Why you should never trade happy

It should be no surprise to anyone that asset prices sometimes get overblown, and that’s putting it very mildly. The tech wreck of 2000 wiped 60% off the Nasdaq index in 10 months.

In the aftermath of such massive destruction of wealth the commentators always line up to explain how it was all so inevitable. The way they tell it the warning signs of a bubble had been written in flashing lights — and no-one noticed!

For anyone who went along for the ride, attracted by higher and higher prices before someone pulled the ladder away, it’s hard not to feel duped.

And that’s a real shame, because bubbles always happen on a grand scale. It’s not just amateur investors who are taken in but also professionals with wealthy clients.

It’s hard to escape the gravity of bubbles, of course, because on the way up people are making spectacular profits. You may have an inkling something’s not right, but why miss out?

Join the chorus

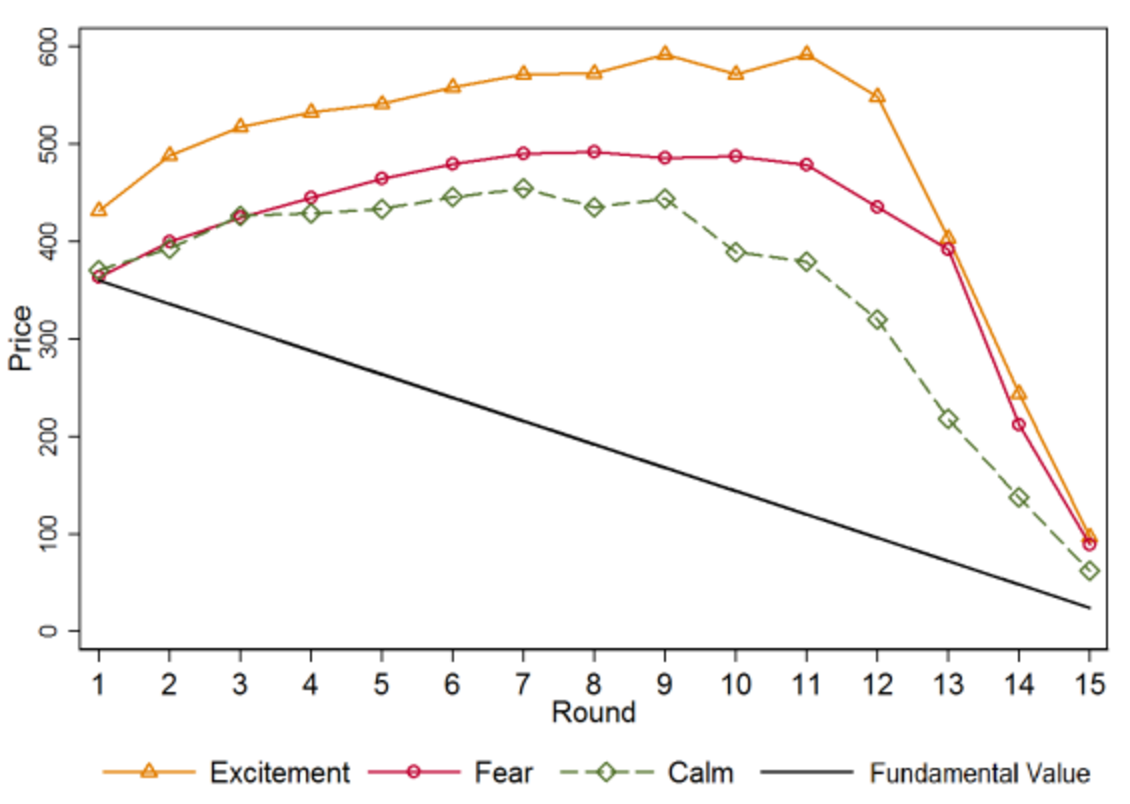

On the surface it might be fair to conclude that bubbles are created by mass hysteria, but a simple hunch isn’t good enough when it comes to the heavily researched world of finance. The theory that bubbles are inflated when emotions run amok has been tested by Eduardo Andrade, Terrance Odean and Shengle Lin in their paper Bubbling with Excitement*, which concludes that traders who are primed to an emotional high will push prices higher than those who are calm or fearful.

“The excitement generated by rapidly rising prices in real-world markets may trigger emotions that lead to larger asset pricing bubbles,” the researchers concluded.

So far so obvious, but a look into the methodology shows just how prone we are to our emotions.

Set up for a downfall

To test the disconnect between rational and emotional trading, an experiment was conducted where a made-up asset was traded over 15 sessions. At the end of each session the asset paid a random dividend of 0c, 8c, 28c or 60c (an average dividend of about 24c) and after 15 sessions it was worthless.

During each trading round the fundamental value of the asset was displayed on the screens used by the respondents along with buy and sell offers.

After three warm-up trades, the students were asked to hold on for about five minutes and watch a video before the real trading began. At this stage they were unwittingly “primed” with clips they later claimed triggered “excited/eager/enthusiastic” feelings (scenes from the films Knight and Day and Mr & Mrs Smith), made them feel “calm/relaxed/peaceful” (scenes from Franklin and Peace in the Water) or “afraid/scared/anxious” (scenes from Hostel and Salem’s Lot).

Emotional baggage

After the survey respondents’ emotions were modified by the video interlude it looks as though they sent their rational faculties to the sidelines for some time out. The results show excited traders are willing to pay more for assets than fearful traders, who are willing to pay more than calm traders.

It’s too early to say that excitement causes bubbles, but it looks as though a very positive emotional state contributes to them. “During the run-up of a bubble, an investor who is earning unusually and unexpectedly large returns is likely to experience excitement. This excitement may trigger excitement in others,” wrote the researchers, who relied on a sample of 495 UC Berkeley students each paid about $US22 to take part in the study.

The researchers were also pretty clear about what they didn’t test.

“While we also believe that real world bubbles can generate excitement, we do not test this,” they wrote. “Nor do we claim that excitement alone can generate bubbles.”

Frothy markets

No two bubbles are the same, and research like this will not stop unbridled zeal from destroying hard-earned wealth in years to come. The lesson then is to at least be conscious that your emotional state has more control over the decision-making process than you may realise.

Unexpected sharp increases in wealth during the lead up in a bubble will inspire plenty of positive emotion. “Thus,” the authors conclude, “the excitement generated by rapidly rising prices in real-world markets may trigger emotions that lead to larger asset pricing bubbles.”

The rational approach

The only way to avoid being swept up in the euphoria of a bubble is to switch off your emotions, which is almost impossible. One way to put any investment into perspective is to keep notes on why you committed to it in the first place. If the price becomes frothy, the market has decided future earnings will be higher. Does that sound right to you? Maybe your notes include an estimate of earnings growth. If you had decided at the outset to exit when the share price had breached a limit, which it has since surpassed, how convinced are you that it’s a good idea to hold on? Revisiting your original notes on strategy may feel like sitting down in front of your sober self, but it’s a great way to clear the head.

Alternatively, when you sit down alone or with your adviser to review your portfolio after a big market fall (such as January this year), make sure you are in the right frame of mind to make unemotional decisions.

* The researchers came from the Brazilian School of Public and Business Administration, the University of California Berkeley and San Francisco State University.

Frequently Asked Questions about this Article…

A financial bubble occurs when asset prices become significantly overvalued, often driven by emotional trading and mass hysteria. As excitement builds and prices rise, more investors jump in, further inflating the bubble until it eventually bursts.

Emotions play a significant role in investment decisions during a bubble. Excitement from rapidly rising prices can lead investors to pay more for assets, contributing to the inflation of the bubble. Conversely, calm or fearful investors tend to make more conservative decisions.

While excitement can contribute to the formation of a financial bubble, it is not the sole cause. Other factors, such as market dynamics and investor behavior, also play crucial roles in bubble formation.

To avoid getting caught in a bubble, investors should focus on rational decision-making and avoid letting emotions drive their actions. Keeping detailed notes on investment strategies and regularly reviewing them can help maintain perspective and prevent impulsive decisions.

Reviewing your investment strategy during market fluctuations helps ensure that decisions are based on rational analysis rather than emotional reactions. This practice can prevent costly mistakes and help maintain a long-term investment perspective.

Investors can manage their emotions by taking a step back to review their original investment goals and strategies. Engaging in regular portfolio reviews with a clear mind and possibly with an advisor can also help make unemotional, informed decisions.

Professional investors, like amateurs, can also be swept up in the excitement of a bubble. Despite their expertise, they may still make decisions driven by emotions, contributing to the bubble's growth.

Unexpected increases in wealth during a bubble can trigger positive emotions, leading investors to make riskier decisions. This excitement can spread to others, further inflating the bubble as more investors join in.