Why the Fed won't flex its muscles on rates

Another modest inflation number -- and the global equities sell-off -- has pushed back expectations for a US rate rise. The timing of that hike remains murky and a lot will depend on whether strong employment growth begins to flow through to higher wage demands.

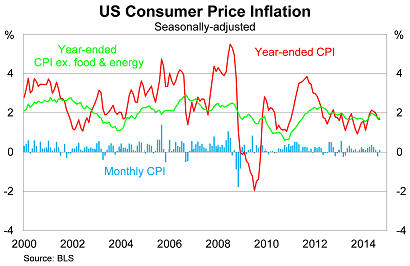

In the United States, headline inflation rose by 0.1 per cent in September, beating market expectations, to be 1.7 per cent higher over the year. Inflation has eased somewhat in the past two months and now sits considerably below the Federal Reserve's target for 2 per cent annual inflation.

Core inflation -- which excludes volatile items such as food and energy -- also rose by 0.1 per cent in September and is broadly tracking developments in headline inflation. Energy prices fell by 0.7 per cent to continue their recent downward trend but this was offset by a 0.3 per cent rise in food prices.

Food and beverage prices have been remarkably strong of late and somewhat inconsistent with the broader inflation environment. Prices are up by 3.5 per cent on a six-month annualised basis and have been rising at their fastest pace in almost three years.

There's some clear upside risk here because I expect energy prices to stabilise well before food prices moderate. Energy prices don't even need to rise, simply stop falling, to help push annual inflation towards the Fed's upper target.

But it's important to note that inflationary conditions remain largely benign. Despite strong employment growth -- non-farm payrolls are on track for their strongest year since 1999 -- wages have not followed suit, reflecting a surge in low-wage and part-time work.

A stronger US dollar and deteriorating global growth expectations have weighed on import prices and will continue to flow through to consumer prices over the next couple of quarters. The effect shouldn't be that large, given the US is less trade-exposed than other developed countries and a range of goods trade internationally in US dollars.

Other measures of inflation provide a somewhat conflicting view of the US economy. The Cleveland Fed's measure of median inflation rose by 2.2 per cent over the year, while their trimmed-mean measure rose by 1.9 per cent. Both measures have eased a little in recent months.

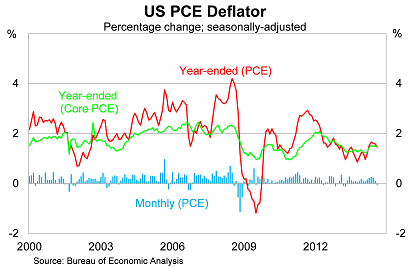

But it's the core personal consumption expenditure deflator -- the Fed's preferred measure of inflation -- that continues to track lower than other estimates. The core PCE deflation rose by just 1.5 per cent over the year to August and remains stubbornly benign despite activity across the broader economy.

That, combined with the recent equities sell-off, has prompted many investors to push back their expectations for a cash rate hike. Expectations for a rate rise have been pushed back to late next year, while the breadth of official Fed forecasts -- which admittedly are now quite dated -- pointed towards the middle of 2015.

Market volatility is not expected, however, to stop the Fed from ending their asset purchasing program at the end of this month.

Wages remain a key concern, not simply for the inflation outlook but for the health of the broader economy. With household spending accounting for 68 per cent of US activity, a healthy household sector is necessary for a sustainable recovery. So far the jobs are being created but purchasing power hasn't followed suit – although admitted a stronger US dollar could change that in a hurry.

The Fed will be following developments in the labour market closely but modest inflation provides them with some flexibility going forward. Fed chair Janet Yellen has a reputation for being more dovish than most and it's unlikely that a Fed chaired by her will act prematurely on rates. I remain bullish on the US economy but if wages don't begin to pick-up, then it won't matter that the unemployment rate is below 6 per cent. The Fed will simply wait.