Will Abbott avoid the Babcock & Brown trap?

“Robert... Robert... in this market if people want to judge the sustainability and the strength of our business off the back of where our hybrids trade on very thin volumes then that’s their judgement.”

— Phil Green, former CEO of Babcock & Brown

In February 2009, the ‘Robert’ in the above quote, Robert Gottliebsen, was giving Phil Green a hard time about ‘look-through’ gearing – the amount of leverage built into the entire Babcock group around the world.

As a senior editor sitting in on the interview, I remember the frustration and anger in Green’s voice as he was pummelled by Gottliebsen. (You can revisit the full interview here.) Green was defiant. Corporate gearing was only 50 per cent, not the 78 per cent Business Spectator was grilling him over. It was a spirited defence, but ultimately a flawed one in a credit-crunch environment. By September of that year Babcock’s share price had fallen by 99.6 per cent and the ‘mini Macquarie’ had become just another victim of the GFC.

Why mention this now? Because something like the reverse of this predicament is happening in the national media over Australia Inc, and its most recent chief executive Julia Gillard (and her temporary replacement Kevin Rudd).

Substantial economic revisionism has begun in Canberra, fuelled by commentators whose joy over the Abbott victory has allowed them to temporarily ignore economic fact.

As JP Morgan’s Stephen Walters put it yesterday, not much has really changed: “The economic data last week showed the expected bounces in business and consumer confidence ... but the disappointing employment report showed a net loss of jobs and a higher jobless rate. We put more weight on the soggy labour market signal; confidence is fickle and we doubt the post-election giddiness will translate into higher activity. Indeed, the new government will face the same sluggish economy as did its predecessor, and the same budget constraints.”

To return to the Babcock analogy, if we are to understand the economic challenges ahead, we need to ‘look through’ the spin and propaganda and stay focused on fundamentals – you can talk the market up for a while, but it won’t stay there unless the fundamentals follow.

If directors at Babcock had not believed their own PR in 2007 and 2008, they might have survived 2009. The new board of directors at Australia Inc should take note.

For political reasons they are trying on some fast talking of their own – particularly by suggesting that it’s time for the world to invest in Australia. Abbott, assistant Treasurer Arthur Sinodinos and Finance Minister Matthias Cormann all said yesterday that we’d better open up our economy to foreign investment.

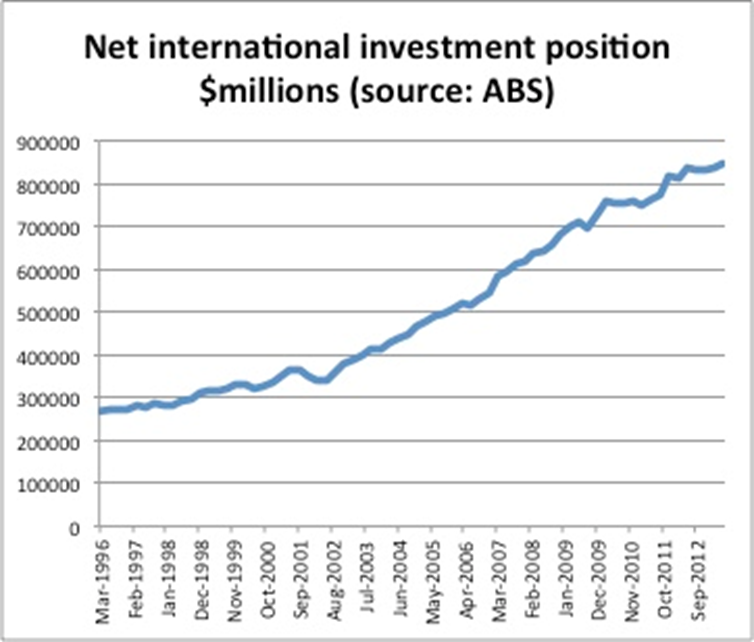

Come again? We’ve just been through more than a decade of accelerated inward investment (see the chart below) – what they really mean is “more of the same please”.

Despite all the fear mongering over the Rudd/Gillard years of ‘sovereign risk’, those two Labor governments were at least as successful over six years in attracting foreign investment – GFC volatility notwithstanding – as John Howard was in his last six years.

The Abbott government can talk it up all they like in public, but in private they know that ‘steady as she goes’ is about the best we’ll achieve. To think, for example, that mining investors really batted an eyelid over the tiny revenues raised by the Gillard/Swan MRRT is simply not borne out by the facts.

Inward investment is, of course, just the issue du jour. The Abbott team is talking it up partly to keep Barnaby Joyce and a few other excitable Nationals in their boxes over foreign ownership of agricultural land. If they make enough noise, they’re wagering, Joyce will have to keep his head below the parapet.

But other issues will arise soon.

The dollar, for instance, is staying annoyingly high – even creeping up a bit as the uncertainty over the Fed’s tapering of quantitative easing continues. Just as during the Labor years, Abbott has very little control over this – both Labor and the Coalition went to the election with fiscally conservative budgets, so there is nothing Abbott can do on the expenditure side to drop rates even lower and convince a few currency investors to shift back into the greenback. We’re at the whim of speculators.

The shift out of the Australian dollar will happen of its own accord, eventually. But if the dollar stays high for an extended period, Labor will try to blame Abbott. Again, though, we must look through the spin and try to stay focused on things the government can actually change.

Government debt is one of these. Unlike Babcock & Brown, Australia is conservatively geared. If net debt – currently at around 11 per cent of GDP – creeps up a point or two, shadow Treasurer Chris Bowen will scream blue murder given the hiding Labor took over ‘debt and deficit’ during the Gillard years.

However, as Saul Eslake pointed out a few months ago, letting debt blow out to around 13-15 per cent (and then start to be paid down) really doesn’t matter – as long as the money is spent on productivity enhancing infrastructure. But Abbott can’t do what’s in the national interest unless journalists and commentators can ‘look through’ the spin, and see the real economic situation.

There are other areas of reform that, spin or no spin, Abbott has promised not to touch – tax reform, though badly needed, will have to wait until 2016, though a promised full review of the tax system is a very welcome development.

And on IR reform, the Coalition is hamstrung for a generation due to WorkChoices. Abbott can stretch his mandate a little in altering the Fair Work Act’s flexibility arrangements, and he will re-instate the ABCC – but that’s it.

So those two are off the table – when both sides of politics agree not to reform, only time and economic deterioration can change things.

We are entering a period of history in which Australians pay themselves too much, in an overvalued currency, to do what others can do more cheaply. The dollar needs to fall, the revenue side of the federal budget needs fixing, taxes and IR need more work.

Arguing that these were special problems of the Labor era, or that Abbott has some silver bullet to fix these major structural problems, is very dangerous. It’s a failure to ‘look through’ and see where Australia Inc, like Babcock in early 2009, might soon end up.