Why the market will crack 6,000

Summary: Out of the S&P/ASX 200's four attempts to break through 6,000 points this year, none have been successful so far. While some analysts raise doubts as to whether the market can accomplish that at all this year – and we can't rule out a correction – it's likely that the market will grow in the longer term given central banks are still engaging in monetary easing in what's a solid global expansion. |

Key take-out: The break through the key 6,000 threshold will come, but we may have to see several issues getting resolved first, such as bank capital requirements. |

Key beneficiaries: General investors. Category: Shares. |

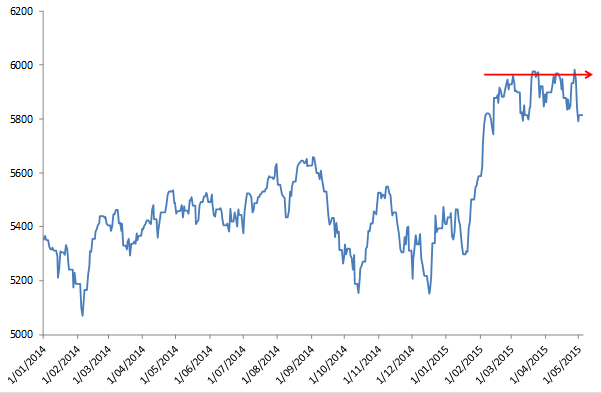

The market has made four attempts at breaking through the 6000 mark so far this year – two in March and two in April – each to no avail. Suffice to say, that looks like a pretty strong psychological resistance level for the market.

Chart 1: Can the All Ords crack 6000?

So what would it take to get through there? Some are even raising doubts as to whether we will at all this year and argue that a correction is due.

The analysis is complicated by the fact that we're coming into a tricky period for investors: The ‘sell in May go away' seasonality. It's a fairly strong seasonality, as since 1995 the market has sold off in May (or from April) about two-thirds of the time. Since the GFC, that probability has increased to about 80 per cent, with stocks selling off in 4 of the 5 years.

Obviously we can't rule it out – corrections happen. Yet since the GFC most corrections have tended to be driven by events abroad, such as Greece, the US fiscal cliff or double dip fears. Of those only Greece stands out as a major probability, though there is some concern over US growth currently.

Maybe a better way of looking at it is to have a think about what is holding the market back? The first thing I'd highlight to readers is that it's nothing structural – nothing permanent.

Take the global backdrop. Obviously for our market to push higher we need to see a bit more strength overseas. Last week, the price action wasn't great – although it was hardly disastrous either. The US market ended 0.5 per cent lower, while European stocks were down 2-3 per cent.

Much of the concern in the US is over the weaker first-quarter GDP figures that we saw. As a reminder, GDP slowed dramatically in the US, rising by only by about 0.2 per cent for the quarter, which is the weakest growth in about a year and well below average.

Here's the thing though. The best available evidence suggests that the slowdown in US growth is temporary, driven by industrial action on west coast ports and bad weather. We saw the impact of bad weather in the first quarter of last year as well. Otherwise GDP growth had been very strong, averaging nearly 4 per cent per quarter over the last three quarters. The good news is that economies don't just change direction like that, so underlying growth is likely still strong. Thus the market rally on Friday.

Despite this, there is a common view among some analysts that the high USD is weighing on US economic growth – and that this in part contributed to the weak March quarter US GDP report.

Yet even if that is true, the US dollar index is down 5 per cent from its peak and it looks set to head even lower from here. The US Federal Reserve have, once again, signalled that they will delay hiking rates and I remain sceptical that they'll hike at all this year. That should see further dollar weakness.

Over in Europe, the economy continues to recover. The Greek threat looks to have abated somewhat and the ECB is still printing money. In fact, central banks around the world continue to ease, and there is even talk that China may start its own version of quantitative easing. As much as I think this is terrible policy and grave long-term threat, it does tend to support equity markets in the short to medium term.

When you look at all that, global equity markets will in effect have earnings support from accelerating growth momentum and valuation support from loosening monetary policy – and that will carry our market higher as well.

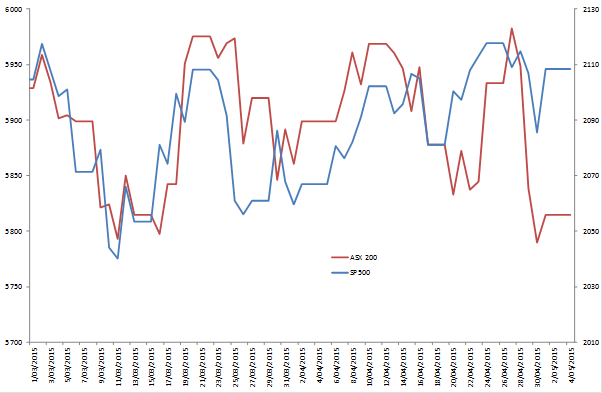

The problem, however, is that to some extent Australian equities seem to have decoupled from global moves, especially the US. That suggests some Aussie centric factors are weighing on the market and making it difficult to pass the 6000 barrier.

Chart 2: showing divergence between US and Australian markets

As to what has driven that divergence, it looks to be largely the banks, CSL and Telstra. Out of the big guys, that is – but then again that's a third of the market just in those six stocks.

For the banks we know what the issue is. The Australian Prudential Regulation Authority (APRA) is sabre rattling about capital ratios and is pushing the need for banks to raise more capital. It's also fair to say that the market got a bit spooked by Westpac's weaker-than-expected profit figure (released Monday, May 4).

A lot of this is just noise though. Capital ratios will rise, as is the global trend, but given the systemic importance of banks to the economy – an 80-90 per cent market share and nearly a third of the stock market, regulators won't be too heavy handed no matter what the rhetoric. More to the point, Westpac's interim figure doesn't tell investors much about the underlying trend. Revenue growth in business and retail banking does that and there the news was good, with revenues up 8 per cent.

Outside of that, commodity price volatility is weighing more generally on the market and there are still lingering concerns on the domestic economy. The RBA is even set to lower its growth forecasts despite slashing interest rates and despite the weaker Australian dollar. Regardless of how much of a threat you think each of these is, my own view is that they are overstated. The important thing to note about these headwinds is that none of them are particularly new. Indeed, they've been with us for years in some form or another.

The important thing to note at this point, despite these lingering fears, is that the Aussie share market has still rallied nearly 40 per cent over the last couple of years. Investors are obviously very conscious of these headwinds, but the fact that the market can still rally in the face of them suggests that investors don't view any of these as a sufficient reason to sell. That's a very important signal.

What it shows is that a majority of investors still hold a strong view that despite the current news flow the underlying forces driving the market higher since the GFC haven't really changed. That the fundamentals remain very supportive and that's a view with which I would agree.

That all suggests that the breakthrough will come – and we shouldn't be overly swayed by negative press reports. But we will likely have to see resolution of some of the above issues, such as bank capital. For now, the debate still rages, commodity prices are weak and the new assault of the Aussie economy is just about to begin. That's not to forget the usual May seasonality and that there aren't a lot of short-term catalysts to drive equities higher.

Longer-term, central banks are still easing into a solid global expansion of above trend growth that will continue to drive equities higher in a world where there are no few other alternatives.