BKI: A steady accumulation of wealth

BKI Investment Company Limited (BKI) will come into the model portfolio to provide exposure to the large cap end of the Australian market. BKI's wealth of investment experience has been able to produce a total shareholder return of 9.3 per cent pa (not including franking) compared to the ASX 300 Accumulation Index return of 7.1 per cent pa. The team has also consistently achieved their stated aim of increasing the dividend year on year. Simply put, they do what they say they're going to do.

To get a good sense of the long-term investment approach employed by BKI you need to put yourself in the mind of a Millner. The surname is synonymous with true long-term investing through Brickworks Limited (BKW) and Washington H. Soul Pattinson (SOL).

BKI came on to the market to make way for Brickworks' 2003 acquisition of tile manufacturer Bristile Limited. To fund the acquisition the company floated its investment portfolio which was established within BKW in the 1980s. BKI listed with a market cap of approximately $174 million and it has grown from there acquiring Huntley Investment Company and Pacific Strategic Investments along the way. Some of the core names from the portfolio in the 80s are still there today.

Experience

The BKI portfolio is managed by Tom Millner along with senior investment analyst Will Culbert and company secretary Jaime Pinto. Three of the board members also sit on the investment committee as well. Across the board and management there is a combined 180 years of investment experience. On top of this, the team at SOL sits in the same office as BKI above a Soul Patt's chemist in Pitt Street Mall in Sydney. The SOL team brings considerable experience, having never missed a dividend payment in over 110 years.

Portfolio construction

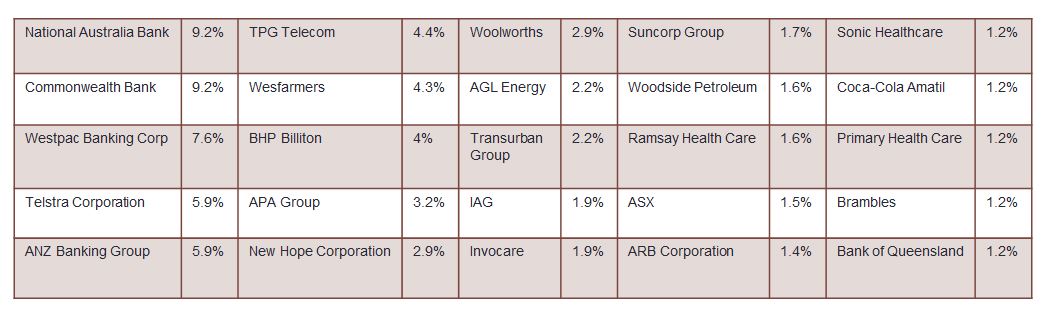

BKI invests in predominantly large-cap ASX-listed companies. The portfolio does not attempt to track any index or sector nor does it have restrictions as to the size of companies it invests in. However saying that, looking at the top 25 holdings, which make up 86 per cent of the portfolio (and a further 6 per cent is cash), 22 come from the ASX 100. On average the portfolio holds 50-60 stocks. The portfolio holds minimal cash. As Millner stated when we met up recently: “We are paid to invest not to hold cash. People come to us to be invested and will hold their own cash.”

Source: BKI monthly report

Stock selection

When it comes to selecting stocks for the portfolio there are five key things that Millner and his team look for when assessing a company: income, debt, principal business activity, management and valuation.

As the team at BKI are long-term investors, when they talk about “principal business activity” they look at the industry position of a company and what it does and assess whether this business is going to be around for not just the next five years but the next ten to twenty years. This means they really need to understand what the company does and they place a great deal of importance on management and the board and the experience they bring. Do the management team and board have a history of creating shareholder value?

When talking with Millner the first line of questioning for a company was around the dividend. Does the stock pay a dividend, if not what is the likelihood of it paying one, how sustainable is the dividend, what is the dividend growth rate and what are the franking credits like? Talk to Millner for more than a minute about investing and the portfolio and count how many times you hear the word “dividend”. You get a sense of a theme developing and can see the focus management and the board place on them.

Instead of looking for specific events to provide a catalyst for share price movement before they invest, BKI identifies attractive businesses the group would like to hold for the next 10 plus years and lets time take care of the rest. “If there is a catalyst that unfolds in 6 months or 18 months or 10 years then so be it, we don't get paid for picking that. We get paid for buying good quality companies that are going to give us dividends over the longer term,' Millner says.

They do take heed of their initial valuation when purchasing a business, not wanting to pay too much, and will be patient and wait for an attractive price. Interestingly enough, they are patient and pay attention to value when purchasing but when questioned about valuation and selling Millner said, “Valuation is very rarely a trigger for us to sell.” He went on to use Commonwealth Bank (CBA) as an example. “At $90 60-70 per cent of the market had a neutral on it just because it was $90, but fundamentally nothing had changed from when it was $50 from our point of view. The income was still good, they've got a good capital level, debt positioning and principal activity isn't any different than when it was $50 and it's the same management.”

BKI recently removed DUET Group (DUE) from the portfolio. It's a good example of a company straying from the team's original investment thesis of income, debt, principal activity and management. DUE's debt is $6.5 billion and its market cap is $3bn. DUE bought another business which the team didn't understand; it had strayed from the original investment thesis so it was removed from the portfolio.

Dividends

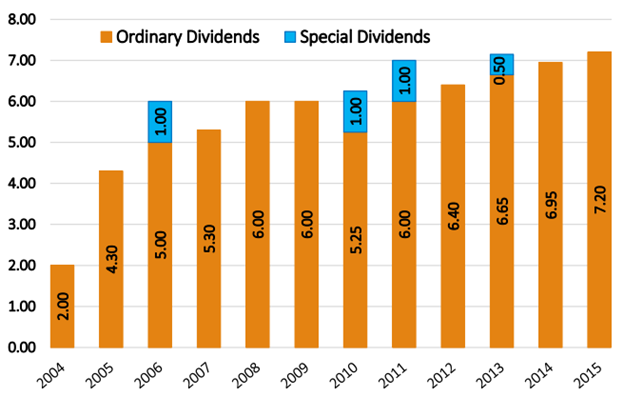

Coming back to one of Tom Millner's favourite words, paying an increasing dividend year upon year is a strong focus for the BKI team. At the top of every monthly NTA report you will see this sentence: “Our aim is to create wealth for BKI shareholders, through an increasing fully franked dividend and capital growth.” And the team is true to its word. Every year, with the one exception of the GFC, the ordinary dividend has grown. On top of this BKI has also thrown in a special dividend every now and then too. As at July 31 BKI's grossed up yield was 5.9 per cent.

Source: BKI investor presentation 22/07/2015

The competition

When LICs are discussed BKI tends to get included in the discussion with the other big players like AFIC and Argo. It's easy to forget it was listed in 2003 and not 1953. The reason for this is because it feels like it is run with the same long term, slow accumulation of wealth in mind with a focus on dividends to shareholders while keeping the management expenses low.

Unlike a lot of modern LICs, BKI does not have a managed fund style management fee of 1 per cent plus performance. Its management fee currently stands at 0.18 per cent. The reason for this is simple. The board and management are all significant shareholders in the LIC. It's in their interest to keep fees to a minimum and pay out the maximum they can to shareholders as a dividend. As at June 30 they collectively held approximately 28m shares.

Another reason for BKI being compared to AFIC, Argo, Djerriwarrh and Milton is returns. They have all been within a whisker of each other (give or take one per cent) over the last 10 years. But unlike the aforementioned elder statesmen of the industry, who on average have traded at NTA, you have historically been able to buy BKI at a discount with its long term average being close to a discount of 10 per cent. Right now with the popularity of the LIC space those bigger, well-known names are trading at a premium compared to their long-term average, with Djerriwarrh trading at a 26 per cent premium. BKI has worked hard on closing its gap to NTA and getting its name recognised with the big players and it is starting to show.

You can buy a similar portfolio, with a similar return profile that is trading at a slight discount to NTA compared to others trading at significant premiums.

BKI's place in the portfolio

As far as a large cap Australian equities manager with a long-term investment approach goes for me right now and the model portfolio right now BKI ticks the boxes. As mentioned, BKI gives us a similar return profile to the big names in the space but without it being priced in. You cannot fault a board and management team that has 180 years of investment experience among them and having the investment experience of Soul Pattinson's down the corridor is an immeasurable value add. All of this and we're able to buy it at a slight discount; it makes sense to me.

The portfolio as it stands

We now have our core holdings in the LIC model portfolio. BKI is going to be my highest weighted initial purchase coming in at 15 per cent. I am bringing it in with a view to increase the holding over time. It will be my largest holding.

Look through the portfolio you will see we have amassed a collection of different investment styles covering large-cap Australian and international stocks as well as small- to mid-cap stocks and emerging markets in Asia with the PM Capital Asian Opportunities Fund. Looking through the latest NTA announcements by Cadence Capital (CDM) and BKI I am not concerned by a crossover in Australian bank holdings as the two managers have very different investment approaches with BKI being very long term focused and CDM relying on technical indicators to determine its positions.

On the same note on the international side CDM also holds MasterCard and Visa as does Magellan Flagship Fund (MFF). But MFF's investment approach can be viewed in a similar stance to BKI (just a little more concentrated) investing for the long term and not swayed by technical indicators.

The portfolio sits at 55 per cent invested and I will be looking to add to the positions on some share price weakness. I am taking a long-term approach and I am not in a hurry to be invested right now. I would not put LICs in the category of stocks you trade. The ones held in this portfolio are positions I could happily hold for a number of years.

Saying that I will also be open to the idea of including new holdings along the way. There are a lot of interesting LICs still out there which I will be taking a close look at especially those that offer a niche investment opportunity to investors who would otherwise not have access. It's also interesting to see the new players trying to add value in the small cap end of town like Acorn Capital Investment Fund (ACQ), the team at NAOS Asset Management or the new Glennon Capital LIC who we were able to speak with on Eureka Interactive.

On top of this we must keep an eye on the familiar and not so familiar names in the Australian space as there are a lot of solid investment teams out there but at the time of putting this portfolio together they were just too expensive. Add to this the international LICs as well with two more Asian LICs coming on to the market in the next few months. The watch list is growing. Just because they did not make it into the portfolio right now does not mean they do not deserve your attention. I will do my best to highlight investment grade LICs that could add value to your portfolio over time.