Will Australia's economy age gracefully?

Australia's ageing population presents a considerable challenge to Australia's economy. After a generation of favourable demographics and a once-in-a-lifetime terms-of-trade boom, it will be old-fashioned hard work and Australian ingenuity that determines our economic future.

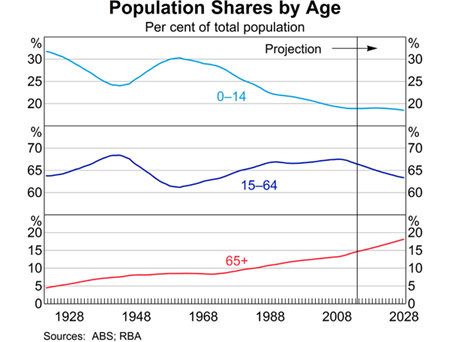

One of the least discussed causes of Australia's economic success over the past half century has been our favourable demographics. Until recently, Australia had a relatively young population, flush with working age individuals and supported by rising labour force participation among women.

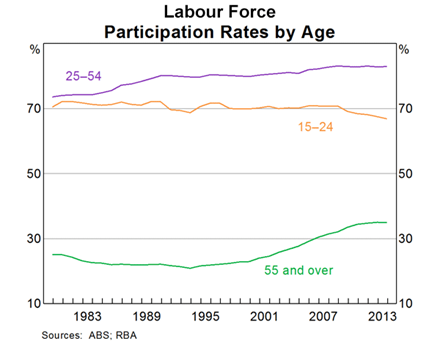

That period of unprecedented success is over and the labour market participation rate is now on the skids. That is set to continue over the next generation due to the retirement of the ‘baby boomers' and relatively low fertility rates in Australia.

Reserve Bank of Australia assistant governor Chris Kent was in Adelaide today discussing some of the implications of an ageing population on Australia's economy. Clearly this is an issue that is on the mind of the RBA's top brass, and rightly so, with deputy governor Philip Lowe providing an excellent analysis back in March (Coming to terms with Australia's stark economic reality, March 13).

The implications of this trend are vast and will fundamentally change the composition of Australia's economy. The first concern is the number of workers, with the economy becoming increasingly reliant upon a smaller share of the population to drive growth and finance government services. The share of workers in health and aged care services is set to boom but the demand for teachers may ease.

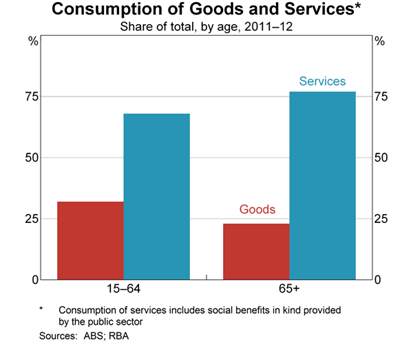

More broadly domestic demand is expected to shift increasingly towards services. According to Kent, “services constitute a larger share of total consumption for older people than for the rest of the population.” The retail sector is set to be one of the biggest losers from Australia's ageing (A new grey area for retailers, March 24).

Kent notes that “we can expect that ageing will lead to extra demand for services at the same time that it weighs on the supply of services.” That will inevitably push the price of services higher relative to goods. But we shouldn't blame ageing entirely for this trend, productivity growth has been much higher in goods manufacturing than in services for a long time.

There are two other issues that warrant further discussion: government finances and risk-taking.

It's widely accepted that an ageing population will narrow the tax base and weigh on tax revenues. At the same time it will increase the demand for government health and aged care services. The Productivity Commission estimates that an ageing population could increase aged care, aged pension and health care expenditures by around 7 percentage points of nominal GDP by 2059-60.

The aged pension will come under increasing pressure due to insufficient retirement savings. Superannuation has helped to some extent, but remains insufficient for many ‘baby boomers'. Unfortunately, the superannuation tax system largely favours the wealthy, offering tax concessions that accrue primarily to those who don't need them.

Although as noted by RBA governor Glenn Stevens, there is also the risk that ‘baby boomers' hold too much of their wealth in property and are particularly susceptible to a market correction (Have baby boomers made a big investment mistake? September 4).

Finally, Kent notes that older Australia's have less tolerance for risk, “including those associated with new business ventures, developing new products and services, and pursuing innovation more generally.” None of that is a surprise but it suggests that an ageing population may create an impediment for productivity.

However, according to Kent an ageing population does provide some opportunities. But I'm not sure that longer working lives is what a lot of people have in mind when they think of opportunities.

Nevertheless, higher wages will encourage some older workers to either stay in the workforce or re-enter it. To some extent we are already seeing this process in action with the participation rate among older Australians increasing significantly over the past decade. That is a trend that should continue over the next generation.

Another important point is that a longer lifespan will necessitate a rise in national savings. That said, the performance of our superannuation industry -- which charges exorbitant fees for subpar work -- suggests that this may not be as beneficial as it first seems.

An ageing population presents a considerable challenge for the Australian economy. Innovation and productivity growth are the two keys to solving the riddle and they will ultimately determine our long-term standard of living.

The obvious issue though is that an ageing population tends to weigh on productivity and risk-taking. It also encourages greater consumption of services -- a sector where productivity growth has historically been relatively low.

Nevertheless, we will have to boost investment and productivity growth if we hope to maintain our recent economic gains.