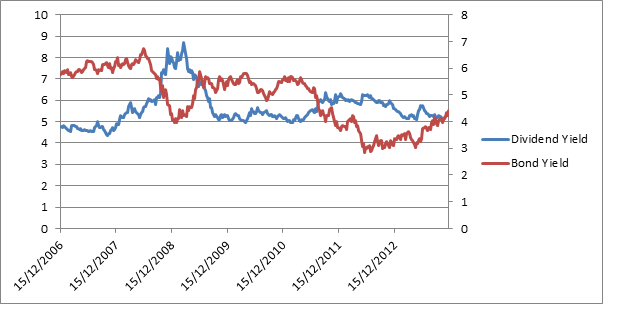

Yields tip in favour of bonds

Not since mid-way through 2010 has the yield on an Australian 10-year government bond been higher than the Australian equity market.

It has made it an easy decision for investors to favour equities over fixed income as the income on offer has been substantially more. Though as bond yields rise, fixed income opportunities will once again regain the attention of investors.

*fully franked dividend yield

Source: Bloomberg

Rising long term rates are set to force investors to rethink the investment style of favouring investments for their dividend yield alone.

As the gap between the yield on a government bond, typically perceived to be risk free and dividend yield on an investment comes closer the risk-return profile changes. This is not to say there is no place for high-yield investments, rather the focus should likely shift to value metrics as share price growth potential will have an increased importance in conjunction with dividend yield.

Flows into high dividend yield funds have dominated equity flows since 2009 but relative flows are now bordering on zero as the investment style begins to lose its appeal with investors globally. This can be explained by interest rate expectations and the continued abatement of risks in the Eurozone, providing attractive investment opportunities across this region.

On a historical basis, high dividend yield as an investment approach has underperformed when government bond yields rise. Despite this, the market reaction to the imminent tapering may distort historical relationships if investors remain married to previous investment styles.

It is almost impossible to gauge how the market will in fact respond to the imminent tapering and current predictions are varied. Volatility in the short term could cause an undesirable volatility, but nothing equity markets haven’t seen in the past decade.

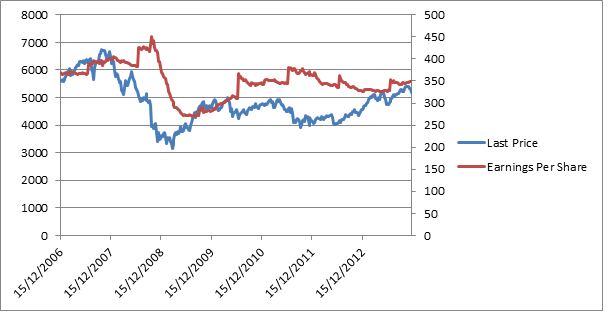

Over the past seven years, earnings per share and the ASX 200 index have closely mirrored each other for the most part.

Source: Bloomberg

A substantial fall in the market would have to follow up with a similar fall in earnings per share. If future earnings expectations remain the focus of the market, volatility and an undesirable market slide could possibly be temporary.

Latest economic data coming from the two largest economies is offering a better global outlook. Importantly, China’s surging exports suggests the global economy continues to improve relative to the past few years offering a better backdrop for the prospect of improving earnings, domestically and globally.