Will business credit upset the rates juggling act?

The Reserve Bank of Australia must have conflicted feelings about credit growth. On one hand, housing credit is doing exactly what it had anticipated. But on the other hand, the business sector is failing to generate any momentum.

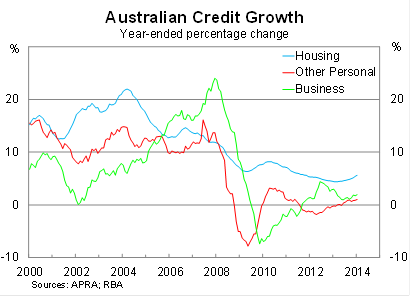

Private credit balances outstanding rose by 0.4 per cent over January to be 4.1 per cent higher over the year. Credit growth continues to be driven by housing, particularly from investors, with other forms of personal and business lending remaining weak by historical standards.

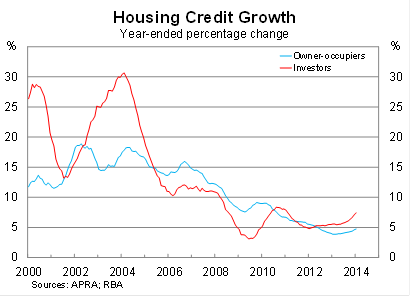

Housing credit to investors rose by 0.8 per cent over January and has begun to pick up pace in recent months. Based on the last four months, investor credit growth is set to push to its highest level since around 2006. We are really only beginning to see the effects of the sharp rise in investor lending.

Borrowing by owner-occupiers has been less enthusiastic, primarily due to the reluctance of first home buyers to leverage up during difficult times. Nevertheless, it is on the rise.

But the gathering momentum in housing credit is nowhere to be seen for businesses. Business credit remains exceptionally weak given how low lending rates currently are. As we know from the monthly lending data, many firms are taking advantage of low rates but other businesses are remaining fairly cautious and are reluctant to take on risk (Business is nibbling at the RBA’s carrot, February 14)

It is entirely understandable. The news is being flooded with stories about how Qantas is struggling and how the manufacturing sector is doomed. Job losses from major Australian companies seem like daily events. Obviously, the non-mining sector remains fairly subdued.

Business credit is unlikely to pick up much over the foreseeable future. As I noted yesterday, business investment is set to fall massively during 2014/2015 and there is likely to be additional declines the following year (Business is preparing for a capital strike, February 27).With investment so muted, there will be little need for firms to seek out additional financing to fund expansion and improve capacity.

The RBA has shown very little concern about the gathering momentum in housing loans and instead would be happy with how household lending has developed. Conversely, business activity must be a huge concern, particularly given the outlook is far from bright. It is set to become a tough balancing act for the RBA in that it may struggle to set rates at an appropriate level to support business investment but not cause the housing market to overheat.