Why the Aussie market is still below its peak

| Summary: The Australian share market is well below its 2007 high point, while the US market is streets ahead. There are several reasons for this. |

Key take-out: Australian investors are sceptical on the prospects of earnings growth and sector-specific risks. |

Key beneficiaries: General investors. Category: Shares. |

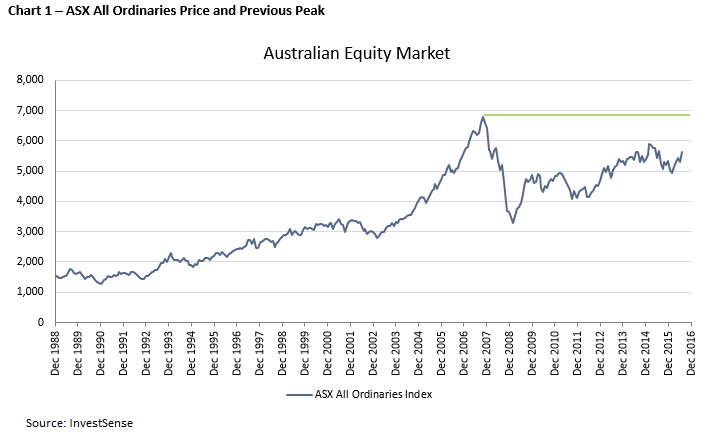

One observation that commonly gets made is that, despite it being about eight years since the global financial crisis, the Australian equity market is yet to reach its previous peak as measured by the price of the All Ordinaries Accumulation Index.

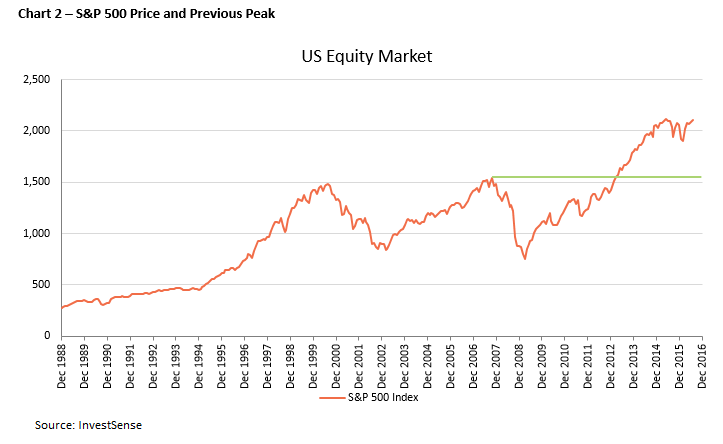

Contrast that with the US equity market, which has more than exceeded its pre-GFC level and actually surpassed its previous peak in early 2013.

So, why the disparity? Well, one aspect that needs to be addressed is that a comparison between the two markets only looks at price and doesn't account for dividends that have been paid.

Australian equities tend to pay a higher level of dividends than their US counterparts, so Australian equity investors aren't as worse off as it initially seems.

Nonetheless, putting the dividend aspect aside, the reason the market hasn't recovered to previous levels basically boils down to two main factors that ultimately drive market performance: earnings growth and price multiple expansion/contraction (that is, people essentially being willing to pay more or less for the same level of earnings).

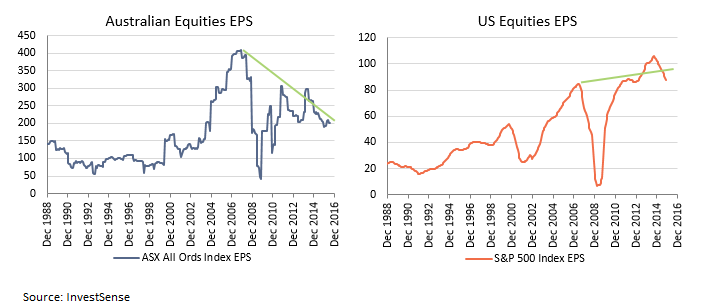

Looking at the earnings-per-share (EPS) profile of the Australian and US equity markets in the charts below, it is a little more obvious as to why the Australian equity market has lagged the US in price terms.

In the period from early 2000 to 2007 the Australian equity market was characterised by a booming resources and housing market, driving earnings growth for the biggest constituents in the Australian share market. Post 2007 it was a much more mixed story and outlook.

Earnings for resources collapsed on the back of weak commodity prices and earnings growth for the banks looks much more subdued looking forward. In the US, however, earnings rebounded quickly post the GFC. Some of this rebound in earnings was a genuine recovery and growth in earnings, but it was also fuelled by capital initiatives such as share buy-backs (generally funded through increased debt) which helped drive EPS growth.

While some of this share buy-back continues, we suspect that with earnings growth slowing in the US so will the amount of buy-backs. This slowdown in earnings, coupled with high valuations, is why the InvestSMART Diversified Portfolios remain underweight US equities.

The other aspect as to why the Australian market hasn't reached its previous peaks is the price multiple investors are willing to pay.

In the US, at the peak prior to the GFC, investors were willing to pay a cyclically adjusted price-to-earnings multiple of around 27x. It then collapsed to 13x in the midst of the GFC, and since then has climbed back to around 26x.

In Australia, the cyclically adjusted price-to-earnings ratio peaked around 30x prior to the GFC, then fell to around 13.5x and currently stands around 19.9x today. Even based on where earnings are today, if investors were willing to pay as much for Australian equities as they were for US equities it would imply that the Australian equity market would re-rate by around 30 per cent and you would see the index level way above 7,000 for the All Ordinaries.

Perhaps the reason that this hasn't happened is that investors are much more sceptical on the prospects of earnings growth in the Australian equity market and/or wary of the sector-specific risk of the Australian equity market with a large exposure to banks (and by de-facto housing) and resources.

Fil Andronaco is a director of InvestSense, a portfolio construction and consulting company offering outcome-based portfolio solutions based on managed account technology.