Why inflation won't force the RBA's hand on rates

Inflation hit the top of the Reserve Bank of Australia’s target band in the June quarter but that is no cause for concern. The outlook for inflation remains benign, underpinned by soft wage growth, and the exchange rate is no longer putting upward pressure on prices.

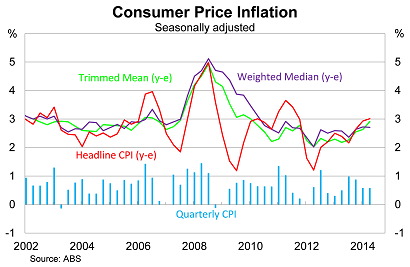

On a seasonally-adjusted basis, consumer prices rose by 0.6 per cent in the March quarter, with core measures exceeding market expectations, to be 3.0 per cent higher over the year.

In recent quarters, annual inflation has pushed towards the top of the Reserve Bank of Australia’s target band for inflation of 2-3 per cent but momentum is showing some signs of moderating. This may represent the peak of the inflation upswing, particularly now that the carbon tax is removed.

The major contributors to inflation in the June quarter were medical and hospital services (up by 4.6 per cent), new dwelling purchases by owner-occupiers (up 1.6 per cent) and tobacco (up 3.1 per cent). Offsetting this (albeit to a small degree) were falls in holiday travel and accommodation (down 3.8 per cent), automotive fuel (down 2.7 per cent) and telecommunication equipment and services (down 1.6 per cent).

Core measures of inflation (which remove volatile items) suggest that inflation has picked up a little during the June quarter. The trimmed mean measure rose by 0.8 per cent in the June quarter, to be up by 2.9 per cent over the year. By comparison, the weighted median measure rose by 0.6 per cent to be 2.7 per cent higher over the year.

Should we be concerned about the recent uptick in prices? Could this force the RBA’s hand? Could it raise rates before the non-mining sector is ready?

The answer to all three is an emphatic no. There is no reason to be concerned about recent inflation and, as I mentioned earlier, this may represent the peak of the recent upswing.

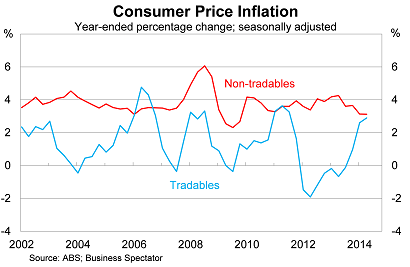

The outlook for inflation is remarkably benign. To understand why, we should take a glance at inflation on tradable and non-tradable goods.

On a seasonally-adjusted basis, prices on tradable goods were unchanged in the June quarter, to be 2.9 per cent higher over the year. By comparison, inflation on non-tradable goods rose by a hefty 0.9 per cent, to be 3.1 per cent higher over the year.

The data indicates that the lower Australian dollar, at least compared with this time last year, is no longer placing upward pressure on inflation. As a result, annual inflation on tradable goods is set to moderate and may even begin to decline unless the dollar falls swiftly in the coming months.

But any forecasts for inflation should remember that prices for tradable goods can be particularly volatile: both commodity prices and the exchanges rate can vary significantly from quarter-to-quarter (and day-to-day for that matter). As a result, forecasting is often difficult and shifts in the series often prove temporary. It’s not unusual for many tradable goods to be excluded from measures of core inflation.

On the domestic front, wage growth remains subdued and at its lowest level since at least 1998 (when the data began). Wage expectations should continue to moderate, on the back of a soft labour market, and that will feed through to inflation over the next year or so.

Inflation is set to moderate somewhat in September owing to both tradable and non-tradable goods. The repeal of the carbon tax will also weigh on inflation a little, though not by as much as the federal government has promised. When we get the read for the September quarter, I expect a result of around 2.5 to 2.6 per cent for annual inflation.

Needless to say, that outlook will not concern the RBA. I also expect it to take a forward-looking approach to policy and look through the recent volatility.

In recent communications it has highlighted the benign outlook for inflation and they expect inflation to remain within its target band over the next few years. Since the risks to inflation are to the downside, there is no chance that the RBA will raise rates in the near-term and I see no reason to shift my view that the next move on rates will be down.