Why the regulator gets power prices wrong

On ABC’s Lateline program on Wednesday last week, Environment Minister Greg Hunt stated:

This is in some ways reassuring for the renewables industry relative to Abbott’s belief that the “Renewable Energy Target is causing pretty significant price pressure”. But in other ways it is a little concerning.

Throughout the interview Hunt repeatedly referenced IPART’s numbers as being the authoritative estimates of the cost of the RET. Yet IPART has systemically overestimated the cost of the target for electricity retailers, allowing them to pass through to end-consumers price increases above what it’s likely to have cost them. I even had a staff member of IPART admit this to me, which was detailed in an article I wrote back in September 2012 (O’Farrell’s renewable energy wonderland).

The reason behind why IPART’s numbers have been a significant overestimate stem from the calculation method it uses to estimate retailer’s costs. This is not based on actual market costs. Instead it largely relies on a theoretical calculation of what it is likely to cost to build new power supply in the case of retailer's acquisition of wholesale electricity and also the cost of the Large-scale RET.

This approach isn’t too bad in a market where demand and supply are reasonably close, but it falls down completely where a market is heavily oversupplied. That is precisely the conditions we’ve been in for the last few years in both the overall electricity market and the Large-scale RET. Under such conditions prices can fall well below the cost of building a new power station.

In addition, until recently IPART had assumed the cost of meeting the small-scale renewable energy scheme will always be the absolute maximum price a retailer is required to pay of $40 per certificate, or STC. Yet for a large period of the existence of the small-scale renewable energy scheme the price has been noticeably below $40.

IPART themselves freely admit in the 2013 price determination final report that their approach, “means that the regulated prices under our final decision are unlikely to be the lowest price in the market”. Instead IPART explain that it knowingly sets regulated prices above retailer’s likely costs because in their view:

- They are not in a particularly good position to second-guess retailers’ costs, especially a few years into the future; and

- If they set prices at a level which only provides marginal profitability they will remove any incentive for competition between retailers, which they believe is the best way to serve consumers' long term interests.

Instead, IPART’s regulated price should be seen as a last resort safety net rather than a highly accurate estimate of the overall costs of the RET.

The extent of the overestimates are considerable.

In IPART’s June 2013 determination, they allowed the retailers to pass on a cost per large-scale renewable energy certificate (often referred to as an ‘LGC’) of $51. But the spot market price of these certificates has been below $40 since January 2012 and has been lower than $35 since June last year. In fact it plummeted just recently down to $26.

Now the volumes traded in the LGC spot market are small at present, which is used as a justification for estimating retailer costs based on the cost of building new power stations. However, the reality is that retailers were able to procure a huge number of certificates via the spot market in 2010 that were substantially below $51 (due to the solar PV certificate multiplier). This means that IPART’s estimate of retailers’ costs to meet the LRET are a very large overestimate.

And the cost figures that they used to call for the RET to be scrapped in a submission they sent to the Climate Change Authority in the last review of the scheme, assumed the cost of an STC was $40, when the going market price was between $26 to $30. Realising their error, IPART have now moved to use market rates for estimating STC costs

In addition to this, because IPART have assumed that the cost for retailers of procuring electricity is largely or entirely the cost of building and operating a new power station, they don’t take into account the fact that extra power supply from renewables will avoid the need for this new power station and act to depress the price of electricity.

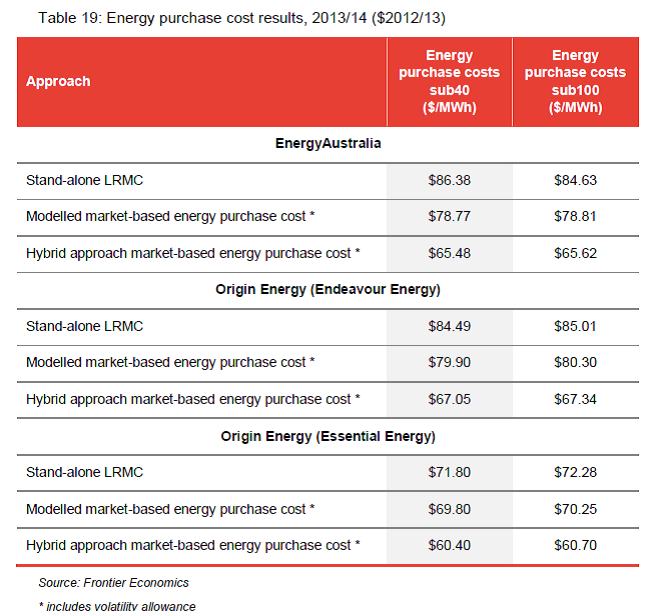

The table below, taken from Frontier Economics' cost estimates used by IPART, shows the large difference in energy procurement costs between using an assumption of building new power supply (referred to as ‘stand-alone LRMC’), and the market rates (the ‘hybrid approach’ uses the prices of energy supply contracts you can buy on the market right now via the ASX energy contract exchange).

I actually don’t have a problem with IPART setting regulated retail prices in a way that gives energy retailers plenty of profit headroom. That’s because I generally agree with IPART’s logic that consumers can get a vastly better deal than regulated rates through just shopping around, and setting prices at marginal levels of profitability or even a loss has negative consequences for consumers and the economy.

However, in campaigning to scrap the Renewable Energy Target, IPART should not be using their own acknowledged overestimates of the cost of the RET. And neither should Greg Hunt.