World solar's week in the sun

Three actual, or potential, solar records have been announced over the last week.

Last Thursday, India's Department of Heavy Industry unveiled plans for the country's biggest solar project to date – a 4GW solar farm in Rajasthan state, according to an emailed statement from the body. This would be over three times India's total capacity at end-2012. By 2015, the nation will have just over 9GW of solar installations, forecasts Bloomberg New Energy Finance's market size tool. State-run companies will form a joint venture to complete the first gigawatt by end-2016.

Meanwhile, the world’s biggest unsubsidised solar farm is to be built in Chile, French energy company Total announced on Thursday. The 70MW PV project will cost $US200 million, of which 70 per cent will come from the US's Overseas Private Investment Corporation in US-dollar-denominated debt. Solar developers are being attracted to northern Chile for its sunny weather and high energy prices. Swiss renewable energy producer Etrion will own 70 per cent of the project, Total 20 per cent and Spain's Solventus Energias Renovables 10 per cent. Construction will start in the 2013 fourth quarter and the plant is expected to start generating power by the first quarter of 2015.

Singapore is also set to see a new solar record as Germany-based Phoenix Solar said on September 25 it had won a contract to build a 1.2MW plant – the southeast Asian nation's biggest to date – for CMM Marketing Management. The unit will be built on the roof of CMM's head office.

Given this spate of records, it is perhaps no surprise that solar installations will slightly edge out wind this year – for the first time – according to Bloomberg New Energy Finance's latest projections. Some 33.8GW of new onshore wind farms will be added, together with 1.7GW of offshore capacity, compared with 36.7GW of new solar PV plants. Though Europe is declining as a solar market, new incentive regimes in Japan and China – as well as continued cost reductions for PV – mean continued growth for the technology, In contrast, policy uncertainty in key wind markets, the US and China, will cause installations to shrink by nearly a quarter this year.

Wind may not be the 2013 renewable energy winner for installations but it will remain a leading technology thanks to falling equipment costs, new markets and the growth of the offshore industry. Indeed, on Friday, Mitsubishi Heavy Industries and Vestas Wind Systems announced they had agreed to form an offshore wind joint venture. The partnership, to be formed in March 2014 and equally owned by the two companies, will design, procure, build and sell offshore wind power plants. Having been unprofitable for two years, Vestas is seeking to lower fixed costs by €400 million ($US540 million) and expand its foreign business. It will move development of its 8MW sea-based turbine to the venture and the Japanese company will inject €100 million, rising to €200 million based on milestones met. Wind did have a record of its own last week, with Friday producing the first ever IPO of a US wind developer: Pattern Energy raised $US352 million after shares were priced at $US22 each and opened at $US24.10 on Nasdaq, touching a high of $US24.30 later that day. Pattern owns and operates eight wind projects in the US, Canada and Chile. Its IPO success could spur other such filings. Meanwhile, the leader of the UK Labour Party, Ed Miliband, stirred up a hornets' nest on 24 September by announcing that, if elected in May 2015, his party would cap gas and electricity prices until January 2017. The proposal would cost energy companies £4.5 billion ($US7.2 billion) but would save an average family £120 ($US193) a year, Miliband's office said without saying how it had made the calculations. In addition, Labour's energy spokesperson, Caroline Flint, told delegates at the party conference that if elected, it would split up Britain's six largest gas and electricity companies and force them to trade all their power on the open market to drive down prices.

The UK is not the only European country where governments are concerned that consumer energy prices are too high: Hungary's conservative government recently announced its intention to renationalise utilities for that reason. Retail tariff controls – disliked by the European Commission – are not uncommon in the region. Indeed, the average household electricity bill in the UK has risen 68 per cent since 2008, though the nation's power prices are the fourth lowest among 15 EU countries according to a study by the Department of Energy and Climate Change.

In response to Labour's announcements, the industry has said that the freeze on prices could deter investment in new power capacity, which the regulator Ofgem has said is necessary to avoid blackouts towards the end of the decade. Miliband's proposals backtrack on Labour's support for Prime Minister David Cameron's energy policy, which is designed to attract £100 billion ($US175 billion) for replacing older power stations. The profitability of European power generators is under pressure from multiple angles. The region has begun to see utilities announce capacity reductions, albeit to a large extent involving mothballing rather than permanent closure. Some UK utilities have also said the government's clean energy policies are to blame for the rising consumer electricity bills. Low-carbon policies will make up around a fifth of the domestic electricity price in 2020 – double the current level of 10 per cent – according to Bloomberg New Energy Finance.

EU carbon

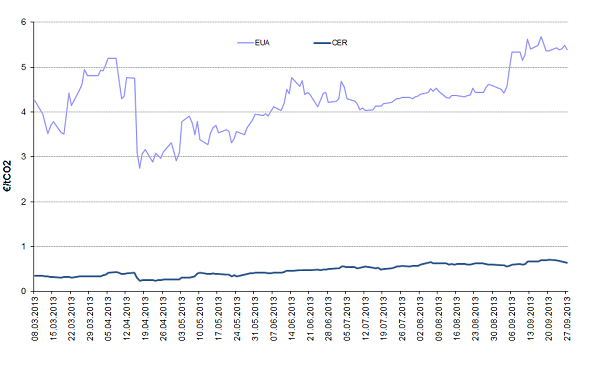

European Union Allowances for December 2013 advanced 0.6 per cent last week.

EUAs for delivery in December ended last Friday’s session at €5.39/t on ICE Futures Europe exchange in London, compared with €5.36/t at the close of the previous week. German power for delivery in 2014 ended Friday’s session at €38.85/MWh, a 0.7 per cent increase on the previous week’s €38.60/MWh close. The market appeared to be undecided on the ultimate impact of Angela Merkel’s victory in German elections 22 September. Soon after the opening of the market the next day, EUAs for December 2013 surged to €5.55/t but collapsed later to a low of €5.25/t. Front-year EUAs tracked a spike in 2014 German power on Tuesday morning – hitting a high of €5.58/t. The Dec-13 contract traded mostly in a wide range between €5.30/t and €5.50/t for the rest of the week. UN Certified Emission Reduction credits for December 2013 lost €0.07/t last week to close at €0.64/t.

For information on how to subscribe to Bloomberg New Energy Finance's daily news, data and analysis on clean energy and carbon markets, click here.

This article was originally published by Bloomberg New Energy Finance. Republished with permission.