Capitol Health: Let's see

In December 2015, the federal government announced reforms to the incentives paid to MRI providers in Australia that will become effective on July 1 2016. Essentially, the change will “reduce the bulk billing incentive for Magnetic Resonance Imaging (MRI) services from 15 percent to 10 percent of the Medicare Benefits Schedule, aligning it with other diagnostic imaging services”. There are some small exceptions to this, but it appears that the changes will have a material adverse effect on the industry and on the ability of Capitol Health to grow its profits. In light of these proposed changes, CAJ's prospects are far more uncertain, but this is well reflected in the current share price.

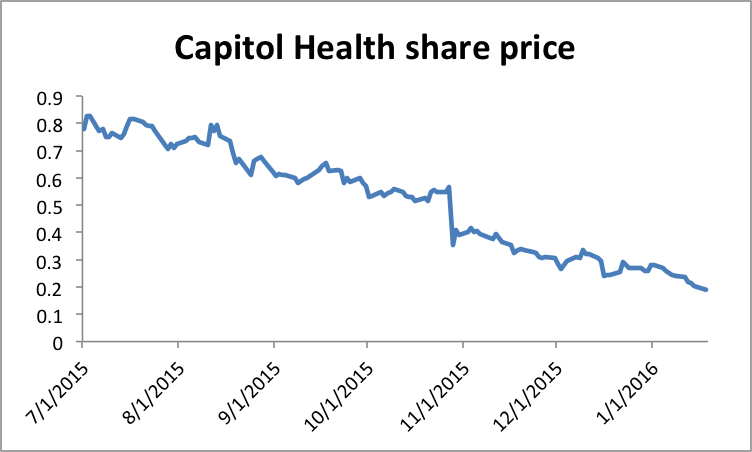

Our recommendation on this accordingly changes to a hold, and we provide an updated valuation at $0.28. CAJ is a business that has shown significant promise, executed well, but has come under pressure due to regulatory changes. Given the focus on growth in this portfolio, we need to acknowledge that risks have lifted significantly in CAJ. However, the price decline is such that our holding in CAJ is now less than 1.5 per cent of the portfolio. With such a small exposure, we are comfortable holding the stock to see how the regulatory changes unfold, noting that the price now reflects close to a worst case scenario in our view. While the company's prospects are shrouded in uncertainty at present, the business must be given the time to adjust, and at current prices there is no need for kneejerk reactions. Here is the CAJ price since July 1 – it paints a pretty ugly picture.

Regulatory change

As mentioned, the recent issues confronting CAJ are largely a result of regulatory change. CAJ management issued an announcement to the ASX in mid December, stating that the changes could adversely impact revenue in FY17 by around five to seven percent. That said, the announcement goes on to clarify that there is a large amount of uncertainty in terms of the gravity of the impact of these changes on CAJ's earnings outlook. This leaves investors with a high degree of uncertainty, and places serious doubts as to the group's ability to grow in the short term. The industry response may be to introduce co-payments for diagnostic imaging services, but this will potentially come at the cost of volumes and is not a significant remedial response in our view. Either way, it is expected that if these proposed changes pass through parliament (which is likely), the business will be materially impacted.

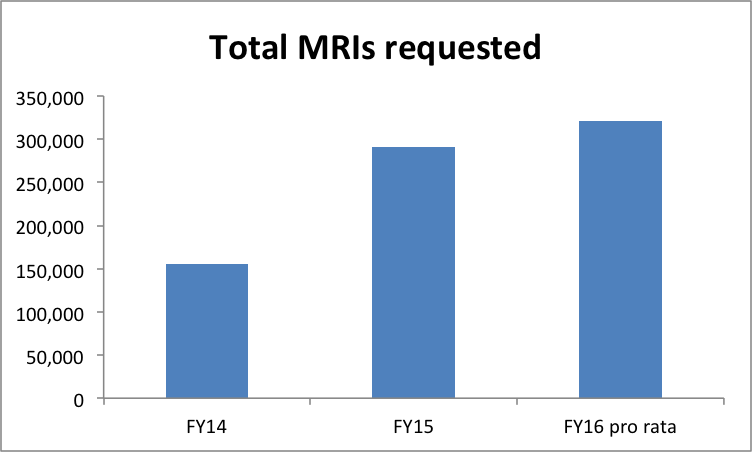

Here is a chart of the total requests for MRIs in Australia under the Group I5 - Magnetic Resonance Imaging category (taken form the Australian government's Department of Human Services web page). Given the growth in requests, and the financial payments needed to support it, it's no wonder these payments are being looked at as a source of funding cuts:

Source: MBS data

The impact is material

At first it might seem that a five to seven percent revenue impact may not justify a share price decline of more than 40 per cent (that is the price drop that has occurred since December 15). However, it is the change in the outlook of the business that is so concerning. Only 12 months ago, CAJ was considered a strong growth story with years of expansion left in a defensive industry that was well supported by government subsidies. In October the company announced that “regulatory uncertainty and subsequent disruption to referral patterns has led to slower than anticipated growth in FY16”. Following this, the materiality of the most recent announcement lies in two facts. Firstly, the company is now unlikely to meet the previously expected rate of growth in the short term and should be rerated in terms of its earnings multiple (i.e. it cannot continue to be priced for long term growth). Secondly, there is a high degree of uncertainty that means additional risk needs to be priced in. This explains why the share price has fallen so heavily, and underlines the impact of the changes in the industry.

Valuation

Our updated valuation for CAJ is $0.28. This is a reflection of the two risks outlined above. I would also note that the company held borrowings of around $73.3 million at June 30, 2015. This isn't concerning at first, with the group's asset base totalling $191.525m. However, given that $105.032m of this is intangible assets related to goodwill created through acquisitions of imaging and radiology centres over the years, we expect that there will be impairments to the balance sheet coming. With a balance sheet that is largely valued on intangibles and a reasonable level of debt on the books, there are risks that can arise if earnings drop by more than what is anticipated when regulations change – driving lower earnings.

Despite this, we expect that CAJ's interest cover ratio will remain near five times (EBIT / interest expense), after adjusting for expected EBIT reductions associated with the regulatory changes. This should afford CAJ some ability to continue to negotiate its debt funding and operate with some degree of comfort.

Too Low?

At the end of FY15, Capitol held more than $36m in cash, which is an undoubted positive. There has been limited spend of this cash, with around $4.5m spent on the acquisition of 5 centres in Liverpool and another $US10m earmarked for investment in the Enlitic partnership. From a cash perspective, CAJ is in decent shape.

However, my concern lies in the likelihood that the company's goodwill balance will be impaired significantly as the regulatory changes impact the future value of the acquired assets. To what quantum these write downs will occur is anyone's guess, as it will be determined by the earnings impacts on CAJ assumptions. What we do know is that this leads to significant balance sheet risk.

I'd be hesitant to say “it's all over” for CAJ. The company may yet recover from these share price depths to find its growth path again in the future. However, the balance sheet position, and the high level of intangibles, are such that the prudent path is to limit our exposure to these risks. Nonetheless, it is simply too low to sell at these current levels.

Upside potential does still exist

CAJ has undoubtedly been impacted by the recent changes, and this has seen a material reduction to our valuation and a change in our call to a hold. However, there is an upside scenario. Firstly, the company's balance sheet needs attention. We expect a significant write down to goodwill in the near future. However, the business is operating cash flow positive, and has the ability to pause on spend in terms of acquisitions in order to pay down debt and address a stretched balance sheet. The ability of management to take stock of the recent changes and address the balance sheet will be key to the future. Should this be addressed, there is still a fragmented market that CAJ could look to further consolidate once regulatory impacts have settled and an earnings base is found.

There are also potentially other catalysts, including the potential for regulatory issues to be reversed, the possibility that write downs will not be as large as the market is expecting, and options for CAJ to seek further balance sheet repair through either capital raising or reduced dividends.

Summary

We are disappointed with the performance of CAJ and the low current share price. Unfortunately, when investing in small caps that rely heavily on subsidy-based income, the risks can be significant even when the business appears to be operating with success.

Despite the price perhaps exaggerating the expected impact of regulatory changes, our main concerns are about the uncertainty that has been created. With the negative impact not quantified by CAJ management with any confidence, and the company's balance sheet holding some debt and a high level of intangible assets, we don't want to increase our exposure to a business with this level of risk no matter what the price.

There is no doubt still some value to the business. CAJ currently represents less than 1.5 per cent of the growth first model portfolio (by value), and we are comfortable holding this exposure in order to see how the regulatory changes unfold. We expect that there will be asset impairments as the company writes down the value of its acquired goodwill to adjust for lower than expected future earnings. However, these are non-cash asset write downs. The industry is changing and the need for medical imaging services will remain. For now, we recommend a HOLD on CAJ with a valuation of $0.28.

To view Capitol Health's forecast and financial summary, click here.