Will utilities adapt or fall to solar?

On Friday I wrote about how a range of clever people and companies in Silicon Valley are looking to replicate a process of creative destruction in the electricity sector which they’ve already replicated in a range of other industries.

They are looking at how they can combine a combination of computer chips, solar cells, information networking and batteries into an integrated system which allows households to meet their energy needs at a cost competitive level with grid-supplied electricity, but with dramatically lower emissions.

If they manage to succeed, then power companies could be in serious trouble.

But then again it might be that power companies could adapt their business model to make good money, even with much lower amounts of power being drawn from the centralised grid. So, rather than making money from selling more electrons from big power stations, they might make money from selling solar equipment or, say, providing power management services.

The issue though is can they, and will they?

Paul Nahi, chief executive of Silicon Valley’s leading solar technology company, Enphase, is optimistic that they can adjust – indeed he believes “they don’t have a choice”.

During our chat I raised the prospect that while solar PV is surging in the US and there was large room for further growth, utilities were now mobilising against the technology. Here’s his take:

This is most likely true. But what we’ve seen in Australia is that utilities, or at least power retailers, did get involved reasonably successfully in solar, but have since fallen away.

The largest energy retailer in Australia, Origin Energy, was as recently as October 2011 the largest seller of solar PV systems in the country. It held around 10 per cent market share, which is pretty significant given solar installation has traditionally been a highly fragmented industry dominated by lots of small players.

Origin had built a clearly dominant position by using its existing position as an energy retailer superbly. Origin was able to exploit its existing large customer base to market solar systems at relatively low cost. Also, it bundled in loan repayment plans with payments for existing energy bills, making the purchase easier for customers, while controlling credit risk for Origin. And with solar a relatively unfamiliar product for consumers a few years ago, Origin stood out as a familiar and trusted brand in energy. They also had a good green reputation, which is now in the process of being squandered.

AGL Energy came later to the party, but again it muscled itself into the top 10 retailers (partly through the acquisition of Rezeko) and possibly the top five (numbers are obscured somewhat through representation of renewable certificate agent aggregators). Energy Australia, or TruEnergy were, as usual, way behind the eight-ball and never made an impact as a major solar PV retailer.

Yet after 2011, both Origin and AGL quickly dropped away. Industry analyst SolarBusinessServices has just released its latest report quantifying the volumes of solar moving through the market and noted that Origin’s solar sales have plummeted by 75 per cent compared to 2012, and also estimate that AGL’s solar sales have reduced by almost 50 per cent. According to Green Energy Markets, Origin captured just 1.1 per cent market share for the first two months. AGL had dropped out completely from the top 20 creators of solar certificates known as STCs.

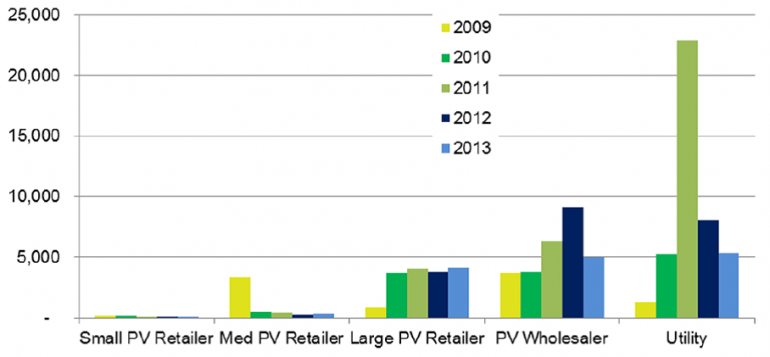

This drop away in solar sales of the utilities is reflected in the chart below prepared by Green Energy Markets, in conjunction with SunWiz and SolarBusinessServices. It shows numbers of solar installations per business in different size segments. You can see that 2011 was the heyday for power utilities as solar retailers. But their level of installations dropped away far more precipitously than businesses in the other segments. Indeed this probably understates the fall for Origin and AGL because the other utilities involved in solar PV were never much chop. Now, one thing to keep in mind is that while those in the medium PV retailer category only install less than a few hundred systems per year, there are 1000 businesses in this category while there are just a handful in the utility segment.

Level of installations per active solar PV retailing business in different segments

Source: Green Energy Markets with SunWiz and SolarBusinessServices (2014)

Energy retailers have clearly shown the capacity to compete successfully in provision of solar products.

But there are a range of other competing opportunities for them to spend their capital and management attention. It looks like billion-dollar acquisitions of coal generators and government power retailers, as well as developing gas resources look like better bets to them than a cut throat, low margin solar retailing business.