Capitol Health: Priced for perfection

Capitol Health has delivered again with an excellent interim result that exceeded our expectations.

On a like-for-like basis, revenue grew 14 per cent and net profit before tax lifted 51 per cent to $6.5 million. That increases to $7.3 million if you strip out the one-off acquisition expenses.

We have slightly upgraded our forecasts, and view FY16 as the year to focus on due to the full-year impact from recent acquisitions. The FY15 price-earnings (PE) multiple of 48 will scare many off, but it needs to be remembered that this year includes the costs for two major acquisitions with minimal corresponding earnings. The FY16 PE of 29 is also not cheap but is justified by high MRI growth rates, further accretive acquisition opportunities and a strong track record from management.

For those with more of a short-term focus, it would be ideal to wait for any share price weakness (at the low to mid 80 cent mark). For long-term investors we still see significant medium-term growth and, as such, it may not be beneficial to worry too much about the short-term price fluctuations.

Acquisitions

Despite the two recent acquisitions, the general message from the results conference call with chief executive John Conidi was that there will be no pause in the rate of acquisitions.

Southern Radiology was the company's first entry into the fragmented NSW market and it would appear that it has opened up multiple other opportunities in the state.

The earnings margin improvement from 10 per cent to 14.9 per cent (net profit before tax) backs up management guidance around the efficiency and productivity gains that can be achieved from acquisitions. Back office support, a central IT platform and utilising the Capitol management structure enables the smaller radiologists to increase the amount of scans they do per day.

With Capitol Health (CAJ) trading on high PE multiples, it will not be hard to achieve further earnings accretive acquisitions. Accretive acquisitions instantly lower the PE ratio after considering the net effect of increased earnings and the impact from funding.

But the key thing to monitor is the return on capital and making sure that the company is not over-paying for acquisitions. So far it has a perfect track record, but it will be important for Conidi and his team to not get complacent.

The funding mix will also be an important thing to monitor. There is further room to expand the balance sheet, and the strength of demand for recent institutional and retail capital raisings would suggest management shouldn't have too many problems raising further equity.

MRI scans

The radiology industry is expected to continue growing at two times GDP. On a like-for-like basis Capitol has grown at a much faster rate than this due to its focus on MRI scans.

During the first half, five more unlicensed MRIs were installed with a ramp-up in profitability expected in the second half. The Medicare licensed MRI machines are running very well with an average of 22 to 23 scans per day.

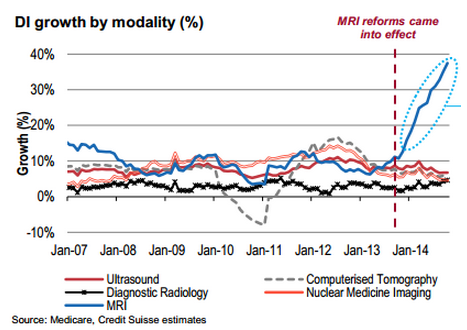

As a reminder, in 2012 the federal government performed a review of the radiology rebate package to improve the accessibility and affordability of MRI services nationally. Following this, on November 1, 2012 new legislation was announced allowing general practitioners (GPs) to refer children under 16 for specific Medicare-funded MRI scans. Then, the following year, on November 1, 2013, adults were also given the ability to get Medicare-funded MRI scans referred from a GP.

Industry opportunities

We recently mentioned the boost to the board with Andrew Demetriou appointed non-executive Chairman.

In further positive news the company has announced the new hiring of Carl Adams from Primary Healthcare (PRY). This is a positive due to some hospital contracts being up for grabs in the next 12 months, and Mr Adams' knowledge is important in trying to capitalise on this opportunity.

About half of radiology in hospitals is completed in-house, whereas all of pathology is completed externally. It remains an uncertainty whether or not more radiology work will be outsourced.

Capitol has not tendered for hospital work before, and the financial metrics that it could achieve from this work is also unknown.

In the conference call Conidi spoke about his expectations that the next 12 months will be disruptive for the industry with some of his major competitors distracted. We assume he was referring to Primary Healthcare (PRY) and Sonic (SHL).

Primary has some significant issues, and one of the resolutions could be a change of ownership. If their radiology division was to be sold off it could present another opportunity for Capitol.

Share purchase plan

Capitol's share purchase plan was increased to $20 million versus its previously stated $15 million. Applications for it totalled $35 million, so a fairly heavy scale back was required.

Risks

The key risks include substitution of MRI from other modalities that affects earnings. This has not occurred to date, but needs to be monitored. Similarly, the MRI growth rates since the increased government support in 2012 are not sustainable, and it remains to be seen what growth level they will settle at.

With acquisitions such a big part of the story, any problems with integration will weigh heavily on the stock. Again, this has not been an issue to date, and is a big tick for the small management team.

There's also the funding risk from government as it seeks to rein in health costs. Some form of co-payment is likely, but a back-flip on the support for non-hospital MRI is unlikely.

Valuation

Olympic park has started to contribute to earnings from last week, and Southern will contribute for the fourth quarter, partly contributing to a stronger second half.

As discussed, the elevated PE ratios are a function of very high growth rates and an expectation of continued acquisitions.

We have upgraded our FY15 earnings forecasts to capture the increased level of recent acquisitions and the stronger-than-expected first-half result.

Our valuation has increased to $1.05 after the upgrades and places more emphasis on the high growth that will be achieved in FY16.

We maintain our long-term “buy” on weakness recommendation.

To see Capitol Health's forecasts and financial summary, click here.