Why housing construction can't bear the mining load

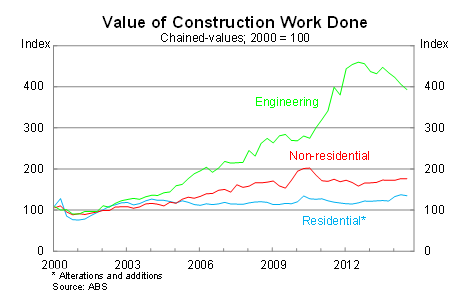

Construction eased further in the September quarter as the decline in mining investment continues. Even residential construction -- a key part of the rebalancing equation -- stumbled during the quarter, and is likely to subtract from real GDP growth during the September quarter.

The value of construction work done fell by 2.2 per cent in the September quarter, missing market expectations, to be 5.1 per cent lower over the year. The result -- weak though it obviously is -- was partially saved by a huge surge in construction in the Northern Territory.

New private residential construction -- a subset of building construction - fell by 2.0 per cent in the September quarter, to be 9.7 per cent higher over the year. This result comes as somewhat of a surprise, but at this point is no cause for alarm.

Based on the level of building approvals, the residential investment boom still has some way to run and should rebound during the December quarter. I'd expect residential investment to peak in the second half of next year, or perhaps early 2016.

By comparison, private non-residential construction rose by 1.6 per cent and is now 9.0 per cent higher over the year. It's receiving less attention, but there's been a subtle upshift in commercial real estate, particularly in the eastern states, which is partially offsetting the ongoing weakness in the mining sector.

Based on the long-run relationship between residential and non-residential construction data and their national accounts equivalent, these sectors should contribute modestly to growth in the September quarter.

My models suggest that private residential investment will decline by around 1.1 per cent, which is more than offset by a 2.6 per cent rise in non-residential building investment. This would mark the weakest contribution to growth since December 2012.

Engineering construction -- widely viewed as a proxy for mining investment -- declined by 3.2 per cent in the September and is now 12.1 per cent lower over the year. What is particularly interesting about this trend is the extent to which engineering construction is also weighing on public investment.

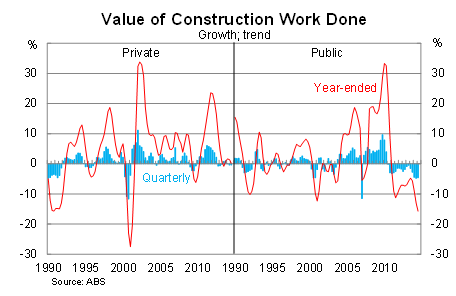

Public construction fell by 5.0 per cent in the September quarter and is now falling at its fastest pace since at least 1986. The graph below highlights the discrepancy between private and public construction and the clear role that the public sector played in facilitating the mining investment boom.

The outlook for construction remains, on balance, very weak. Obviously engineering construction will continue to ease, though there might be a modest rebound in non-mining engineering. The public sector appears intrinsically tied to conditions in the mining sector and, regardless, state and federal governments will need to tighten their belts now that revenue expectations have taken a hit.

The Coalition wants to be the ‘infrastructure government', but it's difficult to see how this is achievable without either raising taxes or reigning in other forms of spending. Neither option seems possible given the current structure of the senate.

Building construction remains the one bright spot and, as I noted earlier, residential construction should remain quite strong for at least another year. But we also need to recognise that residential investment is only a quarter of total construction activity and would have to lift to an unprecedented degree to offset the collapse in mining investment.

Tomorrow the ABS releases its quarterly Capex survey, which will provide some insight into the construction and investment outlook. A lot has changed since the June quarter release -- particularly for our iron ore miners -- and I expect considerable revisions to the outlook for 2014-15.