Why the Reserve Bank is right on rates

In its board minutes, the Reserve Bank of Australia reiterated that it will leave rates unchanged for some time. Naturally it remains unclear how long that might be, but with momentum in the housing market slowing and consumer confidence plummeting, it is hard to argue that its stance is wrong.

For some time it has been obvious that the most pressing near-term challenge for the RBA was balancing an increasingly overheated housing market and a stubbornly high exchange rate. The good news is that both these challenges may have eased a little in recent months.

House prices have eased by 1.2 per cent in May so far, although this does reflect some seasonality -- a softer outlook is consistent with auction clearance rates easing and lending market momentum slowing (Has the housing downturn already begun?, May 15). With interest rates remaining low, it is certainly possible that prices will rebound in June, but for now it removes the only remaining reason for the RBA to consider raising rates.

The RBA has wound back its rhetoric on the exchange rate. To some extent this may reflect a shift in thinking regarding the outlook for the dollar.

Although the dollar remains stubbornly high, a depreciation over the past year has provided some assistance in rebalancing the Australian economy. However, as the RBA acknowledges, that assistance has been less than initially expected given the strength of the dollar in 2014.

Since the board meeting, the exchange rate has appreciated a further 0.7 per cent against both the US dollar and on a trade-weighted basis. Nevertheless there is a light at the end of the tunnel for businesses that desperately need the dollar to push lower.

Iron ore prices have declined further throughout May, following considerable declines earlier in the year. The Australian dollar is a commodity currency and, while it can resist changes in commodity prices in the short term, the terms-of-trade inevitably ends up being the driving factor behind any long-term trend.

If the recent decline in iron ore persists -- and I have no reason to believe it won’t -- then the Australian dollar will eventually follow suit.

The outlook for inflation remains relatively benign and the RBA stated that “underlying inflation was expected to remain consistent with the target over the forecast period”. Inflation on non-tradeable goods should ease further, reflecting spare capacity and subdued wage growth.

By comparison, inflation on tradeable goods is expected to rise further based on the depreciation of the Australian dollar over the last year. Certainly the dollar poses some upside risk to inflation but a risk I think the RBA will be willing to accept given a lower dollar is necessary to facilitate the transition towards non-mining sources of growth.

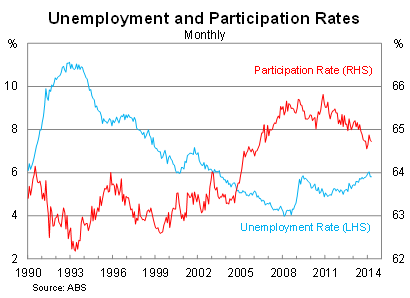

The RBA noted that the labour market is showing some signs of improvement. More timely data indicated that the unemployment rate remained at around 5.8 per cent in April, with the participation rate also largely unchanged (A hard slog ahead for the labour market, May 8).

Consumer spending remains quite strong but measures of consumer confidence have plummeted over the past month. The ANZ-Roy Morgan measure has declined by 14 points since early April – around the time that budget leaks began – and is now at its lowest level since the global financial crisis.

It is likely that the decline might reflect a budget overreaction – it certainly wouldn’t be the first time that has happened – but I wouldn’t discount the possibility that a hit to confidence will weigh on spending and employment in the coming months.

The RBA has made it abundantly clear that it intends to leave rates unchanged for some time. With house prices easing and consumer sentiment plummeting, it appears as though the case for an immediate rate rise has disappeared.

The next major event for the RBA remains the mining investment collapse and until it has a good feeling for the size and scope of that collapse, a conservative approach will be the best approach to policy.