Wind vs Gas vs Premier Barnett

In an interview published yesterday, Vestas CEO, Ditlev Engel skirted around a question on what kind of gas price it would take for wind to be competitive against gas for power in Australia, choosing to move the discussion onto fossil fuel subsidies. Unfortunately, this discussion didn’t really adequately address what is in fact an incredibly significant issue for Australian energy markets and policy.

Thankfully Climate Spectator has published analyses that have looked at this issue in detail for Australian conditions. For example we ran an excellent webinar presented by Ross Gawler and Richard Lewis of SKM, indicating that wind is within striking distance of gas-fired power where new plant is being constructed.

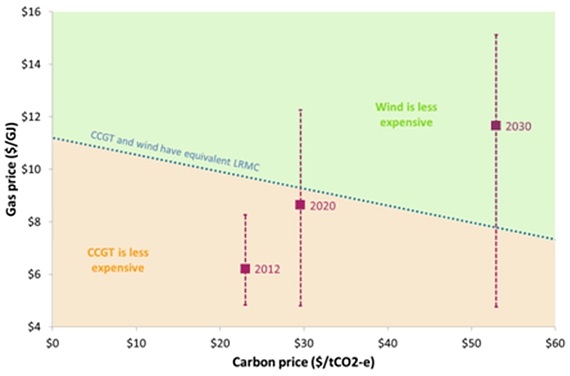

Also the chart below taken from a Climate Spectator article by Dr Jenny Riesz is one of the most illuminating.

It shows the cross-over point between the cost of wind and a gas combined-cycle power plant depending on gas and carbon prices. While it is slightly out of date with the cross-over between wind and gas now about $1 per GJ lower than indicated, it still provides a good illustration of how gas and the carbon price influence the economics between wind versus gas.

Economics of wind vs gas combined cycle power stations at varying gas and carbon prices

To date gas power plants have been clearly ahead of wind because gas prices have been comfortably south of $6 per GJ. But in WA according to the Bureau of Resource and Energy Economics, gas prices for new supply contracts are already at levels above the cross-over point with a zero carbon price. Also Santos’ CEO David Knox has been reported saying he is inking contracts with east coast customers towards the higher end of $6 to $9/GJ and Santos is now basing its gas reserve estimates on a $9/GJ price. This is at the cross-over point for wind with a $23 carbon price.

So why on earth are wind developers so nervous about what happens with the Renewable Energy Target as it looks like they’re in the box seat?

This then brings us to the other part of Ditlev Engel’s interview where he chose to focus on fossil fuel subsidies. Now the term subsidy tends to be highly emotion charged and subject to widely varying interpretations and government policies can be very subtle in how they distort markets in favour of one fuel over another.

So rather than label them as fossil fuel subsidies, it is better to consider how a historical legacy of decisions by government embed incumbent fossil fuels and more particularly coal, not just gas. Then we might think about how things might be different if we were instead working with a fresh sheet of paper.

If we were starting afresh without government driving things, we wouldn’t have built so many coal-fired power stations around 20 years in advance of energy demand requirements. This means power prices don’t properly reflect the capital cost of constructing a power plant.

Also we wouldn’t be gifting these power stations with free transmission capacity as was originally proposed by the Australian Energy Market Commission. Instead we’d make them pay for transmission.

Also state governments wouldn’t own so much power station capacity that they, more than any other entity, have the greatest commercial interest in preserving the returns of incumbent generators.

Also as Giles Parkinson so stunningly revealed in relation the Cobbora coal mine privatisation debacle, state governments have a range of subtle mechanisms to provide coal to power stations at prices below what’s likely under a free market.

We also wouldn’t have government trying to bring forward the development of gas fields by imposing time limits and stimulating demand for gas as has occurred for Bass Strait, Queensland coal seam methane and WA’s North-West Shelf.

What’s this got to do with WA Premier Colin Barnett?

Well, in many respects, Barnett is perpetuating the historical legacy of energy as a tool of the state to stimulate economic development. His bullying of gas producers (so clearly evident with Woodside’s James Price Point LNG development) into developing gas fields earlier than they desired, in combination with reserving gas for WA consumers distorts the economics of gas power relative to wind.

Also his decision to reverse electricity market reform in that state by reintegrating Verve and Synergy will hinder the capacity for new entrant generators (likely to be renewable power) to gain a foothold. His failure to allow electricity prices to rise to reflect costs also hinders new entrant retailers who would be unconcerned about new wind projects depressing returns for incumbent generators.

Of course none of this is to deny that wind is a big beneficiary of government leg-ups. But let’s not pretend that anyone is purer than the driven snow when it comes to energy supply.