Why the gold price could push higher

Summary: The gold price has been range trading despite the reduction of monetary stimulus in the US and expectations the Federal Reserve will hike interest rates. But the US central bank is likely to restart quantitative easing in the future if there is some turn for the worse. This means official buying of gold will likely remain strong. China holds a low proportion of its reserves in gold and any increase would also support demand. |

Key take-out: A bull run in gold is unlikely to re-emerge but underlying demand is otherwise strong and likely to get stronger. |

Key beneficiaries: General investors. Category: Commodities. |

Gold has been hammered this year – again – falling $US136 from the peak in March. Now that's a big move, seemingly consistent with the idea that the great gold bull-run is over. Perhaps that's true. It has certainly come off a great deal from the all-time peaks of around $1900 in 2011.

Yet that fact alone doesn't mean that gold can't push higher again over time, or that it is a bad investment – or even that the structural forces underpinning long-term growth have changed.

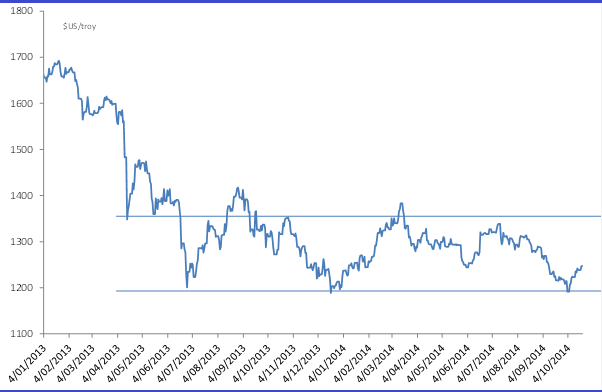

Chart 1: Gold price

Indeed, following on from the very sudden and somewhat bizarre gold slump in early-mid 2013, gold prices appear to have stabilised. Range trading, in effect. More recently, chart 1 above shows that gold has been trading around the $US1200/$US1300 mark for about four months now. What's interesting about that is that the range has held despite the US Federal Reserve's tapering program (where the Fed prints less money each meeting) and despite expectations for a Fed rate hike intensifying this year. This is extremely unusual. Investors would ordinarily expect gold to continue to sell off. Yet it didn't – overall. The range held.

Against that backdrop, I'm not overly excited about the recent rally, although it does serve as a reminder of how the market might react to any change in Fed rate expectations – driven as it was by a realisation that the Fed perhaps isn't as hawkish as markets thought.

If anything the Fed's gamesmanship this year (first aggressively talking up, then talking down the prospects for rate hikes) serves to highlight one fact: quantitative easing (QE) and low rates will remain a feature of the investment landscape for the foreseeable future. This is regardless of what the Fed actually decides at the next Federal Open Market Committee meeting (next week).

Why? Because it highlighted just how quickly the Fed would reverse course in the advent of any market turbulence. Having talked up the need for volatility, once that volatility arrived, many of the Fed's senior presidents and governors immediately adjusted their rhetoric and urged caution or patience in removing stimulus.

The rhetoric from a broader array of Fed Presidents and Governors has otherwise been mixed on the matter. Some have suggested they would be happy to delay the end to QE, some that it should end as planned next week. The immediate decision will probably have some short-term influence on volatility either way. But that decision won't change my underlying point. Consider that even if QE ends this year, there is a very high probability that it will be restarted at some point – whether next year or the year after. Remember, this is QE 3 that is ending. It's ended before – and as soon as there is some turn for the worse, the Fed will reach for the printing presses again and again.

Already we are finding some Fed presidents who want to extend QE, not end it. And of course with inflation outcomes around the world apparently moderating, the near-term case to delay the taper appears compelling.

Against that backdrop, official buying of gold will likely remain very strong. We're seeing that already and certainly central bank demand has surged, rising 30% in the year to the June quarter of 2014. On those trends, total central bank demand for 2014 looks to be about 18% higher than last year. If central banks are buying that's an important signal and it's really quite difficult to see how or why central bank buying would ease given QE is unlikely to be removed as a policy tool. The currency wars are still raging and many analysts expect them to intensify into 2015. Reserve diversification will take on new importance, and that will include gold as paper money becomes increasingly worthless.

That is perhaps especially true for China. China holds just 1.1% of its reserves in gold. This is extremely low and certainly the lowest of the large economies. For comparison, the US holds 72% of its reserves in gold, while Germany holds 67%. This is extraordinary for a country with the largest pool of reserves in the world at $US4 trillion.

If China decided to hold just 10% of those reserves in gold, which would still be quite low, that would equate to an additional demand of roughly 10,000 tonnes – or the equivalent of total world demand for 2.5 years. Obviously the government wouldn't do that over 2.5 years or even five years. Assuming they staggered such a program out, it would underpin exceptionally strong growth in gold demand (of over 10% per annum) for the next two decades. In that regard there are two very strong incentives for China to diversify:

1. The world's monetary system is in poor shape as QE distorts the value of cash and bonds. Confidence in it is low.

2. Geopolitical tensions are rising and China's growing military and economic power will likely bring it into conflict with the US. Maybe not outright war, but certainly tensions will rise.

Given all that, the risk is that China, and other central banks with low gold reserves, will want to stock up. Bonds and cash have no intrinsic value. Gold does.

Just take Russia as a key example. Russia has tripled its holdings of gold over the last decade, and sanctions have intensified that process. Even so, they hold less than 10% of their reserves in gold, while having the fifth largest foreign exchange reserves.

Outside of official demand for gold, Chinese private demand has increased sharply, such that China now accounts for about 25% of private sector demand for gold, from a little over 5% in 2004. This makes sense when you think about it. As per capita GDP has surged, Chinese gold consumption has surged. Chinese jewellery consumption has tripled over the last decade from a little over 200 tonnes, to something closer to 700 tonnes now. That trend isn't going to change.

These are all very powerful forces which should buttress gold over coming years. I doubt the bull run will re-emerge given investors have been scared off. Yet underlying demand is otherwise very strong – and as discussed, there is every reason why that will just get stronger.