Write downs could see ANZ emerge stronger

| Summary: ANZ's report last week saw it bite the bullet and cut its dividend to 80c. The bank is still considered to have riskier exposures than its peers, but write downs mean it is likely to emerge as a stronger business in the longer term. |

Key take out: We remain cautious on the banks in general and will continue to hold ANZ in the Income First model exposure for the strong dividends still on offer. |

Key beneficiaries: General investors. Category: Shares. |

Bank results get the market tick

The Income First portfolio holds positions in both ANZ and NAB, and both banks reported interim financial results to the market on Wednesday and Thursday (May 4 and 5) respectively. Both results showed evidence of building pressure on cash earnings, with ANZ going so far as to cut its dividend in order to preserve its sustainability into the future. Despite the spectre of challenging profitability that overshadowed these results, both banks were cheered by the market on their respective reporting dates. In my view this indicates that the lower share prices have moved to factor in some of the pressure on the sector, and that the market's expectations for these two banks were particularly low.

This has led to ANZ and NAB (see more on NAB's result in my report here: NAB impresses in tough conditions) trading at decent discounts to CBA and WBC, something that has allowed relative outperformance in light of the financial results last week. We remain cautious on the banks in general, noting that cyclical pressures from a changing economy as well as regulatory uncertainty is likely to continue to produce headwinds to profits growth. However, given the strong dividends we continue to hold our portfolio positions unchanged in both banks.

ANZ result – new chief executive clears the decks

It isn't unusual for a new chief executive to write down book values after taking the helm. The cynic in me believes that this behaviour affords easier achievement of future growth rates, ROE targets and other performance related metrics in future reporting periods. However, the reality is in the case of ANZ there was some confessing to do in terms of restructuring as well as the write off of Asian asset values. In terms of numbers, chief executive Shane Elliot appeared to have delivered an ANZ statutory profit that looked awful, down 24 per cent. But the result was messy, needing a large number of adjustments. On an underlying basis (with these adjustments made), the result showed a more tepid profit decline to around $3.5 billion, still a small disappointment on consensus expectations. The adjustments to reach this underlying result included some changes to capitalisation methods for software, restructuring charges, write down to Asian minority investments carrying values, and some gains made on the sale of Esanda. All in all, this was a $717 million adjustment to reach underlying numbers. ANZ cut its dividend to 80c, and continues to target a payout ratio in the 60 per cent – 65 per cent range. While the cut was a little deeper than we expected, it was taken positively by the market as a signal that the bank was focusing on ensuring the quality of a sustainable business.

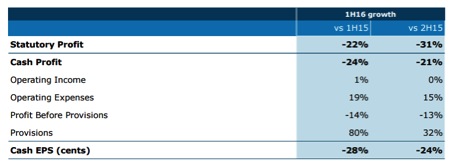

Here's ANZ's key numbers from its result presentation:

Dividend

As mentioned, ANZ will pay an 80c interim dividend (down from 86c in the prior corresponding period), with the company commencing to trading on an ex-dividend basis today (May 9). Additionally, ANZ announced that the full year dividend would be at least 80c as well putting a $1.60 floor on the full year payout. Traditionally, ANZ has paid a higher dividend in the second half, so the floor of 80c seems logical. The floor implies a dividend yield of around 6.4 per cent (over 9 per cent if you include franking value). So the income stream from ANZ remains appetising.

Write-downs and impairments

Perhaps the key negative in the ANZ result was some deterioration in asset quality. Essentially, ANZ is considered to still have riskier exposures than its peers. While the write-downs to Asian investments, and the restructuring go a long way to address and rebase this, there are lingering concerns that more “one-offs” may be needed in the future.

So why did the ANZ share price lift on the result?

This result for ANZ was a mark to market of some tough operating conditions. The company bit the bullet in a sense, cutting the dividend, and taking the hit on write downs. The result is likely to be a stronger, higher quality business will emerge from these write downs. It may not be the last of the write-downs, nor of the dividend cuts, but it is a step in the right direction. The company clearly has one eye on capital requirements that are likely to be more demanding as Basel 4 approaches and APRA interprets the requirement for ‘unquestionably strong' under the financial system inquiry.

With all this in mind, ANZ is probably trading at a discount to its big four peers that is too large. The bank's outlook may hold some greater risks than its big four rivals, but with a lower dividend payout ratio and a focus on ‘righting the ship' ANZ may also offer more potential upside than its peers.