Adding Arena REIT

Real estate income offers growth and is a good diversifier

This week I am adding further to the Income First model portfolio. Arena REIT (ARF) is a real estate investment group with a focus on properties used for childcare and medical centre services.

As ARF puts it in announcements to the market, the business aims to invest in social infrastructure style property. In my view these operations are attractive for a REIT to have exposure to, as both industries are experiencing supply growth above trend and are defensive in nature once established. As such, I would expect that these markets are more likely to bear both price rises and demand resilience into the future when compared to traditional commercial residential, industrial or office properties held by many REITs.

ARF has provided guidance for the FY16 total distribution at 10.7 cents per unit, representing a forecast dividend yield of around 6.4 per cent on the current share price ($1.63 at the time of writing). While this yield is unfranked and investors should note any tax consequences when considering an investment here, it does have a tax advantaged component to its distributions, it is well above the broader market, and is offered from a business that has a strong exposure to growth sectors. Additionally, as ARF continues to expand, the potential for growth in the distribution is apparent given the current low cost of debt.

In light of this, we are adding a 5 per cent weight in ARF to the Income First model portfolio. This will add diversification in the form of property exposure but also fulfils the portfolio's two main objectives of strong income and potential growth in future distributions. I am initiating coverage on ARF and have a buy call. My initial valuation is $1.82.

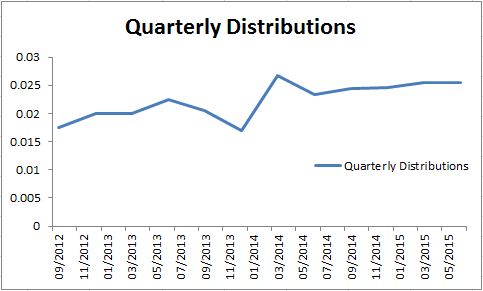

Net operating income and distribution history

ARF listed in mid-2013, so the track record for the company as a listed entity is still building. However, since listing growth in distributions has been solid and relatively constant. Below is a chart showing the quarterly dividends paid since listing. You may notice some volatility in the dividends at the end of 2013. This can be explained as a timing difference whereby the acquisition of Sydney Healthcare Trust necessitated closing the second quarter on December 10 instead of December 31. This resulted in some income being pushed from the second quarter into the third quarter. If we were to smooth the income on a pro rata basis to the actual quarter timing, the result is a far flatter, more consistent income stream.

Diversification of earnings

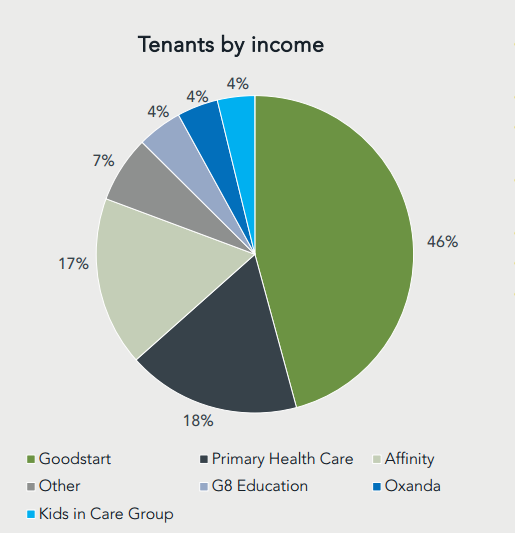

At listing, ARF sourced a touch under 70 per cent of its income from Goodstart early learning centres. Today, this amount is around 45 per cent.

Let's not forget that about 80 per cent of ARF's income is still sourced from three high quality tenants, with a total of 17 tenants in the portfolio, and with this comes some unique risks. Diversifying tenancy risk has been an important strategic goal for ARF management over the last two years and the current level of risk is far lower than at IPO as a result.

One of the key drivers of this has been the addition of the Sydney Health Trust properties, which has added exposure to health care services businesses to the portfolio, largely in the form of Primary Health Care as a key tenant. Indeed, as attractive as the childcare model is, diversification of earnings is important at an industry level as well as a lessee level.

That said, ARF management has indicated that the returns being generated from childcare developments in particular are unmatched. So it appears for now that the focus will remains squarely in the childcare sector. Below is a chart from ARF's recent FY15 results presentation showing the tenant exposure of the group:

ARF has taken an interesting approach to addressing the current supply and demand shifts occurring in the childcare sector. Firstly, the REIT has focused more on rural, low fee centres that wouldn't initially seem desirable. However, this was an intentional tactic to expose the group to operations that have higher percentages of centre revenue paid through government subsidies. The feeling is that this will afford greater upside as subsidies and regulations change in the coming 18 months.

On this point ARF MD Bryce Mitchelson suggests that the group takes a collaborative approach to the tenants' operations and looks to justify higher rental prices through the successes of the underlying occupants' business. This approach is a helpful one from a reputation standpoint and is likely to continue to place ARF in a strong position as the industry continues to grow.

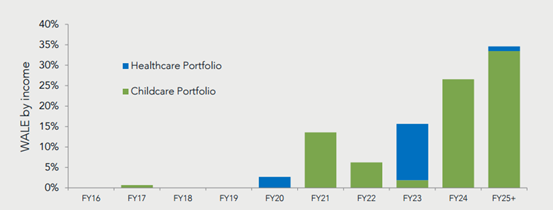

Lease profiles and upside

ARF's weighted average lease expiry (WALE) was 8.9 years as at the FY15 result. Most of ARF's leases are offered on 10 year terms with 5 year options, though the trend of late has been to grant longer leases, leading to incremental growth in the WALE in recent years. In light of this I am comfortable with the certainty provided by the group's current lease expiry profile.

If anything however, the absence of meaningful renewals may limit upside in the near term, as there is less opportunity to review lease prices higher. Despite this, the development pipeline and the terms of leases (CPI or min 2.5 per cent annual increases) should afford some level of growth.

Funding needs must be considered

ARF targets a balance sheet gearing level of 35 per cent to 45 per cent on a net debt to total assets basis. Unfortunately, I feel this is a little flawed in that total assets are largely driven by periodic property revaluations.

Pleasingly, the company's gearing is in my view conservative as is the valuation of the overall investment property portfolio, providing headroom for additional investment. In fact, ARF has $44 million of debt headroom and a $45m development pipeline, as well as a cash balance at financial year start of around $10m.

So, with this in mind, and considering the fact that REITs pay almost all distributable income as dividends, there is a strong likelihood that ARF will come to the market and raise additional capital in the next 12 months. Where this is normally of concern for investors due to potentially dilutive impacts, I believe that the growth opportunities in terms of new developments would lead to earnings accretion should any capital be needed to further fund expansion of the group's portfolio.

ARF has added value to the portfolio through the pursuit of development projects over property acquisitions. Given that property markets have risen with such force in recent years, ARF can generate a passing income (yield on cost) of around 9.4 per cent from developments. The general market yield (on market valued buildings) is significantly lower, nearer 7 per cent. Thus, part of ARFs value creation is its development pipeline.

Pleasingly, ARF's MD believes that the client support for ARF developments has been strong and indications are that this trend is continuing. Additional developments have the ability to add to the company's distributable income for FY16 and beyond, in excess of the current 10.7 cents guidance.

Internal changes enhancing distributable income

ARF created an in-house management function for the REIT in 2014, removing management and other fees payable to an external management entity. This structure is market best practice and ensures management is aligned with investors' best interests. This move has also resulted in operating cost savings flowing through to enhanced distributable income margins for ARF holders.

This benefit was felt for the last six months in FY15 but will now provide a full-year contribution in FY16 onwards. According to Bryce Mitchelson, ARF's MD, this is likely to bring the management expense ratio down towards 0.55 per cent from a previous level nearer to 1 per cent in previous years, giving ARF a significant cost advantage over its main competitors.

Under the internalised structure, Arena also manages two unlisted investment schemes and derives management fees. These funds own healthcare related investments which have long leases. With its specialised skill set, there is opportunity to potentially grow this side of the business which would positively impact on earnings.

There are always risks in REITs

Sure, ARF seems to have it all. A strong dividend yield, good growth prospects in a growing yet defensive sector and a building track record for performance.

However, investors must acknowledge that ARF is subject to real estate value based risks, tenant risks, and industry risks associated with childcare. The same way that ARF's attitude of working collaboratively with its tenants can be seen as a positive in the good part of the cycle, a significant change in the landscape for childcare operators could impact the ability of tenants to pay rent, which is ARF's sole source of distributable income.

While this is a key risk, and must be considered in the context of a rising national supply response to childcare demand strength, I believe that ARF is unlikely to see tenants suffer to the extent that rental payments are unable to be made. With no renewals in FY16, or FY17, ARF's base case for distributable income appears to carry low risk of failure.

Guidance for FY16

ARF has provided guidance to the market that its FY16 distribution will be 10.7 cents paid quarterly. This distribution is based, in my view, upon a conservative set of assumptions.

For now, we are forecasting a distribution in line with this guidance, but I note that there is potential upside to this distribution should the company deliver additional earnings and income through further development or acquisition activity. ARF will hold its AGM on November 19, so any updates as to how the business is tracking will likely be provided then.

Adding a 5 per cent weight to the Income First portfolio

I am quite confident that ARF is an interesting exposure that fits the attributes desirable for an Income First investment. However, it should be noted that the distribution is paid with no franking credits. Further to this, the lion's share of earnings is sourced from the childcare sector. Given the portfolio already holds a c.4 per cent exposure to G8 Education Limited (GEM), we are also cautious on being overexposed to the sector.

As such, a 5 per cent weighting is determined as sufficient, and not so high as to add unacceptable levels of risk. I am confident that the recurring revenue model within childcare and the demographic drivers of the sector are appealing to income focused investors. As mentioned, we take a 5 per cent weight and add a buy call on ARF with a valuation of $1.82.