Ceasing on CTI Logistics

Perth based CTI Logistics (CLX) is a very well run transport and logistics operator that is navigating its way through very difficult market conditions. With a management team and board that's been in place since the 1980s, they have successfully transitioned the business through tough market conditions on multiple occasions.

A number of assets, including a substantial land portfolio, are on the balance sheet at cost price, which is well below market value. As an example during the difficult first half of FY16 management sold the long held Bibra Lake warehousing and distribution property for $26 million - producing a net profit of $18.9m.

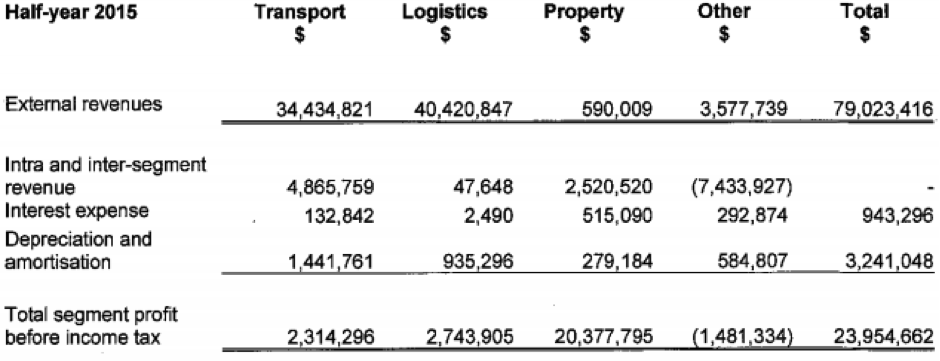

Given the weak operating conditions it was an ideal time to sell the land and reduce debt, as well as demonstrate the hidden value on the balance sheet. If we exclude the profit on the property sale, then the profit before tax was down 16.2 percent to $5.03m for the first half. Revenue from operations was up 21.2 percent to $79m.

The interim dividend was maintained at 4 cents per share, and net debt was reduced from $60.6m to $48.5m. Despite the under-stated balance sheet, the current share price of 92 cents is only at a slight premium to the reported net tangible asset backing of 79 cents.

The company reports in three key divisions – transport, logistics, and property (rental income). Transport includes courier, taxi truck, parcel distribution, and fleet management. Logistics includes warehousing and distribution, specialised flooring solutions, supply based management services and document storage.

It is no surprise that severe downturn in business activity in the Western Australian economy has impacted operations at CTI. During the half there was weaker than expected throughput in demand from the warehousing client base in late November and December. Also significant unexpected costs associated with the implementation of a new distribution model and warehousing management system for the largest client.

There were also building and other associated costs with the partial completion of 13,500 square metres of additional warehousing at Hazelmere. Hazelmere is the large company-owned site near the Perth Airport. In FY15 the company invested $20m to gain an additional 67,000m square metres of land next to the existing Hazelmere warehouse and distribution centre this takes the total CTI land owned at the site to 154,000 square metres.

The decline in volumes across the courier business is slightly less damaging because the company leases their fleet. The decline in general freight markets can have a larger impact due to lower utilisation of company owned fleet.

The much-publicised downturn in WA minerals and energy work is obviously having an impact. Further to this, some of the company's existing maintenance work is under margin pressure. The company also hasn't disclosed the earnings it has received from LNG projects, with risks around its ability to replace some of this work.

In terms of positives, the GMK Logistics acquisition from June 2015 is performing well, and the company has been able to expand into South Australia with existing customers.

Although the outlook for the WA economy remains poor with downside risks, management remains focused on growth initiatives which include further contract wins, and acquisitions similar to GMK. Downside risk is also partly offset by a diversified customer base.

We are confident in management's ability to guide the business through the difficult markets. But that doesn't mean there isn't further downside earnings risk. Our $1.35 discounted cash flow valuation doesn't include any assumptions around a near term recovery in the WA economy. At 92 cents, the stock is trading on a PE of 10 times our FY17 forecast, with an 8.5 percent fully franked yield. With further property assets that can be sold for profit, we are comfortable with the balance sheet and level of gearing. Despite seeing longer term value at the current share price we are ceasing coverage with a hold recommendation due to a lack of near term catalysts.