Why guesswork has a place at the RBA

The old saying goes that economists were invented to make meteorologists look good. When it comes to forecasting this statement seems particularly apt.

Last Friday the Reserve Bank released its quarterly assessment of the Australian and global economies, which I addressed in some detail (The RBA’s crystal ball is clear as mud, November 8). Most of the interest in the Reserve Bank’s statement on monetary policy surrounds its outlook for Australia and its forecasts of GDP and inflation.

But is there any value to these forecasts?

Internally the central bank forecasts in two distinct ways. It has its model approach, which is typically of the structural vector autoregressive variety. If you don’t understand what that is don’t worry, neither do most of the people working there.

The second approach is more of the gut feel variety. It might use some very simple models to map monthly or quarterly indicators to GDP but it lacks the complexity of the first approach. These forecasts can be done in a top-down approach – we want GDP growth of 4 per cent so we manipulate the components to achieve that – or a bottom-up approach – we forecast each component and then add them together to form a complete forecast.

Despite one methodology being vastly more complex than the other there is no evidence that either method is objectively superior. The truth is both methods do a pretty horrible job of providing insight into the future.

A Reserve Bank research discussion paper released last year does not shy away from this fact. The paper, Estimates of Uncertainty around the RBA’s Forecasts, written by economists Peter Tulip and Stephanie Wallace, shows that the Reserve Bank is typically fairly good at forecasting underlying inflation (inflation minus volatile items) in the near-term but as the outlook lengthens its forecasts become increasingly meaningless.

Most problematic though is that there is no evidence that the central bank can predict GDP growth even in the near-term. Perhaps surprisingly the paper finds that Consensus market economists provide more accurate forecasts – though I use the term ‘accurate’ loosely.

This second point is one worth considering further. The Reserve Bank has greater resources and more economists analysing the economy so they should be more accurate than an economics section in a bank with three or four members. There may be a few things going on here that prove detrimental to the Reserve Bank.

First, the timing of the forecasts. The central bank produces its forecasts in the middle month of the quarter, while Consensus forecasts can be filed at a later date utilising more timely information.

Second, Consensus forecasts can use market expectations for the cash rate compared with the Bank’s constant cash rate assumption. Internally, the Reserve Bank produces forecasts with an alternative cash rate path built in, which for decision-making purposes would be given more weight than the forecasts presented in the SMP.

Third, market economists are not bound by expectations. There is a tendency at the central bank to anchor all forecasts towards trend in the medium-term, which typically results in forecasts where inflation always ends up within the 2 – 3 per cent band and GDP growth appears solid by the end of the forecast horizon. It reinforces the idea that policy is always on the right track but I wonder whether it proves detrimental at times.

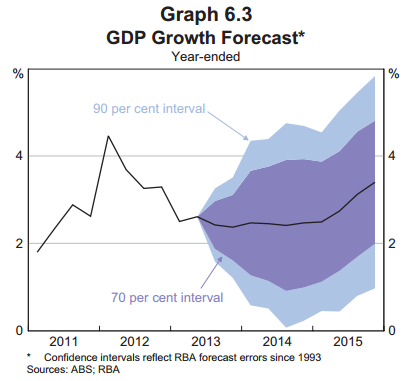

To the Reserve Bank’s credit it implicitly acknowledges the uncertainty surrounding the economic outlook and provides a detailed discussion regarding the uncertainty. The graph below featured in the latest SMP and shows that the central bank is 70 per cent sure that GDP growth will be between 2 per cent and 4.75 per cent by the end of 2015. At least they are 90 per cent certain there will not be a recession in the next two and a half years.

However, the reality is that the Reserve Bank makes important decisions based on these forecasts and if you accept that economic growth is a random walk then perhaps being forward-looking is not as important as it should be.

It would be unfair to simply isolate the Reserve Bank on this issue. Both the European Central Bank and the Federal Reserve are no better than the Reserve Bank of Australia, and in some ways proven worse. Both these central banks have proven themselves to be too optimistic throughout the global financial crisis and in the ECB’s case made the fatal mistake of not recognising that austerity is really contractionary.

The moral of all this is that readers should look past the graphs and focus on the discussion. The Reserve Bank may not be able to forecast GDP growth but it can create an interesting discussion on the factors that influence it and this is where your focus should be.