Brickworks cements growth prospects

Brickworks (BKW), together with its joint venture partner Goodman Australian Industrial Fund, has signed an agreement for the sale of the Coles Chilled Distribution Centre for $253 million. The transaction is expected to be completed in the next three months.

The 55,295 sqm distribution facility is located within the M7 Business Hub in Eastern Creek, NSW and is BKW's most valuable industrial property holding. The facility was expanded in July 2014 and at the time Coles signed a 20-year lease, which expires in 2034.

We are comfortable with the sale price of $253m, which is approximately 15 per cent higher than its previously published book value. This equates to a $0.11 per share increase in value ascribed to Brickworks shareholders with respect to BKW's interest in the sale.

The transaction will allow Brickworks to release capital from a fully developed, stabilised asset and initially reduce gearing at both the property and the trust level. However, over the medium term the transaction provides capital for Brickworks to facilitate the ongoing development of vacant trust land and other land held within the group. In this regard we view the transaction as strategically sensible.

The company has previously stated that any loss of income associated with the sale of the CDC facility will be offset by the development of two new facilities at Eastern Creek totalling 58,090 sqm. The company signed a heads of agreement regarding these developments earlier this year. However, clearly it will take some time for equivalent earnings to be generated.

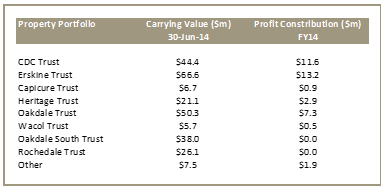

Considering that the realised price was well above book value we also note positive read throughs for Brickworks residual industrial property holdings of which BKW has approximately a $130m interest in. A number of these holdings are due for revaluation at the FY15 result.

With the proceeds likely to be used to reduce debt in the first instance we expect that the transaction will be mildly EPS dilutive (approximately 1 per cent). However, to the extent that this transaction allows Brickworks to allocate capital to further re-developments we view the transaction positively with the potential to be value accretive over the medium term.

Higher brick pricing now in effect

One of the key reasons that we are attracted to Brickworks relates to the company's exposure to the consolidation of the east coast brick market.

Bricks has been a terrible business to be in in recent years with a decade long structural decline. CSR (CSR) and Boral (BLD) have recently received ACCC approval to combine their east coast brick operations, which is the first meaningful improvements in industry structure in years.

We expect that this will result in over 5 per cent increase in brick prices in FY16 with BKW benefiting as the low-cost producer.

In the first-half-result briefing earlier this year management noted that price rises had been implemented in a number of divisions within the building products business. The full impact of these price increases is yet to be reflected in the businesses earnings.

Importantly, Austral Bricks (Brickworks brick business) has previously announced price increases, which became effective July 1, 2015. As such, the benefits of these price increases should now be working through the system but won't be seen in reported earnings until FY16.

Valuation

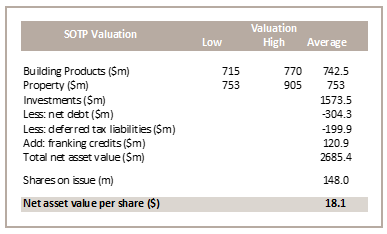

Considering the diverse nature of BKW's business segments we have adopted a sum-of-the-parts (SOTP) valuation methodology. We value the building products division in line with its building material peer group, the property division at net tangible assets (NTA) and the investment portfolio at market value. These are arguably a conservative set of assumptions.

We have adjusted the property divisions NTA to reflect the sale of Coles Chilled Distribution Centre and a likely increase in NTA in residual industrial property asset book value at BKW's upcoming FY15 result.

As outlined above, this results in a SOTP valuation of $18.10. Considered another way, the current share price is ascribing EBIT multiple of less than 4 times FY16 earnings to BKW's building products division, other things held constant. In our view, this remains too low considering the improvements in industry structure within the east coast brick market.

Given the complex nature of BKW's corporate structure, to account for the SOL/BKW cross shareholding we apply a 10 per cent discount to our SOTP valuation and arrive at a price target of $16.20

Click here to view Brickworks' full financials.