Why the Fed will wait on a rate rise

A surprising pick-up in consumer prices suggests that improving labour market conditions may have finally created some modest inflationary pressures. But with significant spare capacity across the United States economy, the Federal Reserve won’t pull the trigger on interest rates until next year.

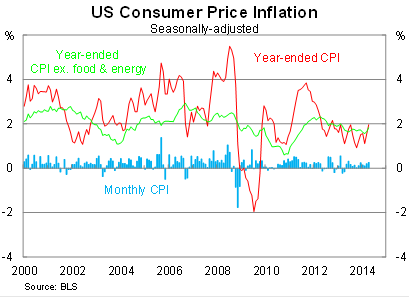

Inflation in the United States rose by 0.3 per cent in April, beating market expectations, to be 2.0 per cent higher over the year. It marks the strongest monthly surge in prices since June last year and year-ended growth is now at its highest level since October 2012.

Core inflation, which excludes volatile items such as food and energy, rose by 0.2 per cent in April, to be 1.8 per cent higher over the year. Energy prices climbed by 0.3 per cent following two consecutive monthly declines, while food and beverage prices rose by 0.4 per cent.

But despite the modest improvement, the Fed is unlikely to get ahead of itself. Its preferred measure of inflation -- the core consumption expenditure (PCE) deflator -- is tracking well below other measures of inflation.

The core PCE deflator rose by just 1.2 per cent over the year to March. Given the stronger inflation reading for April, it appears likely to tick up further. Nevertheless in the near-term, the core CPI is set to remain well below the upper end of the Federal Reserve’s inflation target of 2 per cent.

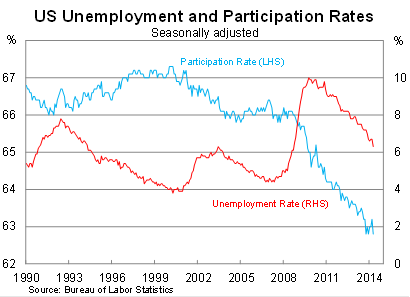

The pick-up for inflation comes after signs that the labour market improved in early 2014. Non-farm payrolls rose by 288,000 in April, the strongest monthly gain since January 2012 (Nothing’s right, nothing’s wrong for the Fed, May 5). The unemployment rate fell to 6.3 per cent in the month and is now at its lowest level since September 2008, though this partially reflects falls in participation.

The labour market received a further boost overnight with initial jobless claims falling to their lowest level since May 2007. It is worth noting that jobless claims have been unusually volatile in recent weeks owing to a number of holidays.

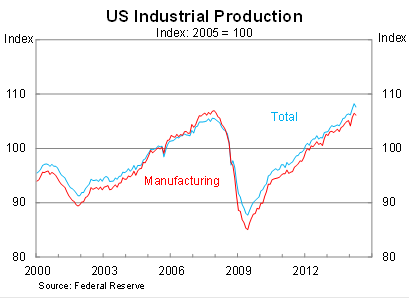

While labour market indicators have been improving, industrial production took a hit in April, declining by 0.6 per cent. Although this may appear to be a poor result, it follows several strong months as production recovered from the cold start to the year. By looking through the volatility, we can see that industrial production remained fairly solid as 2014 began.

The Federal Reserve will be comforted by recent data, which suggests that the economy is developing largely as expected. Labour market conditions continue to improve and that may finally be reflected by inflation.

But at the same time, there remains considerable spare capacity across the economy. Capacity utilisation remains below its pre-crisis peak and there remain millions of Americans who have been unemployed for over half a year. Wage growth has yet to show any genuine sign of improvement.

Recent developments suggest that the economy has maintained its underlying momentum as the Fed has wound down its asset purchases and that slow growth in the first quarter was merely a temporary setback. The US economy has shown resilience over the past year that suggests the recovery is on firm footing and the economy in decent shape.

The US economy should post a strong result in the June quarter but I expect the second half of the year to be fairly solid as well. But with significant spare capacity across the economy it remains unlikely that the Fed will act on interest rates until next year.