Will equities continue to fly?

| Summary: The Australian sharemarket surged 20% last year, but can we expect similar results in 2014? The answer lies in assessing the market fundamentals. |

| Key take-out: With market yields continuing to be attractive, the yield trade probably still has some time to run. |

| Key beneficiaries: General investors. Category: Shares. |

Arguably, 2013 was the best year for Australian equities since the global financial crisis.

The general improvement was largely underpinned by a gradual but persistent recovery in fundamentals throughout the year.

Significant drivers of growth in the market were lower interest rates and a gradually declining currency. In addition, there was a material pickup in the residential property market and signs that consumer and business confidence were improving.

The question is, with the Australian market rising nearly 20% in 2013, how much of the recovery has already been priced in?

The two fundamentals that give me confidence

While I acknowledge there are risks to my view, two points lead me to believe that Australian equities present good value for 2014.

The first is the market’s dividend yield compared to the cash rate, and the second is the improvement in Australian company earnings.

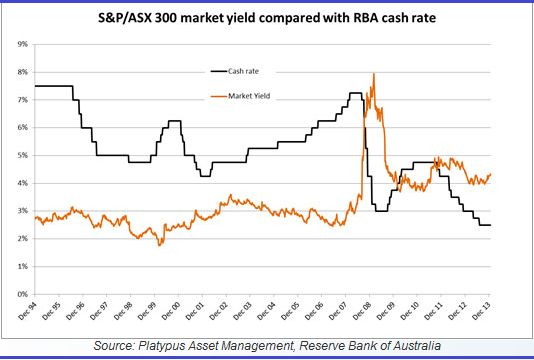

So-called ‘yield’ stocks performed well in 2013. Today’s low-yielding investment environment has meant investors increasingly seek out other income-producing investments with returns greater than cash and term deposits. Currently, as the chart below demonstrates, simply owning the market gives investors a better yield than cash.

With market yields continuing to be attractive, I believe the yield trade still has some time to run.

During January, the Australian dollar ($A) fell to a new three-year low against the US dollar ($US). It seems to be under continued short-term pressure. This will help the Australian economy and give the Reserve Bank some comfort – a lower $A has an expansionary impact on the local economy and is therefore positive for the equity market.

In addition, company earnings are steadily improving without large valuation expansion. The average price-to-earnings ratio (P/E) of the market since the early 1990s is 14.4 times. At the moment, the market is trading on 14.0 times. This is not expensive by any means, especially in context of the current expected earnings environment.

While the equity market fell in January, I do not believe this is the start of a larger correction. In fact, I think pauses are part of any healthy bull market. The January correction was led by larger stocks, with sentiment holding up for smaller capitalisation names. For me, this implies investors are happy to hold smaller stocks, demonstrating some comfort in earnings expectations.

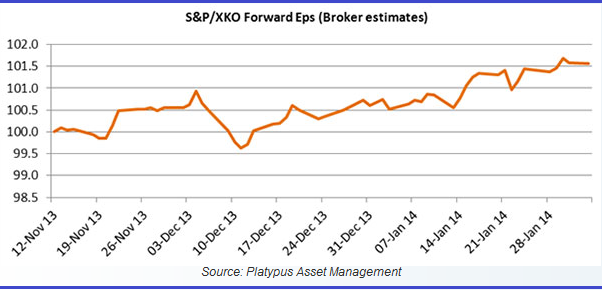

Earnings estimates for the market have been steadily increasing since mid-December, which means the investment community does not have negative expectations for the outlook for companies reporting over the next few weeks.

My view, too, is that forward earnings conditions are improving and the market will likely grow earnings by low double digits in 2014. This is a reflection of the positive environment for company earnings, in particular the double impact of a lower currency and low interest rates.

Looking ahead, I believe it is possible the Australian market is in the early stages of a bull market that started in the middle of last year, and is primed to continue in 2014 and possibly beyond.

This article was first published in the No More Practice newsletter and is reproduced with permission. Donald Williams is chief investment officer and a co-founder of Platypus Asset Management.