Why the non-mining sector is holding back on investment

Why isn’t the non-mining sector investing? The Reserve Bank of Australia is frustrated by a lack of ‘animal spirits’, but the aversion to risk is a rational and reasonable response to a financial crisis and the non-mining sector’s struggles over the past decade.

Although there has been progress, it will take a much lower dollar to get the non-mining sector investing with confidence.

The non-mining sector is responding to low rates, particularly residential construction. but progress so far has been relatively slow. There’s a lot riding on getting this transition right; get the timing wrong and a recession is a very real possibility (and high unemployment and soft wages almost certain).

Non-mining business investment is just one part of the story, but it’s an important one. It’s a key mechanism through which Australia can boost productivity and create sustainable growth in the aftermath of the mining boom.

In a speech earlier today, RBA assistant governor Christopher Kent touched on a number of issues facing non-mining investment. Despite low rates, non-mining business investment has been largely unchanged over the past year and has been genuinely weak for a number of years.

Much of this weakness was intentional, reflecting the RBA’s grand plan to create sufficient spare capacity to make room for a once-in-a-lifetime mining boom without an associated rise in inflation. Nevertheless, we shouldn’t discount how difficult the past decade has been for the non-mining sector.

Kent takes the ‘everything but the kitchen sink’ approach to understanding the ongoing weakness in non-mining business investment, but I think the reasoning can be narrowed to three central themes: the dollar is too high, spare capacity is elevated and the appetite for risk structurally shifted after the global financial crisis.

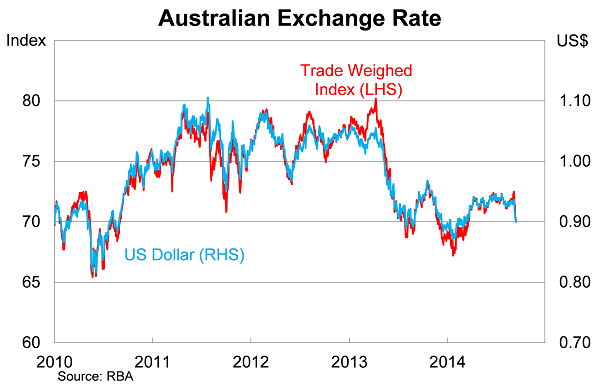

Even accounting for its recent depreciation, the Australian dollar remains much too high to encourage trade-exposed businesses to ramp up production and increase investment. The Australian dollar is down around 3.5 per cent against the US dollar this month at around US90c, but it remains a good 10 to 15 per cent higher than would be ideal.

International competitiveness is not the silver bullet for the Australian economy, but it is a starting point.

Australia is a high-cost economy with elevated wages and land prices that scream bubble to the rest of the world, but it cannot remain that way unless the dollar depreciates significantly.

Spare capacity is also an issue because right now we have too much of it. Is it really surprising that investment intentions remain weak when businesses are not using their existing capacity? In this case, insufficient investment reflects a lack of domestic demand and, due to a high Australian dollar, insufficient foreign demand for Australian goods.

According to Kent, “it’s clear that firms became more risk averse at the onset of the global financial crisis”. Although Australians emerged reasonably unscathed from the crisis, it undoubtedly left an impression that persists to this day.

Both the business and household sectors took the opportunity to re-evaluate their tolerance for risk. The business sector began to deleverage and refinance their existing debt burdens, while the savings rate for the household sector jumped to around 10 per cent and remains there today.

The persistence of this shift -- in its seventh year and counting -- suggests that this isn’t just a temporary change in behaviour. In fact, it’s a perfectly reasonable and rational reaction to a crisis of that magnitude. Australian businesses are simply more cautious than they were pre-crisis and this is consistent with the sluggish response to lower interest rates.

As a result, it is little surprise that many businesses are waiting for more favourable conditions before they commit to new investment.

Low interest rates are obviously one part of the story, but a lower exchange rate is perhaps the more important factor at this point in time.

The bottom line is that we simply cannot underestimate how much is riding on a sustained decline in the Australian dollar. I expect that it will happen, particularly given the ongoing weakness in iron ore prices. But will it happen fast enough? For mine, it remains the key to rebalancing our economy and could very well be the difference between returning towards trend growth and experiencing our first recession in 23 years.