Why you should be wary of crowds

Sometimes being at one with a crowd can be nice, like at rock concerts. It adds to the ambience and safety in numbers can provide comfort. However, when crowds turn they can be dangerous – you might get trampled! In fact a wariness of crowds is essential to successful investing.

The Japanese bubble of the late 1980s, the Asian miracle of the mid-1990s, US tech stocks in the late 1990s, US housing and dodgy credit in the mid 2000s all had one thing in common. Investors had jumped on a bandwagon in a euphoric mass, resulting in assets that became overloved and overvalued and ripe for a crash that of course happened. As Warren Buffett once observed, the key is to “be fearful when others are greedy and greedy when others are fearful.”

But what’s the logic behind this wariness of crowds? Is it as simple as doing the opposite of what the crowd is doing with their investments? What is the crowd telling us now?

Why can the crowd be dangerous?

The trouble with crowds from an investment perspective is sourced in investor psychology. It is well-known that individuals suffer from lapses of logic. For example, they:

- tend to down-play uncertainty & project the current state of the world into the future – eg, resulting in a tendency to assume recent investment returns will continue;

- give more weight to recent spectacular or personal experiences in assessing the probability of events. This results in an emotional involvement with an investment – if it has been winning, an investor is more likely to expect that it will continue to do so;

- tend to focus on occurrences that draw attention to themselves, such as stocks or asset classes that have risen sharply or fallen sharply in value;

- tend to regard events as obvious in hindsight – by fostering the illusion that the world is more predictable than it really is, overconfidence tends to be promoted; and

- tend to be overly conservative in adjusting their expectations to new information and do so slowly over time – explaining why bubbles and crashes normally unfold over long periods.

When many investors make the same lapses of logic at the same time as part of a crowd, the result is magnified. Collective behaviour requires the presence of:

- A means by which behaviour can be contagious – eg, mass communication via various media;

- A structural strain – such as the threat of losing or missing out on financial wealth;

- A general belief which grows and spreads – eg, that it’s a new era of permanent strength or new normal of weakness; and

- A precipitating event which takes place – often referred to as a displacement – to give the general belief some substance eg, technological innovation.

The means by which individual lapses of logic morph into collective views on markets include the general media, both traditional and on-line (where stories of sharp rises/falls in asset prices grab attention) and pressure for conformity via such mechanisms as industry standards, interaction with friends at dinner parties, BBQs, etc and monthly fund managers’ performance charts & benchmarking (which discourage “risk” taking and deviation from the crowd).

Importantly, the combination of lapses of logic by individuals in making investment decisions being magnified by crowd psychology go a long way to explaining why speculative surges in asset prices develop (usually after some good news) and how they feed on themselves (as individuals project recent price gains into the future, exercise “wishful thinking” and receive positive feedback via the media, their friends etc). Of course the whole process goes into reverse once buying is exhausted, often triggered by contrary news to that which drove the rise initially.

During a bull market ‘optimism’ progressively gives way to ‘excitement’, then ‘thrill’ and eventually ‘euphoria’ as the actions of the thousands of investors push the asset class – be it shares, property, bonds or a currency ever higher in value. It is at this point that investors are most bullish. Unfortunately it’s usually at this point that the market has become overvalued and with the crowd fully on board everyone who wants to buy has and so it only takes a bit of bad news to tip the market down.

When a bear market begins investors initially see it as a short term setback. But as ‘anxiety’ gives way to ‘fear’ investors eventually ‘capitulate’ and become ‘despondent’, selling their investments. However, the point of maximum crowd pessimism, when the crowd has sold and the asset class is cheap and unloved is the time when it starts providing its best opportunity for returns. It then usually only takes a bit of good news to start tipping the market higher.

So while it’s impossible to drill into the minds of thousands of investors the behaviour of the crowd gives a great guide to investment market opportunities both at tops and bottoms. Tops are usually associated with some form of crowd euphoria and market bottoms are associated with mass despondency. So being a contrarian and doing the opposite to the crowd at extremes makes sense.

But of course it’s never that simple

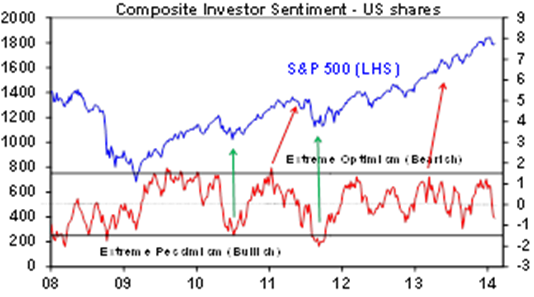

There are two points to note though. First, there is a difference between what people say they are thinking (ie investor sentiment) and what they are actually doing (investor positioning). Both are a guide to where the crowd is at. For example, the next chart shows a composite measure of investor sentiment regarding US shares based on a range of indicators including surveys of individual investors, investment newsletter writers and the ratio of puts (options to sell shares) to calls (options to buy shares).

Source: Bloomberg, Sentimentrader, Investors Intelligence, AMP Capital

Secondly, negative crowd sentiment at market bottoms can tend to be associated fairly quickly with market bottoms reflecting the steep declines associated with panics as a market falls. But during bull markets positive sentiment or even euphoria can tend to persist for a while as it takes investors longer to build exposures to assets than to sell them. As John Maynard Keynes once remarked “The market can remain irrational for longer than you can remain solvent.” But even recognising these complications, investing against the crowd once it reaches extremes is invariably better than going with it.

Current situation

The volatility in shares so far this year provides a classic example of what can happen when the crowd gets a bit too optimistic on shares. The chart above shows that last year ended with relatively high levels of investor confidence in US shares. In fact newsletter writers were the most bullish they had been since the mid-1970s. This had left them vulnerable to a correction which we have seen.

However, as can be seen in the chart, investor sentiment has now fallen sharply following the recent correction – which is a positive sign – and more broadly we haven’t yet seen the sort of euphoria that is usually seen at major market tops. Certainly the flow of money into equity funds has not reached speculative extremes – having only just turned more favourable last year for US equity mutual funds and in Australia the allocation to cash in the Australian superannuation system is still double pre GFC levels. Overall this suggests crowd sentiment and positioning towards shares is ok.

Implications for investors

There are several implications for investors. First, while it may feel uncomfortable, successful investing requires going against the crowd – particularly when the crowd is at extremes of bullishness and bearishness. Various investor sentiment and positioning surveys provide a guide.

Second, right now investor sentiment surveys for shares have become a bit negative – which is positive. And we are nowhere near the euphoria seen at major market tops.

Dr Shane Oliver is Head of Investment Strategy and Chief Economist at AMP Capital.