Why gold's allure tracks US inflation

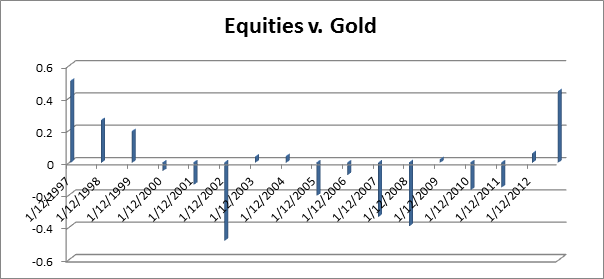

For the first time since 1997 the US based S&P 500 is convincingly returning more than everyone’s favourite metal, gold, in terms of price performance.

The differential in return so far this year has stocks returning 44 per cent more than the precious metal and is fast approaching the 50 per cent outperformance seen in 1997. This doesn’t even include income, which would put equities further in front.

It was recently reported a large gold fund manager feels that there is greater demand throughout Asia than suggested by the World Gold Council. For much of this year there has been constant chatter about rising demand from Asia, with the expectation it would support gold prices at current levels or even push the price higher. While this is a valid theory, it is hasn’t had a material impact on the price of gold just yet – this year gold is on track to record its first annual price decline since 2000.

In reality, it is quantitative easing and the expectations surrounding the Federal Reserve’s future decisions on monetary policy that have been driving the price of gold. Overnight gold reached a five-week high purely on the belief quantitative easing will continue, which is largely viewed to be supportive for the metal.

The latest rise in the gold price is dwarfed in comparison to all-time highs reached by the S&P 500.

While quantitative easing initially had a positive impact on the price of gold, pushing it to all-time highs as the fear of inflation gripped investors, a spike in inflation hasn’t actually come to fruition. Since reaching a peak in 2011 the gold price has retreated along with any expectation of inflationary pressure.

The swing in returns as equities are back to comfortably outperforming the metal is proof quantitative easing has been significant in driving the price of equities.

While the US has been able to avoid any crippling inflation as yet despite its aggressive monetary policy, Dr. William Poole - the former president of the Federal Reserve Bank of St. Louis - explained that if American banks monetise the $US2 trillion of reserves sitting on their balance sheet, the risk of inflation is real.

What we can conclude is the actual act of quantitative easing has manipulated the price of gold along with the expectations of inflation. Consequently the future price of gold will be just as sensitive to future policy changes.