Why the home price rebound is on track

PORTFOLIO POINT: Investors wanting to interpret the property market trends should look to housing finance approvals and clearance rates.

Oh my! Housing data can be very conflicting and these past few weeks are very much a case in point.

Take the headlines from the New Housing Starts survey compiled by the Housing Industry Association (HIA), which reported starts hitting a 15-year low and thereby suggesting the market might be deteriorating further. Literally the very next day, the Australian Bureau of Statistics released its building approvals series and recorded a big bounce in residential dwelling approvals! Both measurements of supply tend to be volatile on a short-term basis. And it should be noted the two indexes measure different things. Housing starts are different to dwelling approvals. To get a new dwelling built, one needs approval first before an actual start can begin.

More can be gleaned from a longer-term trend, which does show supply of new housing stock at or near long-term lows. However I do believe the ABS approvals did show potentially a new trend, as it was driven by a big rise in NSW, which does not surprise me given the amount of state government money on offer for first home buyers to purchase a new property.

Now we come to house prices, that one subject that can match it with the Melbourne Cup.

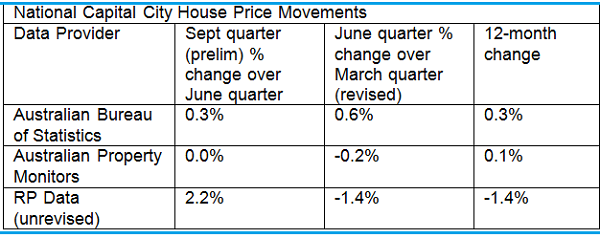

On Tuesday the Australian Bureau of Statistics released its September Quarter National House Price Series. It is one of the indexes I pay a lot of credence to.

I note the rather strong result from RP Data that flies in the face of the other two providers for the September quarter. And I also note that RP Data has subsequently now stated house prices fell 1% in October.

This should come as no surprise that it would present this type of fall due to the gyrations of its daily index. Its October result is more likely just a revert to mean on some additional September quarter data it received. Other leading indicators have been suggesting a more positive market last month. Markets do not violently move from month-to-month, let alone day-to-day. They tend to trend and oscillate. And dwelling price indexes also need to be revised in order to take into account sales data not reported to land titles offices until months after the reported period has passed. RP claims it doesn’t need to revise its daily index as all sales data does eventually make it into the index. But how can the index be a fair representation of market movements on the day when it is, in part, based on sales that happened potentially up to 18 months ago?

In any case, what most likely happened is that house prices did indeed fall in the June quarter and my take for the September quarter is that they were largely running flat, with rises occurring in Perth and Sydney. Melbourne, Adelaide, Canberra and Hobart still recorded some falls.

This current December quarter is interesting as I think it will end up being the quarter that will record real house price rises. All the leading indicators now suggest there is more activity out there. As just released by SQM Research, stock levels were unchanged for the second straight month. This is very abnormal given that seasonally listings rise at this time of year. Housing finance approvals are increasing and auction clearance rates are increasing. So the activity is there and that is what is always required first before rising prices are transpiring.

Putting it all into context, I believe the indicators suggest a housing market that is in the early stages of a housing recovery.

Despite what the various house price measurements may well state, it is difficult ignore the rise in housing finance approvals, the steady results for total listings and the improvement in the clearance rates. But please bear this in mind; I also firmly believe the market remains super sensitive to interest rates given the very high levels of mortgage debt to incomes that still persist.

Louis Christopher is managing director of independent property advisory and forecasting research house SQM Research.