writing about over the next few weeks – Gilead Sciences (NASDAQ: GILD). This is one of the most impressive biotech companies I have ever come across, with a market cap of $US162 billion.

There is no way to really put a value or target price on Celldex without making some somewhat heroic assumptions. Research and development (R&D) will expand from $US63 million in 2013 to as much as $US200 million by 2018.

If Celldex gets approval for just one of its phase 3 indications we might see $US 300 million of revenues in 2017 and maybe $US700 million in 2018. If that's the case then the company would be break-even in 2017 and earn about $US 1.2 million in 2018 (assuming the share count only increased 15% to 105 million).

Celldex would then be a profitable mid cap biotech sporting an industry average multiple of 30 times, making it a $US36-a-share stock. That's roughly a threefold rise from current prices.

Biotechnology companies like Celldex differ from pure pharmaceutical businesses in that they use technology to manipulate living organisms such as bacteria or complex proteins from genetically modified cells in order to treat and cure diseases.

Pharmaceutical companies use chemically derived synthetic processes. Drug discovery for biotechnology companies tends to be more complex, involving a higher level of R&D and simply taking longer.

Many biotechs operate at a loss for many years as R&D is greater than revenues. In many cases, the revenues come from collaborations or licensing agreements with major pharmaceuticals.

One of the most successful biotechnology companies in recent times is Genentech, founded in 1980 (fully acquired by Roche in 1995), and a pioneer in recombinant DNA.

Genentech was one of the first to use technology to develop products with practical and lifesaving applications. I visited the company in 1992 after it developed Activase (or t-PA) – a very successful treatment in dissolving blood clots after a heart attack. I have been a keen investor in biotechnology ever since.

To see Celldex's forecasts and financial summary, click here.