Wobbly numbers paint a mixed US picture

Consumer sentiment remains weak, while house prices and housing investment are on the rise – but with a few caveats.

It was a mixed day for US data. Consumer confidence declined in November, compared with market expectations for a rise, and remains well below its long-run average. The index remained at a low level after falling sharply in response to the 16-day government shutdown in October.

The decline in sentiment really hasn’t been felt in the real economic data so far. Although we will never know the counterfactual – what would have happened? – retail spending in October was consistent with pre-shutdown levels.

That isn’t to say that retail spending is strong. It certainly isn’t, but it does not appear to have softened further in response to consumer concerns. That said, in the current economic climate, it wouldn’t take much for consumers to become a lot more cautious and pull back on spending.

The Federal Reserve has stated that they will consider tightening monetary policy if the unemployment rate continues to decline. But for a recovery to be sustainable, the improvement in labour market conditions needs to be reflected in stronger consumption growth.

Although spending is not as weak as confidence measures suggest, retail spending growth is not as strong as expected at this point of the recovery. I won’t be convinced of the sustainability of the recovery until retail spending picks up.

On the housing front, data was generally positive overnight, but there are some longer-run concerns.

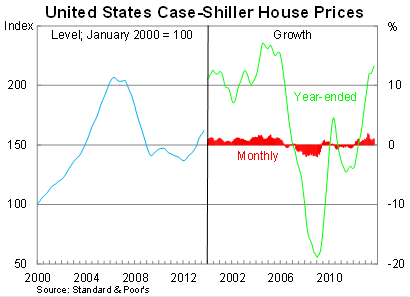

In the United States, the S&P/Case-Shiller house price index rose by 1.0 per cent in September, to be 13.3 per cent higher over the year. Prices have now recovered 18.5 per cent since their trough in early 2012 but remain over 20 per cent below their peak prior to the onset of the global financial crisis.

House prices in the US have picked up over the past couple of years on the back of low mortgage rates and a moderate improvement in economic conditions. But in recent months, fixed mortgage rates have increased significantly (fixed mortgage rates are much more popular in the US compared with Australia) and inventories are on the rise.

According to data from the National Association of Realtors, pending home sales – a leading indicator – have fallen for five consecutive months. With higher prices, greater inventories and softening demand, price growth should slow significantly over the remainder of 2013 and into 2014.

But this has yet to show up in the S&P/Case-Shiller index due to reporting lag – we only have data up to September – and because the index itself is a three-month moving average. September data is actually the average from July to September.

Meanwhile, building permits rose by 6.2 per cent in October to be at their highest level since mid-2008. The rise was almost entirely due to the volatile multi-dwelling structures featuring five or more units.

Although permits declined in the September quarter, there is a general upward trend, which points to a continued recovery in residential investment in the US. But activity is coming off an extremely low base, with building permits still over 50 per cent below their peak.

According to a survey by the NAR, home builders are feeling less confident about the housing market now compared with mid-2013. And with higher mortgage rates and price growth likely to slow, it may discourage some investment. However, given investment activity is still at such a low level, I expect investment to continue to rise and support the tentative recovery into 2014.

While residential investment will continue to support the recovery, more timely housing market data suggests that house price growth will slow or even begin to decline in coming months. Although prices are still at a low level compared with their peak, the improvement over the past two years has underpinned the recovery in household spending and consumer confidence. A fall in house prices now could weigh further on consumer confidence and household spending, and possibly delay the Fed’s decision to taper.